Welcome equity investors—today’s edition unlocks Orion AI equity research on five large-cap US travel stocks: $CCL ( ▼ 1.57% ), $RCL ( ▼ 2.32% ), $EXPE ( ▼ 15.26% ), $BKNG ( ▼ 9.32% ) and $ABNB ( ▼ 7.03% ).

$CCL ( ▼ 1.57% ) - Carnival Corp

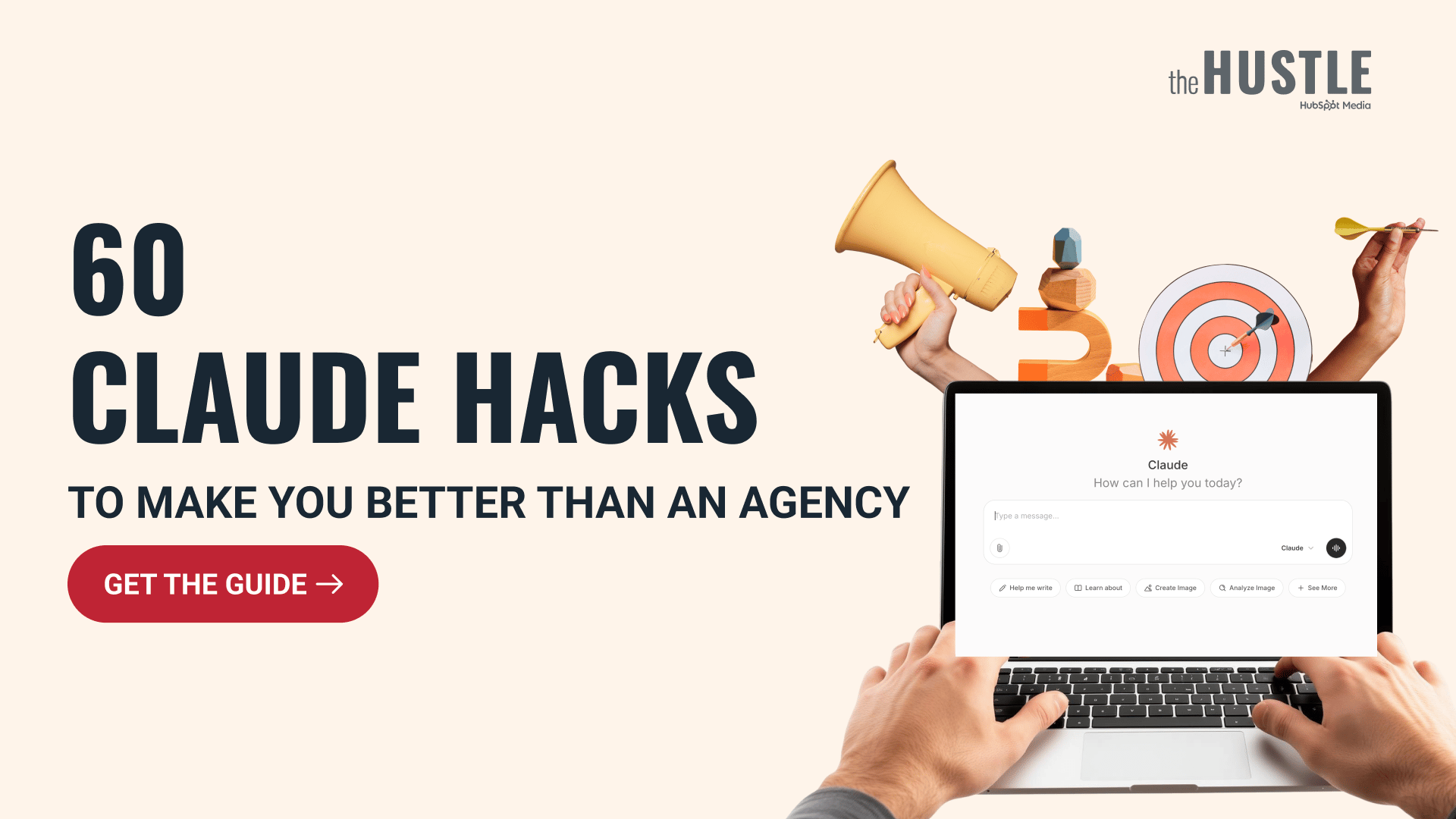

Scores: Fundamental 8 | Analyst Sentiment 8 | Valuation 9 | Catalyst 8 | Technical 6 | Total: 39

Direction: Long

Carnival Corporation presents a compelling long opportunity for the medium term (1-3 months). The company has executed a remarkable post-pandemic turnaround, delivering record financial results, significantly reducing debt, and positioning itself for a return to investment-grade status and shareholder capital returns. Management's high confidence, robust forward bookings at higher prices, and strategic investments in destinations like Celebration Key underscore a strong growth trajectory. Analyst sentiment is overwhelmingly bullish, with attractive price targets. Valuation metrics (low P/E, PEG, EV/EBITDA) indicate the stock is currently undervalued relative to its strong forecast EPS growth and peer group. While the technical chart shows the stock at a critical resistance level around $27, the underlying long-term bullish trend, improving momentum indicators, and a supportive broader market environment suggest a high probability of a breakout. The upcoming Q4 earnings report is a significant catalyst that could validate the strong fundamentals and drive the stock towards its fair value. Investors should consider a long position, monitoring the $27 resistance level and the Q4 earnings outcome for confirmation.

$CCL ( ▼ 1.57% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$RCL ( ▼ 2.32% ) - Royal Caribbean Cruises Ltd

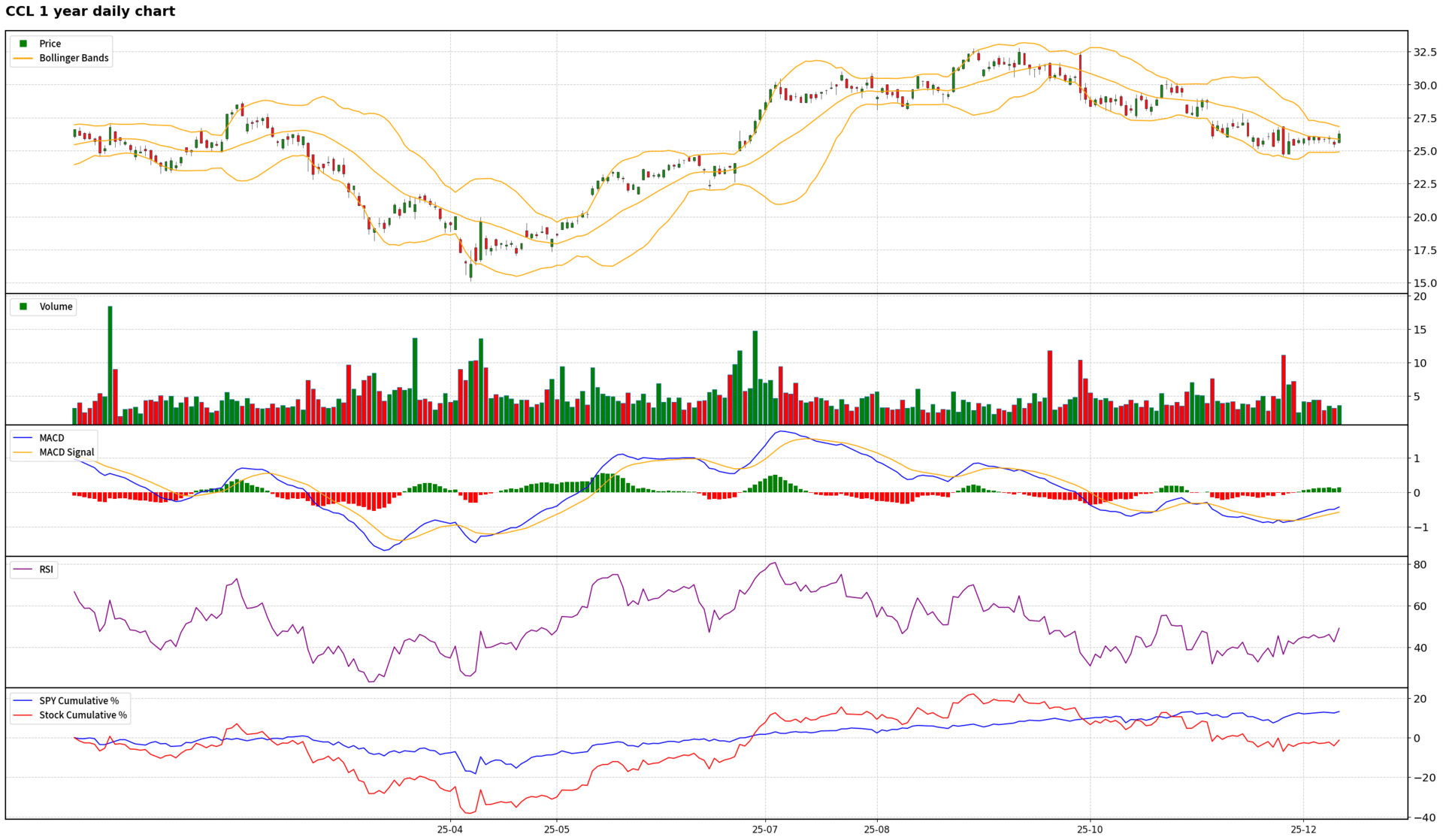

Scores: Fundamental 8 | Analyst Sentiment 7 | Valuation 5 | Catalyst 9 | Technical 7 | Total: 36

Direction: Long

Royal Caribbean Cruises Ltd. presents a compelling long opportunity for the medium term, underpinned by its strong operational momentum, strategic growth initiatives, and a significant commitment to shareholder returns. The company's Q3 2025 results exceeded expectations, demonstrating robust demand and effective pricing power, with management confidently guiding towards continued double-digit EPS growth and ambitious 'Perfecta' targets by 2027. Key catalysts include the recently announced $2 billion share repurchase program, which is a strong signal of management's confidence and will provide direct price support, alongside ongoing deliveries of innovative new ships and expansion into high-margin private destinations. While the stock has experienced a recent pullback and faces some valuation scrutiny, technical indicators suggest a potential bullish reversal is underway, with strong buying pressure emerging from a consolidation phase. The broader market's bullish sentiment provides a favorable backdrop. Investors should consider a long position, anticipating that strong fundamentals, aggressive capital allocation, and improving technicals will drive $RCL ( ▼ 2.32% )'s share price higher, despite some lingering concerns about valuation and potential short-term macro volatility.

$RCL ( ▼ 2.32% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$EXPE ( ▼ 15.26% ) - Expedia Group Inc

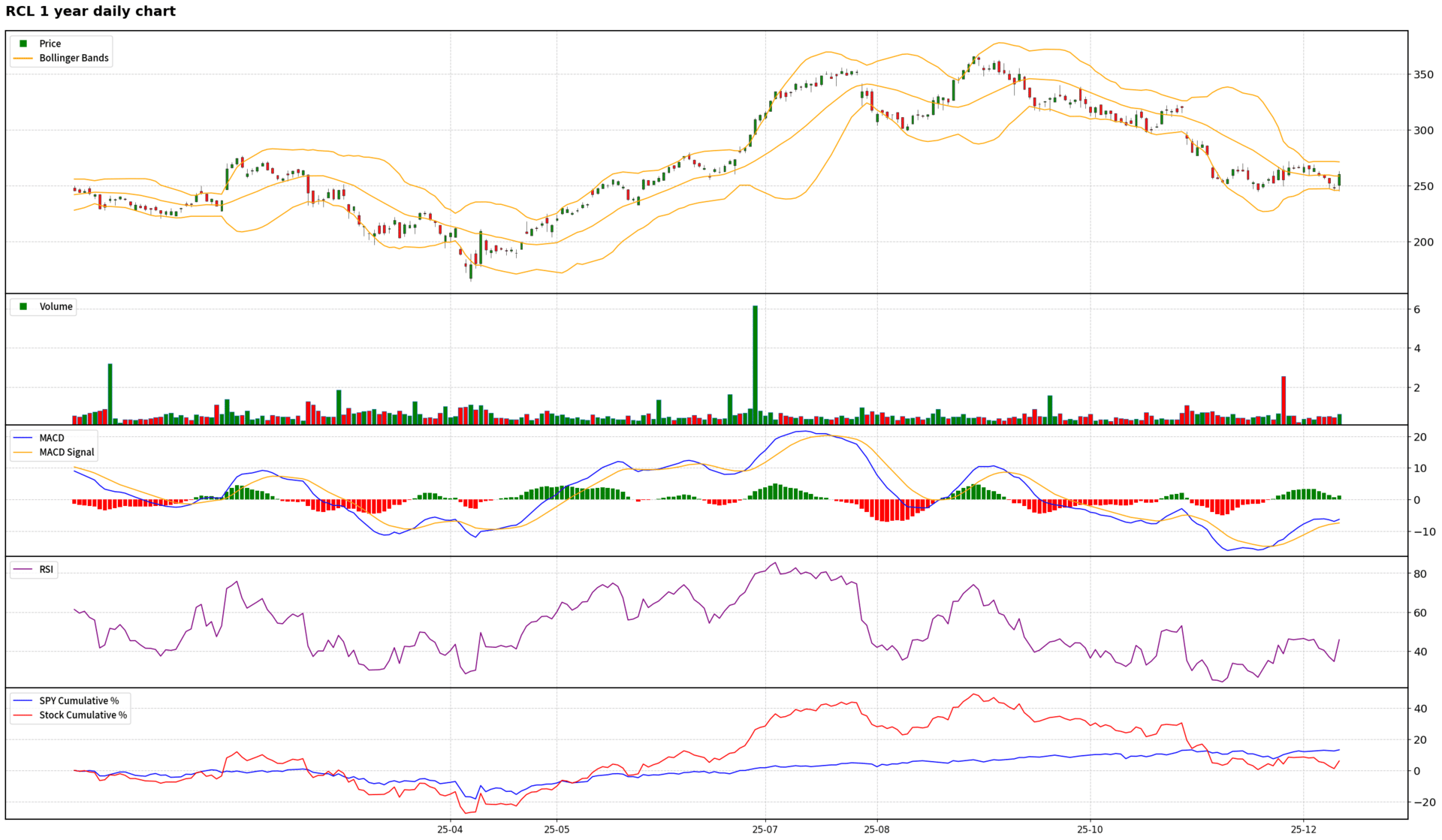

Scores: Fundamental 8 | Analyst Sentiment 7 | Valuation 6 | Catalyst 8 | Technical 7 | Total: 36

Direction: Long

Expedia Group presents a compelling long opportunity for the medium term (1-3 months), underpinned by strong fundamental momentum, strategic operational execution, and a supportive macro environment. The company's Q3 2025 results significantly exceeded expectations, driven by robust B2B growth, Trivago's revitalization, and effective AI integration enhancing efficiency and customer experience. Management's high confidence, reflected in raised full-year guidance and a commitment to shareholder returns through dividends and share repurchases, reinforces a positive outlook. While current analyst price targets suggest limited near-term upside and some relative valuation metrics appear stretched, the improving forward multiples and strong EPS growth trajectory indicate that the stock's valuation becomes increasingly attractive over time. Technically, $EXPE ( ▼ 15.26% ) is in a powerful uptrend, outperforming the broader market and trading above key moving averages. Although short-term overbought signals from Stochastic and RSI suggest a potential for a healthy consolidation or minor pullback, this is viewed as a temporary pause rather than a reversal of the strong underlying bullish trend. The acquisition of Tiqets and ongoing technological advancements serve as strong catalysts. Investors should consider initiating a long position, leveraging any short-term pullbacks as entry points, while monitoring the high debt-to-equity ratio and competitive landscape.

$EXPE ( ▼ 15.26% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

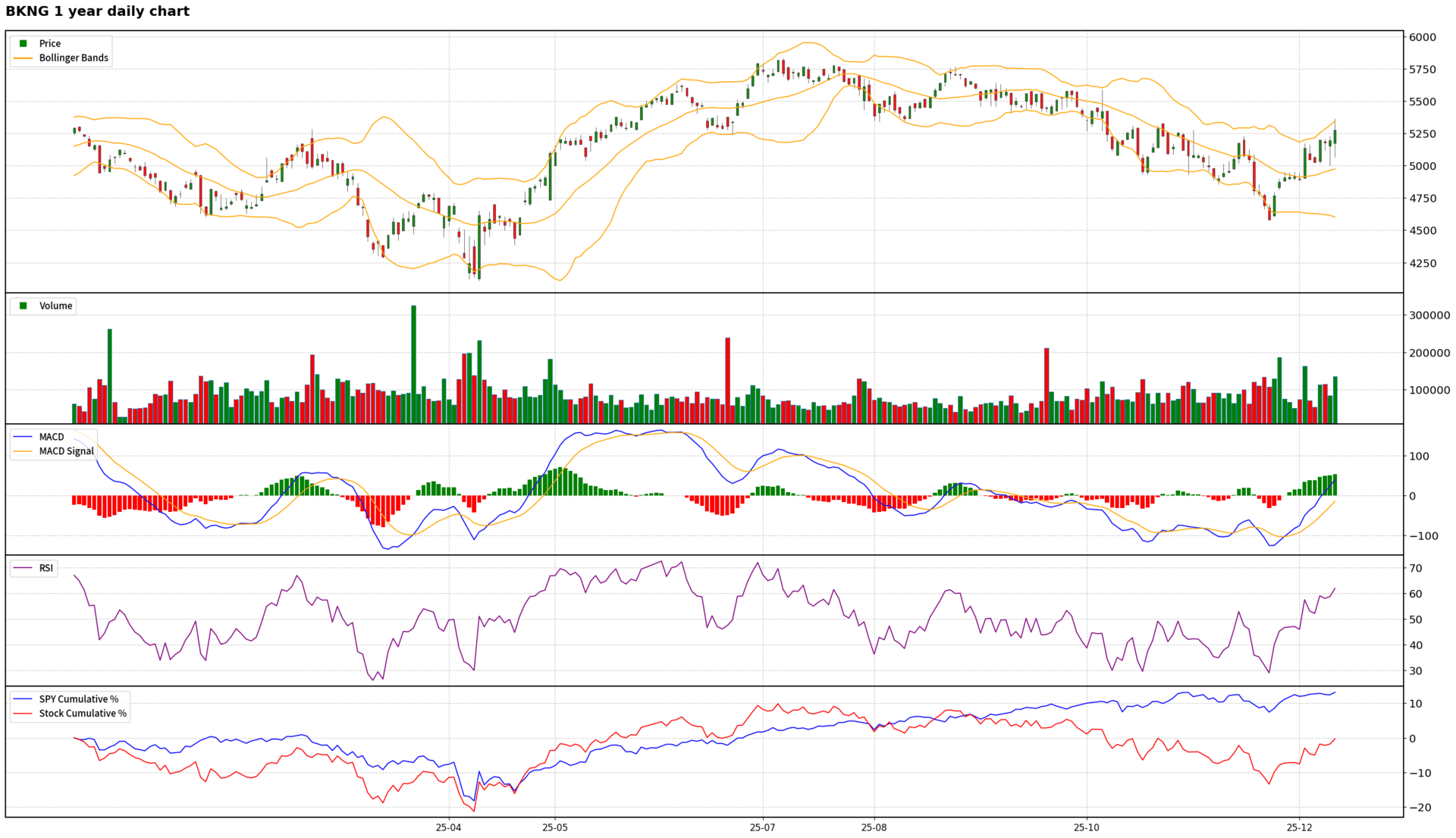

$BKNG ( ▼ 9.32% ) - Booking Holdings Inc

Scores: Fundamental 6 | Analyst Sentiment 7 | Valuation 3 | Catalyst 6 | Technical 6 | Total: 28

Direction: Neutral

Booking Holdings presents a complex investment case. Fundamentally, the company is executing well on its strategic priorities, showing strong revenue growth and management confidence in its 'Connected Trip' and AI initiatives. However, significant balance sheet concerns (stockholders' deficit, debt) and escalating regulatory pressures from the EU introduce considerable uncertainty and potential for increased costs or reduced market dominance. Analyst sentiment, while generally positive, is becoming more cautious due to valuation and competitive dynamics. Indeed, the stock appears overvalued on both intrinsic and relative metrics. Technically, $BKNG ( ▼ 9.32% ) is in a strong bullish trend but is currently overbought, indicating a high probability of a short-term pullback. The broader market also shows signs of being overextended. Therefore, despite its operational strengths, the combination of stretched valuation, significant regulatory risks, and immediate technical overbought conditions leads to a Neutral investment recommendation for the medium term. Investors should await a more attractive valuation or clearer resolution of regulatory uncertainties before considering new long positions.

$BKNG ( ▼ 9.32% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

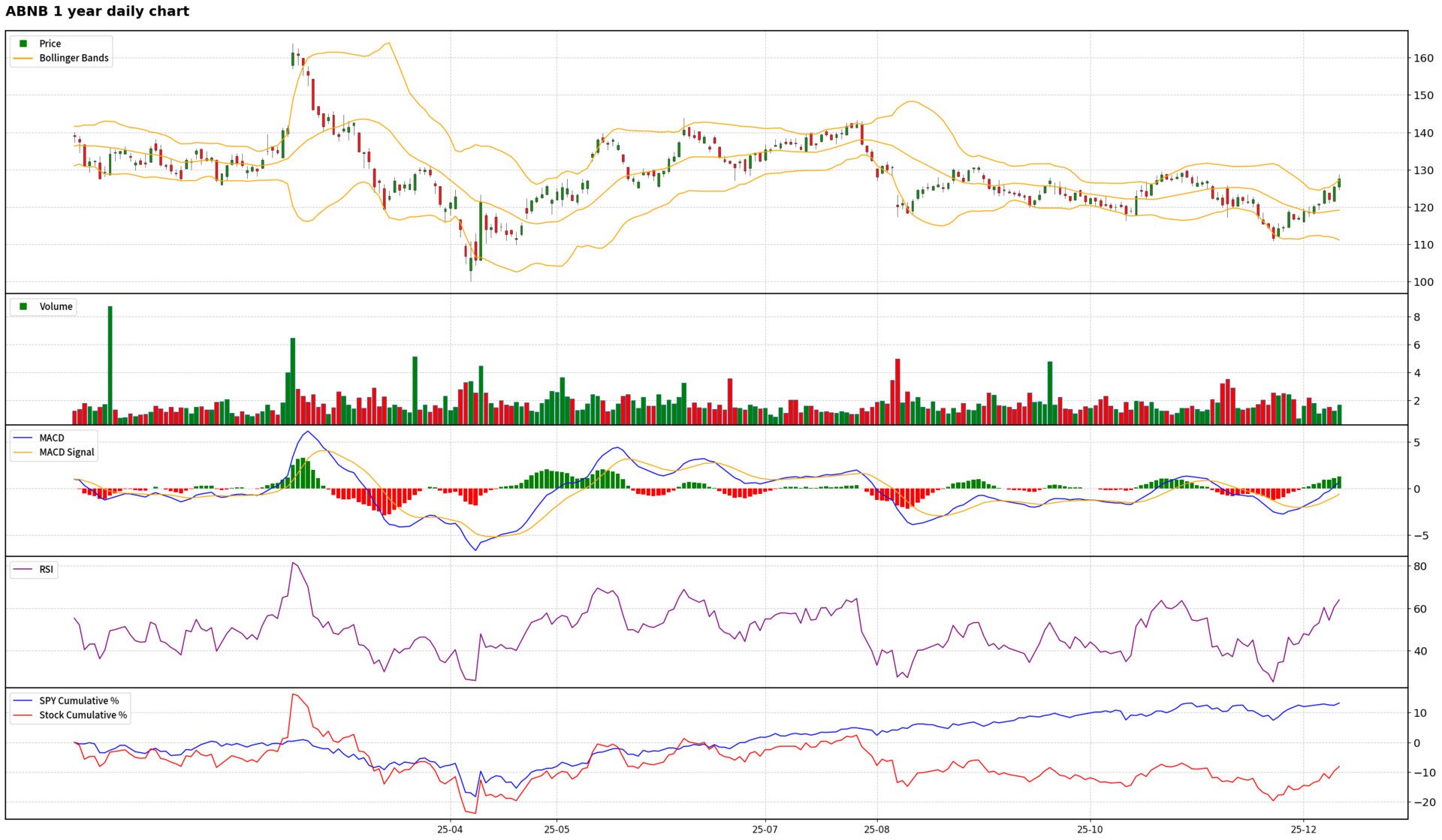

$ABNB ( ▼ 7.03% ) - Airbnb Inc

Scores: Fundamental 6 | Analyst Sentiment 5 | Valuation 2 | Catalyst 4 | Technical 7 | Total: 24

Direction: Neutral

Airbnb presents a complex investment case. While the company demonstrates strong operational execution, robust financials, and a clear strategic roadmap for growth through international expansion, new offerings, and AI integration, its current valuation is a significant hurdle. The stock trades at a substantial premium relative to peers, which is difficult to justify given its decelerating revenue growth and the long lead times for new ventures to become material. Furthermore, increasing regulatory scrutiny in key markets (highlighted by the recent Milan ban) and ongoing tax disputes introduce considerable uncertainty and potential financial liabilities. Technically, the stock is in a strong bullish trend, benefiting from a positive macro environment, but short-term overbought conditions suggest a potential for consolidation or a pullback. Given the confluence of high valuation, regulatory risks, and mixed analyst sentiment, a 'Neutral' investment strategy is recommended for the coming week and medium term. Investors should await either a more attractive valuation, clearer signs of sustained growth re-acceleration, or resolution of key regulatory and tax overhangs before considering a long position.

$ABNB ( ▼ 7.03% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Research any US or Hong Kong stock in seconds using Orion AI.

Earn Your Certificate in Private Equity on Your Schedule

The Wharton Online + Wall Street Prep Private Equity Certificate Program delivers the practical skills and industry insight to help you stand out, whether you’re breaking into PE or advancing within your firm.

Learn from Wharton faculty and industry leaders from Carlyle, Blackstone, Thoma Bravo, and more

Study on your schedule with a flexible online format

Join a lifelong network with in-person events and 5,000+ graduates

Earn a certificate from a top business school

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

The Hustle: Claude Hacks For Marketers

Some people use Claude to write emails. Others use it to basically run their entire business while they play Wordle.

This isn't just ChatGPT's cooler cousin. It's the AI that's quietly revolutionizing how smart people work – writing entire business plans, planning marketing campaigns, and basically becoming the intern you never have to pay.

The Hustle's new guide shows you exactly how the AI-literate are leaving everyone else behind. Subscribe for instant access.

Get in on the markets before tech stocks keep rising

Online stockbrokers have become the go-to way for most people to invest, especially as markets remain volatile and tech stocks keep driving headlines. With just a few taps on an app, everyday investors can trade stocks, ETFs, or even fractional shares—something that used to be limited to Wall Street pros. Check out Money’s list of top-rated online stock brokerages and start investing today!