Welcome equity investors—today’s edition unlocks Orion AI equity research on five large-cap US stocks in Tokenization sector: $BLK ( ▼ 4.43% ), $GS ( ▼ 0.78% ), $JPM ( ▲ 2.18% ), $HOOD ( ▼ 3.16% ) and $COIN ( ▼ 4.37% ).

$BLK ( ▼ 4.43% ) - BlackRock Inc

Scores: Fundamental 8 | Analyst Sentiment 9 | Valuation 3 | Catalyst 9 | Technical 6 | Total: 35

Direction: Long

Based on a comprehensive analysis, BlackRock presents a compelling long opportunity, driven by its transformative strategic initiatives and robust market positioning. The company's aggressive expansion into high-growth sectors like AI infrastructure, private markets, and digital assets, alongside significant global partnerships in emerging markets, underpins a strong fundamental outlook and high management confidence. Analyst sentiment is overwhelmingly bullish, with strong buy ratings and significant price target upside. While current valuation metrics appear stretched and technical indicators suggest short-term bearish momentum and oversold conditions, these may offer tactical entry points. The confluence of powerful, recent catalysts and a generally bullish macro environment, despite short-term market overextension, supports a long position. Investors should consider $BLK ( ▼ 4.43% ) for its long-term growth potential and market leadership, while being mindful of potential near-term volatility and integration risks associated with its numerous acquisitions.

$BLK ( ▼ 4.43% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

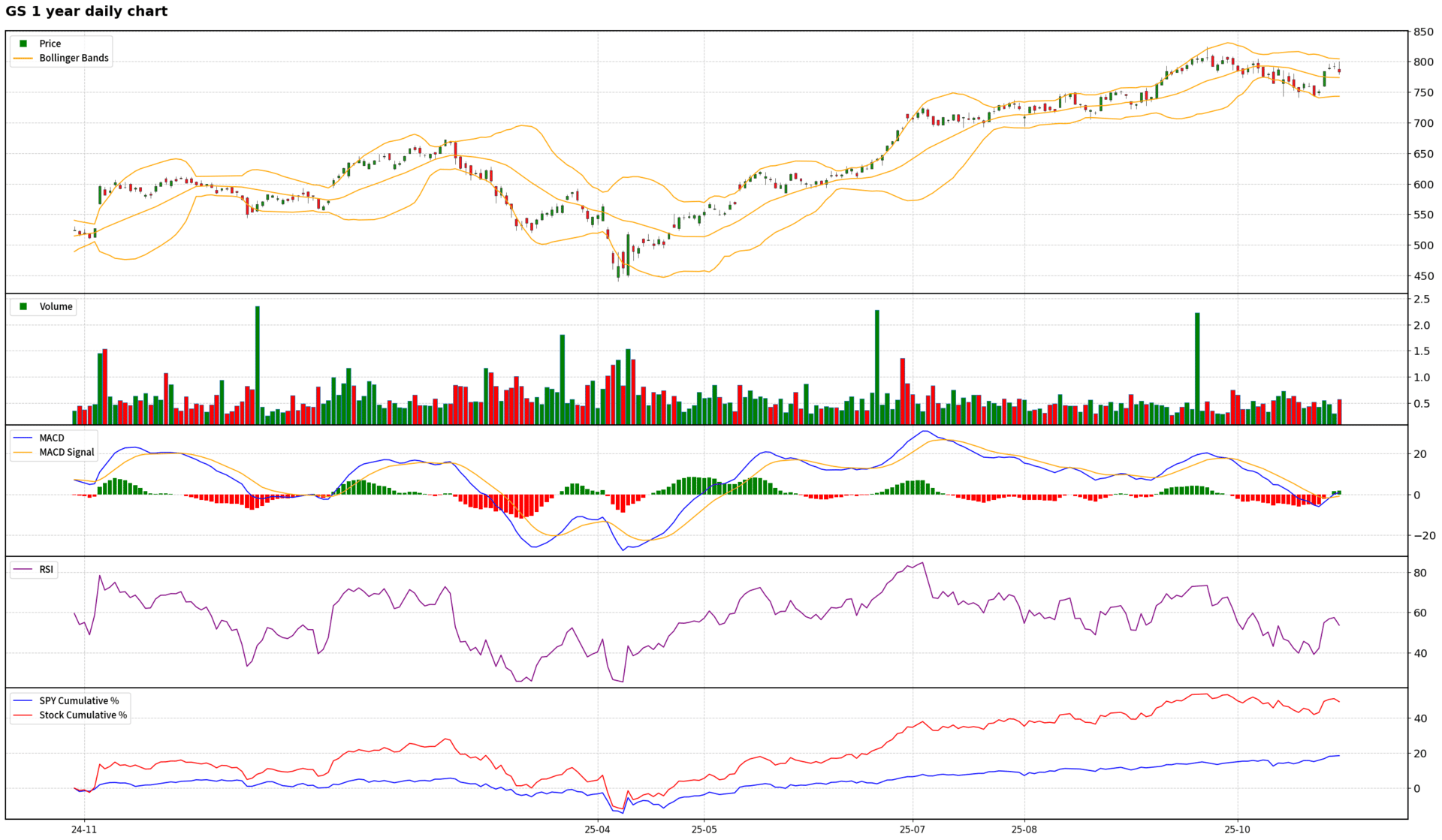

$GS ( ▼ 0.78% ) - Goldman Sachs Group Inc

Scores: Fundamental 7 | Analyst Sentiment 6 | Valuation 5 | Catalyst 8 | Technical 6 | Total: 32

Direction: Long

Goldman Sachs presents a compelling long opportunity for medium-term investors, driven by robust fundamental performance and strategic execution. The firm's exceptional Q3 2025 results, marked by significant revenue and earnings growth across its core Global Banking & Markets and Asset & Wealth Management segments, underscore its market leadership and operational strength. Management's high confidence, strategic focus on high-growth areas, and proactive integration of AI position $GS ( ▼ 0.78% ) for sustained future growth. Numerous catalysts, including large mandates, international expansion, and a favorable regulatory outlook, are expected to fuel continued momentum. While analyst sentiment suggests limited immediate upside due to current valuation, and technical indicators signal short-term overbought conditions, these factors are likely to lead to a healthy consolidation rather than a reversal. The broader bullish macro environment, despite its own overextension, provides a supportive backdrop. Any short-term pullback should be viewed as an attractive entry point, as the strong underlying fundamentals and strategic tailwinds are poised to drive $GS ( ▼ 0.78% ) higher over the next 1-3 months, eventually overcoming current resistance levels.

$GS ( ▼ 0.78% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$JPM ( ▲ 2.18% ) - JPMorgan Chase & Co

Scores: Fundamental 6 | Analyst Sentiment 7 | Valuation 4 | Catalyst 5 | Technical 7 | Total: 29

Direction: Neutral

JPMorgan Chase presents a complex investment case, balancing its undeniable strength as a financial titan with significant near-term headwinds. Fundamentally, the company is performing exceptionally well, driven by diversified revenue streams across its consumer, investment banking, and asset management segments, coupled with disciplined capital allocation and robust shareholder returns. Management's 'optimistically cautious' tone acknowledges potential risks like credit deterioration in non-bank financial institutions (NBFIs), persistent expense inflation, and a delayed deposit growth inflection, which are critical to monitor. The low scores for 'Earnings Quality' and 'Insider' activity, alongside a decelerating forward EPS growth, warrant attention. Technically, $JPM ( ▲ 2.18% ) is in a strong bullish trend, outperforming the S&P 500, with positive momentum indicators. However, the stock is currently trading near its upper Bollinger Band and resistance, suggesting short-term overextension. This aligns with the broader market's (SPY) overbought conditions, indicating a potential for a healthy consolidation or minor pullback. While analysts are generally positive, valuation concerns and modest price targets suggest that much of the good news is already priced in. The immediate future is clouded by the ongoing prime rate fixing lawsuit and Jamie Dimon's explicit warnings about credit market anxiety. Therefore, a Neutral stance is recommended for the medium term (1-3 months). While $JPM ( ▲ 2.18% ) remains a high-quality, long-term core holding, the confluence of short-term technical overextension, valuation concerns, and specific credit/legal risks suggests that a wait-and-see approach is prudent before initiating new long positions. Investors should monitor the resolution of legal issues, credit quality trends, and broader market sentiment for clearer entry points.

$JPM ( ▲ 2.18% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$HOOD ( ▼ 3.16% ) - Robinhood Markets Inc

Scores: Fundamental 9 | Analyst Sentiment 6 | Valuation 1 | Catalyst 8 | Technical 4 | Total: 28

Direction: Neutral

Based on a comprehensive analysis, Robinhood presents a compelling long-term growth story driven by aggressive product innovation, successful diversification beyond core trading, and strong customer engagement metrics. The company's recent financial performance, marked by robust revenue and EPS growth, expanding Gold subscriptions, and strategic acquisitions (Bitstamp, TradePMR), underscores its operational strength and management's high confidence. However, the stock is currently trading at an extremely elevated valuation, with P/E multiples in the high 70s and minimal upside to analyst price targets, indicating it is 'priced for perfection.' Technical analysis reveals weakening bullish momentum, a recent pullback from a double top, and overbought conditions, suggesting a short-term correction or consolidation is likely. While the broader market is bullish, it too shows signs of overextension. Given the significant overvaluation and immediate technical headwinds, a neutral investment stance is recommended for the medium term (1-3 months). Investors should monitor for a healthy pullback or consolidation to a more attractive valuation level before considering a long position, despite the strong underlying business fundamentals and promising long-term catalysts.

$HOOD ( ▼ 3.16% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

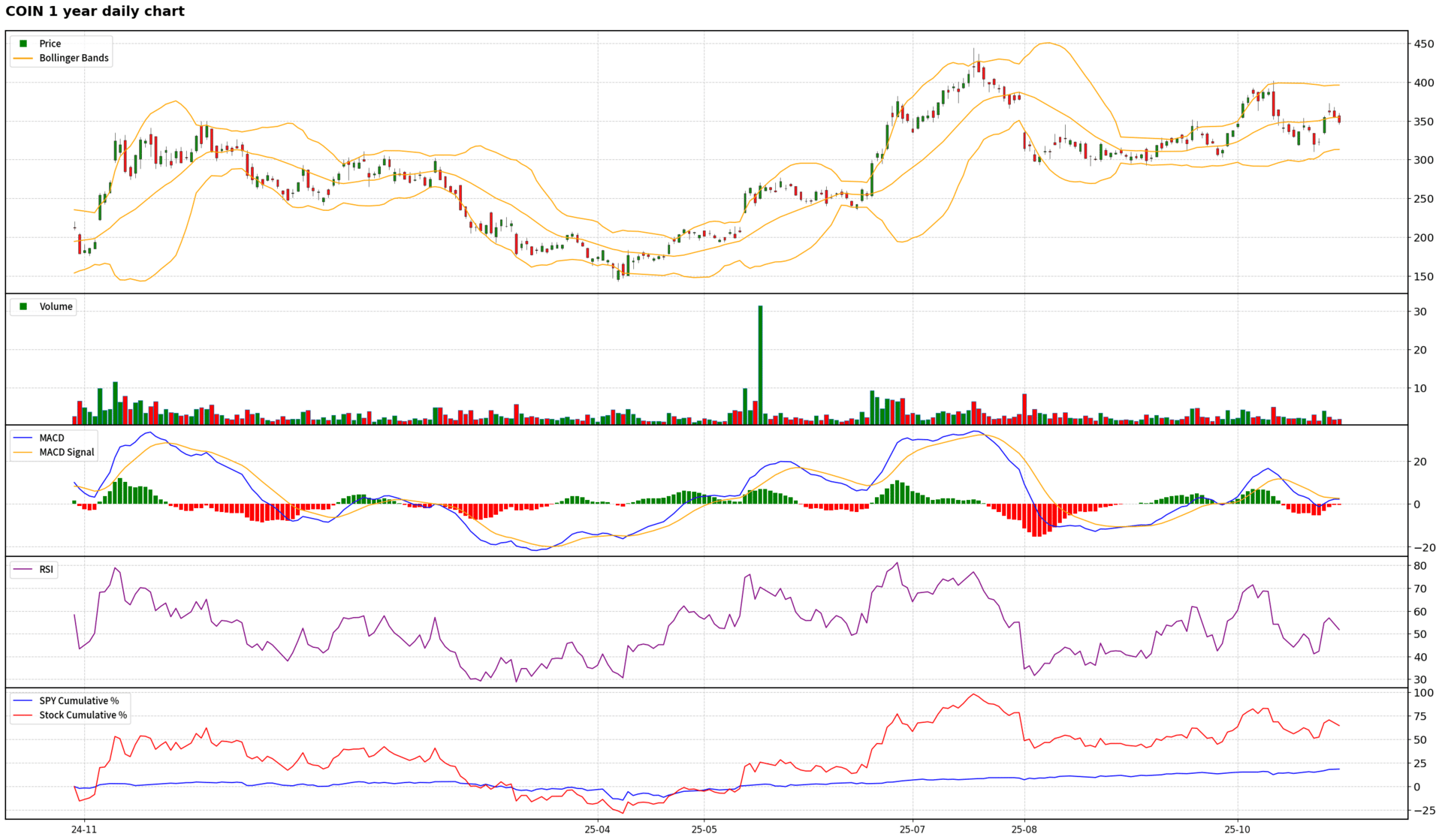

$COIN ( ▼ 4.37% ) - Coinbase Global Inc

Scores: Fundamental 5 | Analyst Sentiment 7 | Valuation 2 | Catalyst 9 | Technical 4 | Total: 27

Direction: Neutral

Coinbase presents a compelling long-term growth story driven by its expansive vision, strategic diversification into institutional services, tokenized assets, and stablecoin payments, and recent significant partnerships with major financial institutions like Citigroup. The dismissal of the SEC lawsuit and regulatory clarity further bolster its position. However, the stock's current valuation is extremely high, trading at a significant premium to peers, which is difficult to justify given its volatile profitability, high operating expenses, and a concerning negative forward EPS CAGR. Short-term technical indicators also suggest a potential pullback or consolidation, aligning with an overextended broader market. Therefore, while the long-term outlook remains promising, a Neutral stance is recommended for the medium term (1-3 months). Investors should await a more attractive entry point following a potential consolidation or correction, as the current price appears to have already priced in much of the anticipated future growth and positive catalysts.

$COIN ( ▼ 4.37% ) 1 Year daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Research any US or Hong Kong stock in seconds using Orion AI.

Turn AI Into Your Income Stream

The AI economy is booming, and smart entrepreneurs are already profiting. Subscribe to Mindstream and get instant access to 200+ proven strategies to monetize AI tools like ChatGPT, Midjourney, and more. From content creation to automation services, discover actionable ways to build your AI-powered income. No coding required, just practical strategies that work.

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.