Welcome equity investors—today’s edition unlocks Orion AI equity research on five large-cap US Space-Tech stocks: $LHX ( ▲ 3.33% ), $RKLB ( ▲ 9.6% ), $LMT ( ▼ 1.22% ), $ASTS ( ▲ 10.72% ) and $BA ( ▲ 0.06% ).

$LHX ( ▲ 3.33% ) - L3Harris Technologies Inc

Scores: Fundamental 8 | Analyst Sentiment 9 | Valuation 4 | Catalyst 9 | Technical 7 | Total: 37

Direction: Long

Based on a comprehensive analysis, L3Harris Technologies presents a compelling long opportunity for the medium term. The company's robust Q3 2025 earnings beat, coupled with raised full-year guidance and a record book-to-bill ratio, underscores strong operational execution and a favorable demand environment driven by geopolitical tensions. Management's high confidence in achieving its 2026 financial framework and beyond, supported by successful integration of acquisitions and the efficiency gains from the $LHX ( ▲ 3.33% ) NeXt program, provides a solid fundamental foundation. Analyst sentiment is overwhelmingly bullish, with significant upside potential indicated by price targets. Key catalysts, including the Pentagon's acquisition reforms and the potential for substantial institutional investment from Norway's sovereign wealth fund, are expected to fuel future growth and investor interest. Technically, $LHX ( ▲ 3.33% ) is in a strong bullish trend, consistently outperforming the broader market. While valuation metrics appear stretched and short-term technicals suggest potential for consolidation or a minor pullback, these are likely temporary pauses within a powerful upward trajectory. The strong industry tailwinds in the defense sector, combined with $LHX ( ▲ 3.33% )'s strategic positioning and financial strength, justify a long position, with any short-term dips potentially offering attractive entry points.

$LHX ( ▲ 3.33% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$RKLB ( ▲ 9.6% ) - Rocket Lab Corp

Scores: Fundamental 6 | Analyst Sentiment 8 | Valuation 2 | Catalyst 7 | Technical 4 | Total: 27

Direction: Short

Rocket Lab presents a high-growth narrative within the burgeoning space industry, driven by strong revenue expansion, improving gross margins, and a robust backlog. Analyst sentiment remains largely bullish on its long-term potential, particularly with the anticipated Neutron rocket. However, the company continues to operate at a net loss with significant cash burn, and the Neutron project, a pivotal catalyst, has faced delays. Critically, $RKLB ( ▲ 9.6% )'s valuation is extremely stretched, priced for perfection, which creates substantial risk. Technically, the stock is in a strong bearish trend, having recently broken key support levels, with MACD confirming increasing selling pressure. While oversold conditions might trigger a temporary bounce, the overall technical picture, combined with the extreme valuation and execution risks around Neutron, suggests a tactical short position or avoidance of the stock for the medium term (1-3 months). The current price does not adequately reflect the inherent risks and lack of immediate profitability, making it susceptible to further correction, even within a generally bullish broader market.

$RKLB ( ▲ 9.6% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$LMT ( ▼ 1.22% ) - Lockheed Martin Corp

Scores: Fundamental 5 | Analyst Sentiment 5 | Valuation 6 | Catalyst 7 | Technical 3 | Total: 26

Direction: Neutral

Lockheed Martin presents a complex investment profile, leading to a Neutral stance for the medium term (1-3 months). Fundamentally, the company benefits from an 'unprecedented demand cycle' and a record $179 billion backlog, driven by global defense spending and nuclear modernization. Management has demonstrated confidence by raising 2025 guidance and increasing shareholder returns. However, these positives are significantly offset by substantial program losses (e.g., $950M for a classified Aeronautics program, $570M for CMHP) that have severely impacted YTD operating profit, net earnings, and free cash flow. Analyst sentiment is mixed, with a majority on 'Hold' despite a decent price target upside, reflecting concerns over F-35 program headwinds, financial volatility, and slow growth. Technically, $LMT ( ▼ 1.22% ) is in a clear downtrend, trading below its 50-day and 200-day moving averages, and has significantly underperformed the SPX. While oversold indicators (RSI, Stochastic) suggest a potential short-term bounce, this would likely be a temporary mean-reversion within the established bearish trend. The bullish macro environment for defense spending provides a supportive backdrop, but $LMT ( ▼ 1.22% )'s specific operational challenges and technical weakness suggest it may not fully participate in broader market rallies in the near term. Therefore, a wait-and-see approach is prudent until there is clearer evidence of fundamental improvement or a reversal in the bearish technical trend.

$LMT ( ▼ 1.22% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$ASTS ( ▲ 10.72% ) - AST SpaceMobile Inc

Scores: Fundamental 5 | Analyst Sentiment 6 | Valuation 2 | Catalyst 8 | Technical 4 | Total: 25

Direction: Neutral

AST SpaceMobile presents a compelling long-term vision for global satellite-to-smartphone connectivity, validated by strategic partnerships and operational progress. The company is actively deploying its advanced Block 1 and upcoming Block 2 satellites, with commercial activations targeted for early 2026. However, this is a highly speculative investment. Fundamentally, $ASTS ( ▲ 10.72% ) is pre-revenue with significant losses and high cash burn, leading to a stretched valuation that has priced in much of its future potential. Analyst sentiment is cautiously optimistic, acknowledging both the opportunity and the substantial risks. Technically, the stock exhibits short-term bearish momentum, although oversold conditions might lead to a temporary bounce. Given the high execution risk, intense competition, and current financial underperformance despite a bullish macro backdrop, a Neutral stance is recommended for the medium term. Investors should await concrete evidence of revenue ramp-up and sustained operational success without significant delays or further dilution before considering a strong directional position. This stock is suitable only for investors with a high-risk tolerance and a long-term investment horizon.

$ASTS ( ▲ 10.72% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$BA ( ▲ 0.06% ) - Boeing Co

Scores: Fundamental 3 | Analyst Sentiment 8 | Valuation 2 | Catalyst 5 | Technical 3 | Total: 21

Direction: Neutral to Slightly Bearish

Based on a comprehensive analysis, Boeing presents a high-risk, high-reward scenario, leaning towards a Neutral to Slightly Bearish outlook for the medium term. While analyst sentiment is overwhelmingly bullish, driven by strong long-term demand and a substantial order backlog, the company's fundamental financial health remains weak with persistent net losses and deeply negative shareholder equity. Valuation multiples are stretched, reflecting optimism for a future turnaround rather than current performance. Operationally, significant program delays (777X, 737-7/-10), ongoing quality control issues, and recent safety incidents pose considerable execution risks. Technically, the stock is in a clear downtrend, trading below key moving averages with bearish momentum, despite being oversold. While the broader market is bullish, $BA ( ▲ 0.06% )'s specific challenges are causing it to underperform. Investors should exercise extreme caution, as the stock needs to demonstrate consistent operational execution, improved profitability, and a stronger balance sheet to justify a sustained upward trajectory. A tactical approach would involve waiting for clear signs of fundamental improvement and a reversal in technical trends before considering a long position.

$BA ( ▲ 0.06% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Research any US or Hong Kong stock in seconds using Orion AI.

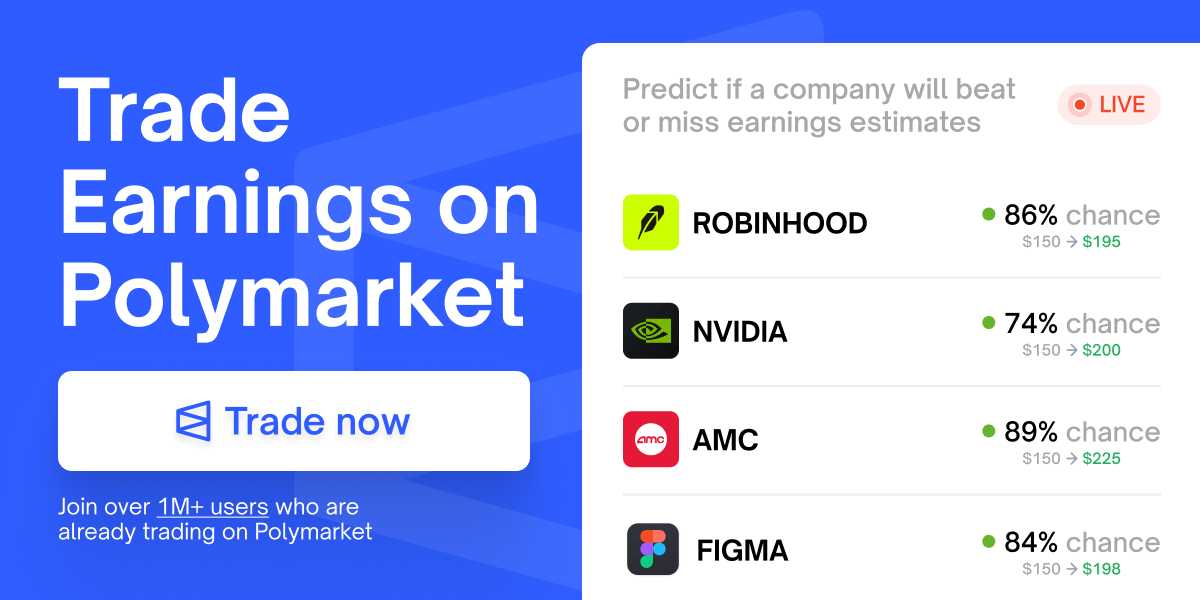

JUST IN: Earning Markets on Polymarket 🚨

Polymarket, the world's largest prediction market, has rolled out Earnings Markets. You can now place a simple Yes/No trade on specific outcomes:

Will HOOD beat earnings?

Will NVDA mention China?

Will AMC beat estimated EPS?

Profit directly from your conviction on an earnings beat, regardless of the immediate stock movement.

Why trade Earnings Markets?

Simple: Clear Yes/No outcomes.

Focused: Isolate the specific event you care about.

Flexible: Tight control for entry, hedging, or exit strategy.

Upcoming markets include FIGMA, ROBINHOOD, AMC, NVIDIA, and more. Built for how traders actually trade.

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 23 sales have delivered net annualized returns like 17.6%, 17.8%, and 21.5%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Debt sucks. Getting out doesn’t have to.

Americans’ credit card debt has surpassed $1.2 trillion, and high interest rates are making it harder to catch up (yes, even if you’re making your payments). If you’re in the same boat as millions of Americans, debt relief companies could help by negotiating directly with creditors to reduce what you owe by up to 60%. Check out Money’s list of the best debt relief programs, answer a few short questions, and get your free rate today.