Welcome equity investors—today’s edition unlocks Orion equity research on five large-cap US residential real estate stocks: $MAA ( ▼ 0.08% ), $EQR ( ▲ 0.29% ), $AVB ( ▼ 0.59% ), $UDR ( ▼ 0.33% ) and $ESS ( ▼ 0.35% ).

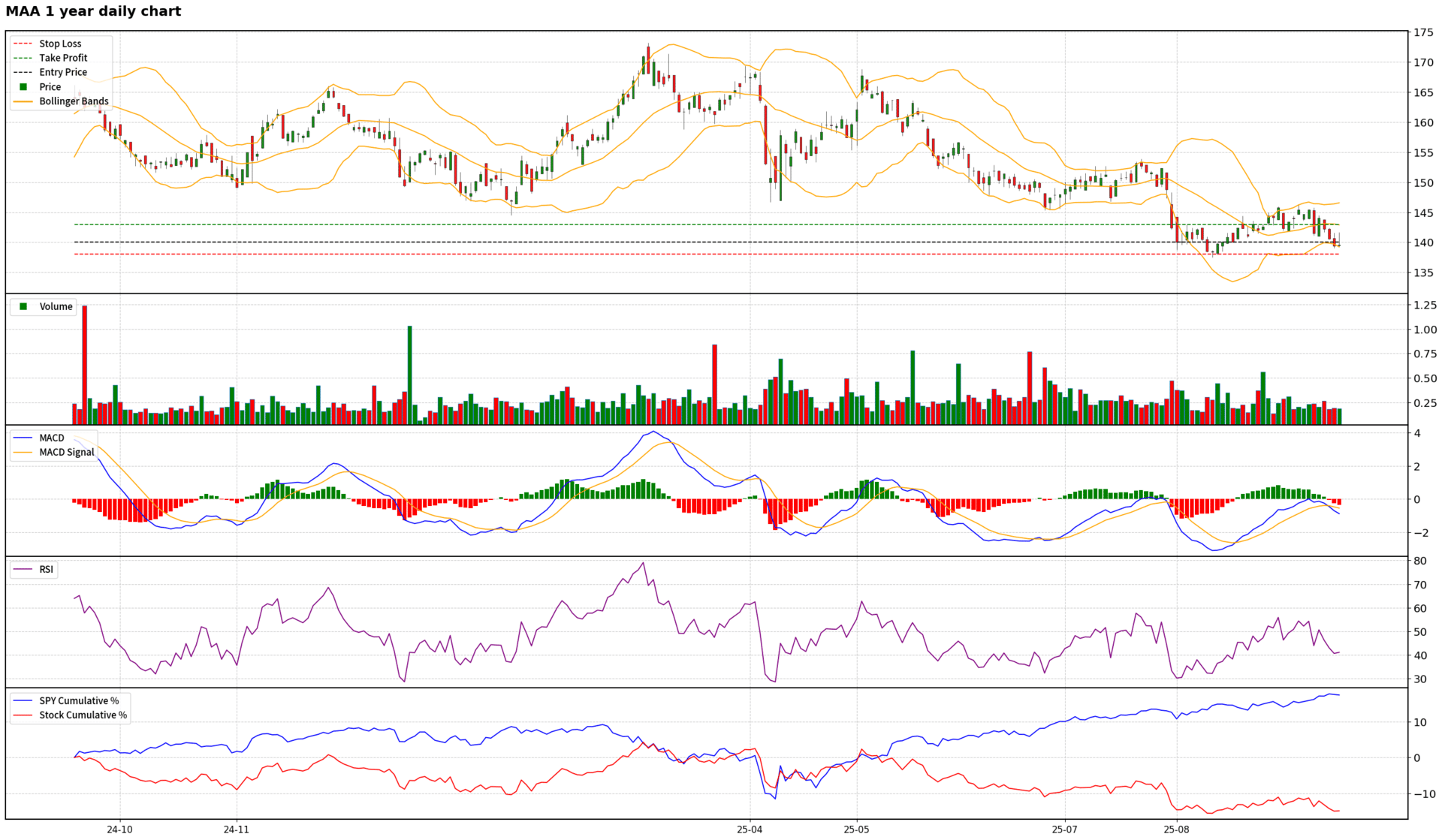

$MAA ( ▼ 0.08% ) - Mid-America Apartment Communities Inc

Scores: Fundamental 5 | Analyst Sentiment 6 | Valuation 3 | Catalyst 5 | Technical 6 | Total: 25

Trade Suggestions: Long Normal | Entry: 140.0 | TP: 143.0 | SL: 138.0 | Confidence: 5

$MAA ( ▼ 0.08% ) presents a complex investment case. Fundamentally, the company is underpinned by a robust balance sheet, disciplined capital allocation, and strong long-term demand in its Sunbelt markets, evidenced by high absorption and retention rates. However, near-term operational headwinds, including declining same-store revenues, rising expenses, and negative EPS growth, are significant concerns. Management's cautious optimism for a recovery is tempered by persistent supply pressures and competitive operator behavior, which are delaying improvements in pricing power and lease-up stabilization. Valuation appears stretched with high multiples and low relative ranking scores, despite an attractive dividend yield. Analyst sentiment is neutral to cautiously positive, with moderate upside price targets. Technically, the stock exhibits bearish momentum but is showing clear signs of being oversold, suggesting a potential short-term mean-reversion bounce. Given these conflicting signals, a tactical long position aiming for a short-term bounce from oversold conditions is recommended, but with conservative sizing and strict risk management, as the longer-term fundamental and valuation concerns persist.

$MAA ( ▼ 0.08% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

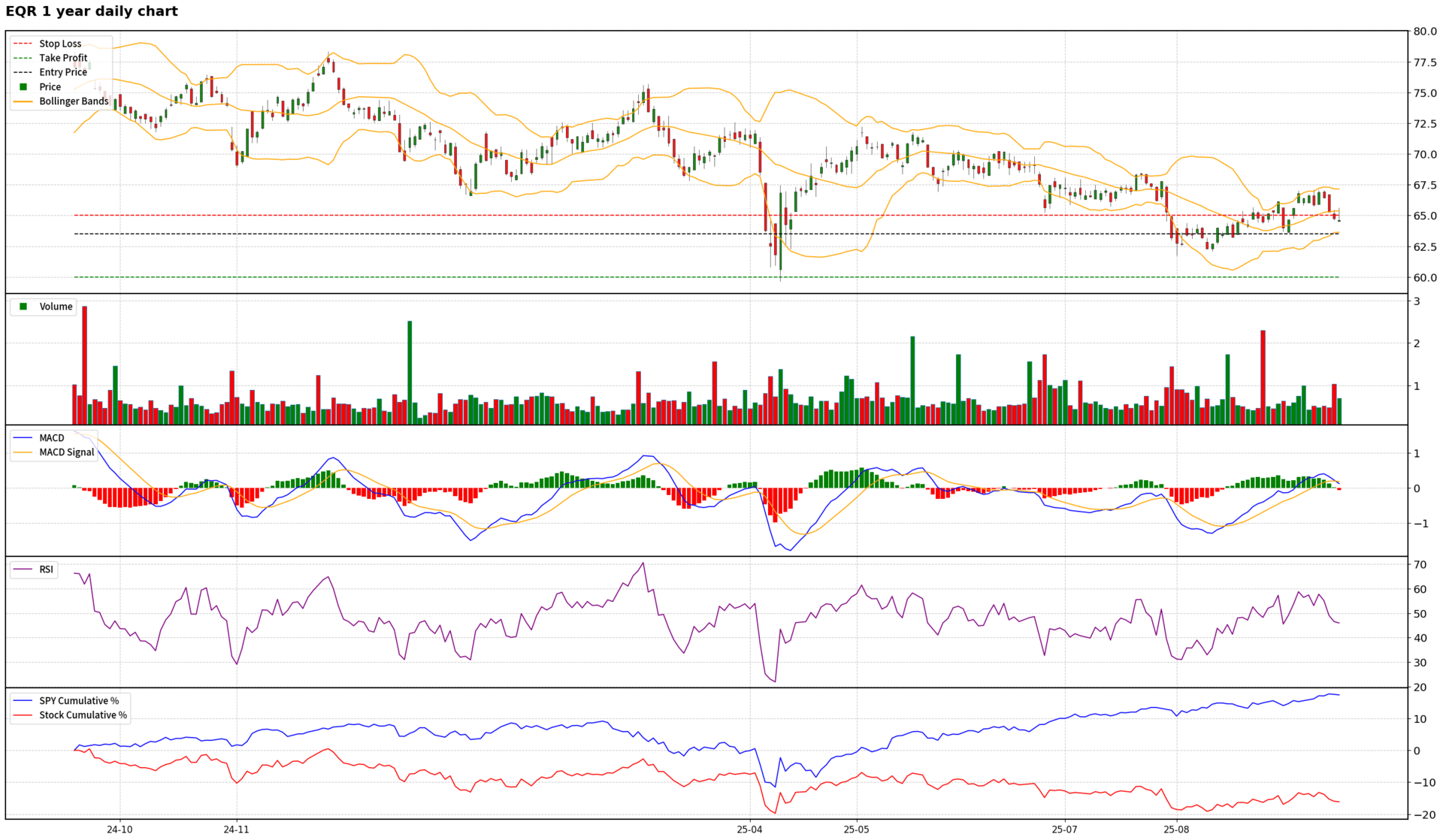

$EQR ( ▲ 0.29% ) - Equity Residential

Scores: Fundamental 5 | Analyst Sentiment 6 | Valuation 3 | Catalyst 4 | Technical 4 | Total: 22

Trade Suggestions: Short Breakthrough | Entry: 63.5 | TP: 60.0 | SL: 65.0 | Confidence: 4

Equity Residential presents a challenging investment case in the near term. While the company benefits from a high-quality asset portfolio in desirable urban markets and management's long-term optimism regarding structural tailwinds, immediate concerns outweigh these positives. The stock is experiencing significant negative price momentum, evidenced by consecutive daily declines and substantial institutional selling. Financial health indicators, such as a declining Altman-Z score and a very low cash ratio, signal increasing risk. Furthermore, the company's valuation appears stretched relative to peers, and a concerning negative forward EPS CAGR casts a shadow on future growth prospects. Technically, $EQR ( ▲ 0.29% ) is in a weak bearish trend, consolidating near support, with momentum indicators suggesting further downside risk if key resistance levels are not breached. Therefore, a tactical short position is justified, contingent on a breakdown below immediate support, to capitalize on the prevailing bearish sentiment and fundamental headwinds, while maintaining disciplined risk management.

$EQR ( ▲ 0.29% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

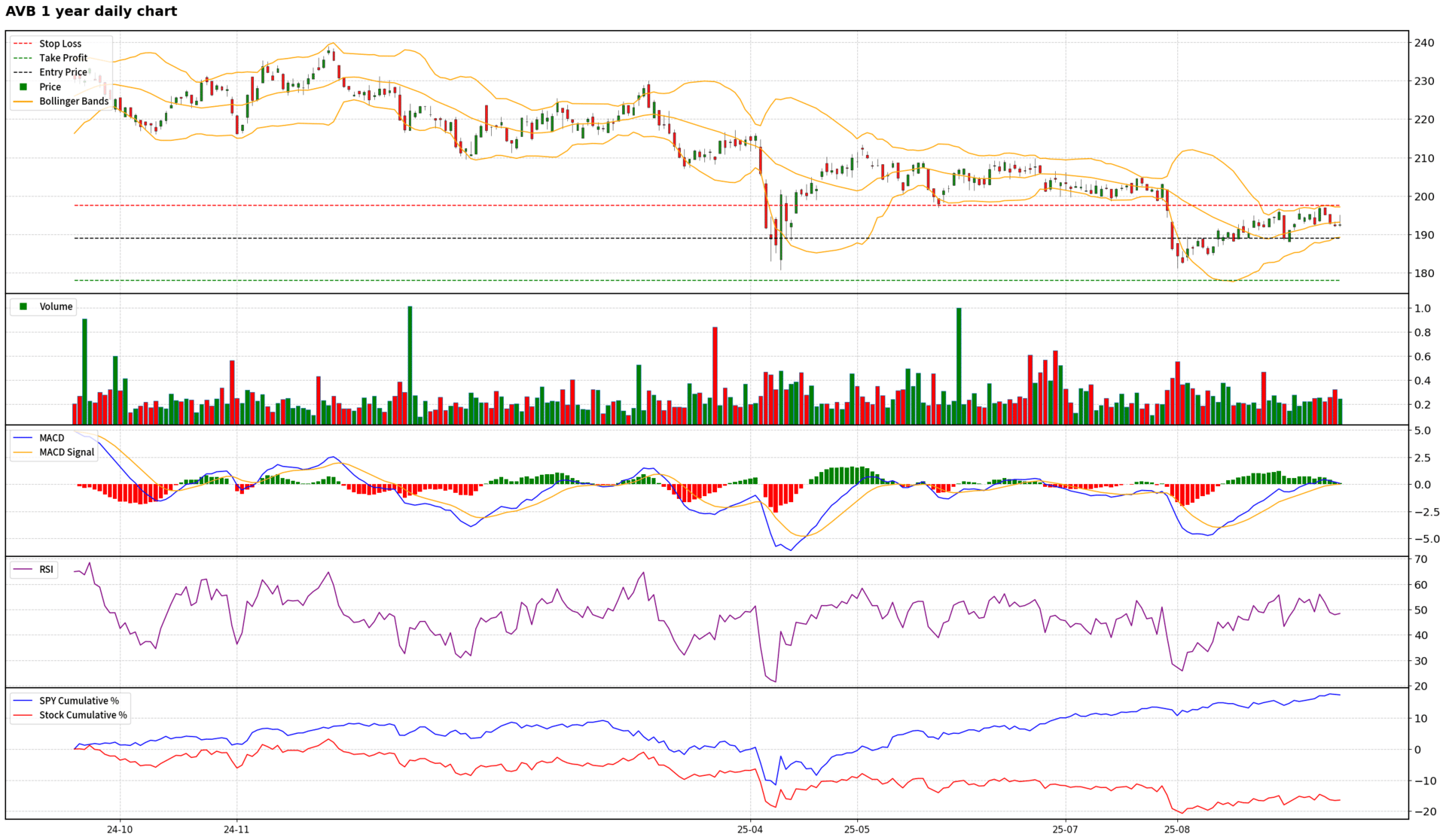

$AVB ( ▼ 0.59% ) - AvalonBay Communities Inc

Scores: Fundamental 5 | Analyst Sentiment 3 | Valuation 2 | Catalyst 4 | Technical 5 | Total: 19

Trade Suggestions: Short Breakthrough | Entry: 189.0 | TP: 178.0 | SL: 197.5 | Confidence: 4

AvalonBay Communities, Inc. presents a compelling short opportunity driven by a significant downward revision in its full-year EPS outlook and a subsequent wave of analyst downgrades, signaling a challenging near-term future. Despite a strong operational base and strategic long-term initiatives, the company faces headwinds from muted job growth, persistent bad debt, and market-specific demand softness, all contributing to an elevated valuation relative to its peers and growth prospects. Technically, the stock is in a consolidation phase, but a confirmed breakdown below key support levels would align with the prevailing negative sentiment and fundamental concerns, making a tactical short position with disciplined risk management a prudent strategy.

$AVB ( ▼ 0.59% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

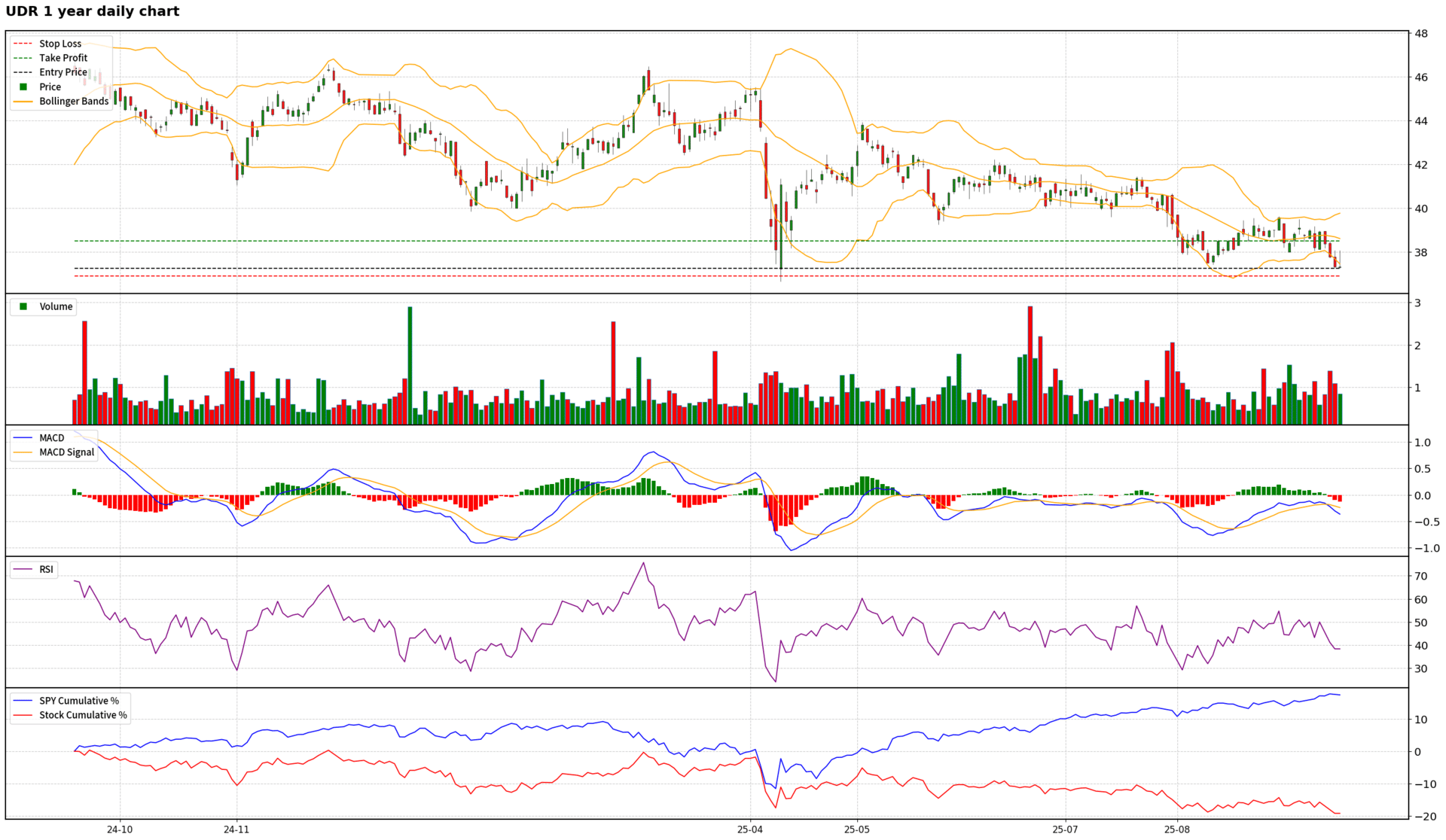

$UDR ( ▼ 0.33% ) - UDR Inc

Scores: Fundamental 5 | Analyst Sentiment 3 | Valuation 2 | Catalyst 4 | Technical 3 | Total: 17

Trade Suggestions: Long Normal | Entry: 37.25 | TP: 38.5 | SL: 36.9 | Confidence: 3

$UDR ( ▼ 0.33% ) presents a challenging investment landscape. While the company exhibits operational resilience with strong Q2 2025 year-over-year growth and management confidence in long-term apartment fundamentals, these positives are overshadowed by significant profitability concerns, including a severe FY2024 profit decline and a sequential drop in Q2 net income. Analyst sentiment is predominantly neutral to negative, with recent downgrades and price target reductions. Valuation metrics are significantly stretched, indicating the stock is overvalued relative to peers and its growth prospects. Technically, $UDR ( ▼ 0.33% ) is in a strong bearish trend, trading below key moving averages and underperforming the broader market. Although oversold conditions suggest a potential for a short-term mean-reversal bounce, the overwhelming fundamental and sentiment headwinds, coupled with high valuation, make any long position highly speculative and low-conviction. For income-focused investors, the dividend yield is attractive, but capital appreciation potential is severely limited by current market dynamics and valuation. A cautious approach is warranted, with a preference for avoiding long positions or considering a short-term, highly disciplined counter-trend trade if a bounce materializes.

$UDR ( ▼ 0.33% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

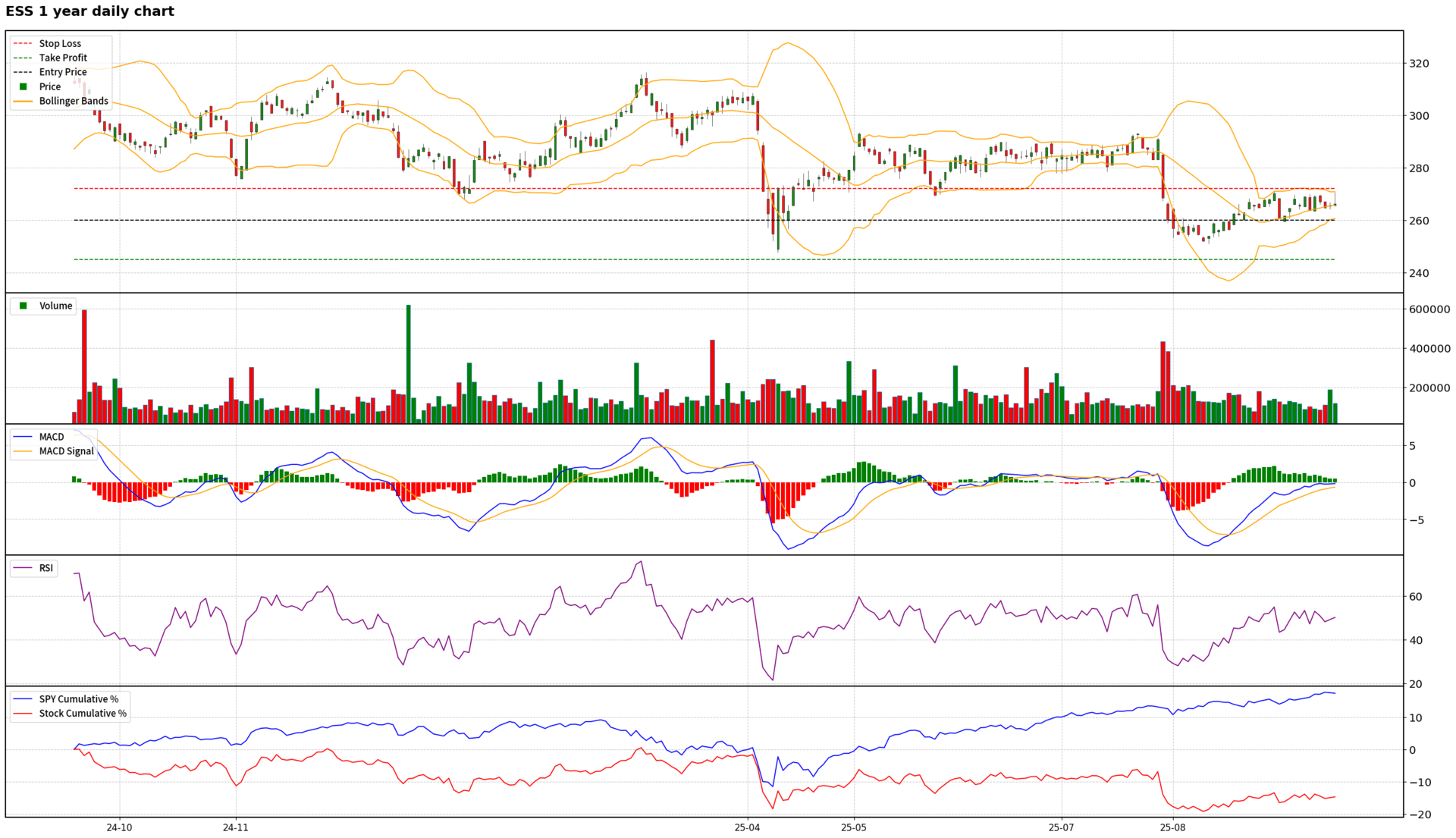

$ESS ( ▼ 0.35% ) - Essex Property Trust Inc

Scores: Fundamental 3 | Analyst Sentiment 2 | Valuation 1 | Catalyst 2 | Technical 3 | Total: 11

Trade Suggestions: Short Breakthrough | Entry: 260.0 | TP: 245.0 | SL: 272.0 | Confidence: 8

Based on a comprehensive analysis, Essex Property Trust presents a compelling short opportunity. Despite some operational strengths in its Northern California and Seattle markets and strategic capital allocation, these positives are severely overshadowed by critical financial vulnerabilities. The company faces a concerning negative forward EPS growth forecast, an unsustainable projected dividend payout ratio of 130.05%, and elevated leverage. Analyst sentiment has recently turned negative with multiple downgrades and price target cuts, and the stock is significantly overvalued based on various metrics. Technically, $ESS ( ▼ 0.35% ) is in a bearish trend, consolidating with weak momentum. The confluence of these factors suggests a high probability of further downside, making a short position advisable upon a confirmed break of key support.

$ESS ( ▼ 0.35% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Research any US or Hong Kong stock in seconds using Orion AI.

Need FREE access? Reply FREE to this email.

Not interested in US/HK stocks? Reply to this email with any stock exchange of your interest and we will contact you when we launch for that stock exchange.

If you are not interested in receiving our FREE reports, kindly unsubscribe below.