Welcome equity investors—today’s edition unlocks Orion AI equity research on five large-cap US stocks in Rare Earth sector: $MP ( ▲ 9.31% ), $NB ( ▲ 21.75% ), $USAR ( ▲ 17.46% ), $IDR ( ▲ 5.12% ) and $UURAF ( ▼ 2.15% ).

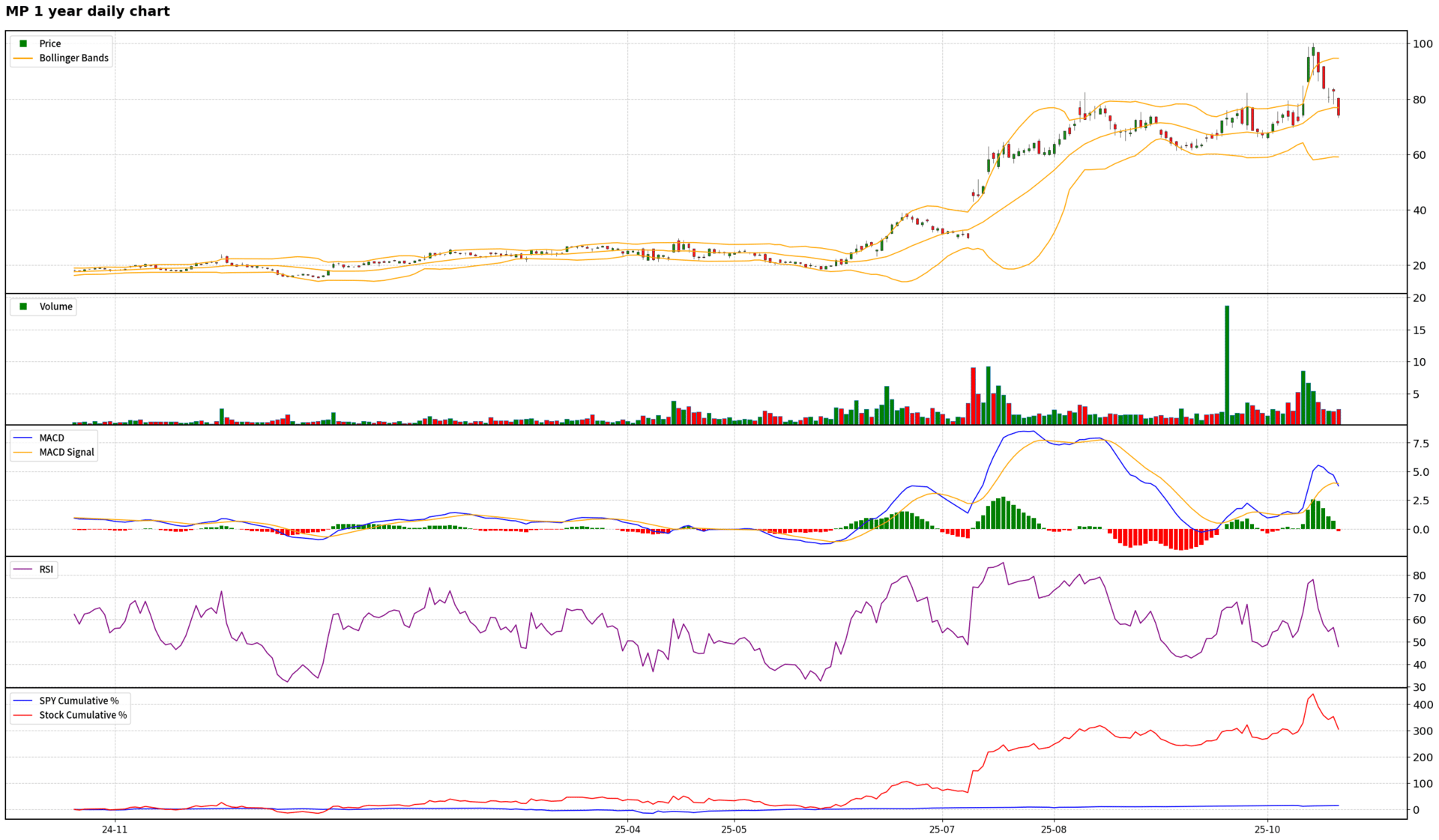

$MP ( ▲ 9.31% ) - MP Materials Corp

Scores: Fundamental 7 | Analyst Sentiment 8 | Valuation 3 | Catalyst 9 | Technical 4 | Total: 31

Direction: Neutral to Slightly Bearish

MP Materials presents a compelling long-term investment opportunity as it transforms into a critical, vertically integrated rare earth and magnet supplier for the Western world, backed by significant government and strategic partnerships with the DoD and Apple. These agreements provide substantial de-risking through price floors and guaranteed offtake, ensuring long-term revenue visibility and profitability. However, the stock's current valuation is extremely high, pricing in much of this future growth. Near-term financials are challenged by the cessation of China shipments, and the full financial impact of the new ventures is still several quarters away. Technically, the stock is showing strong short-term bearish momentum, having recently broken key support levels. Given the stretched valuation and immediate technical weakness, a cautious approach is warranted for the coming week. Investors should consider waiting for a clearer technical reversal or a pullback to more attractive valuation levels before initiating a long position, despite the strong long-term fundamental narrative and bullish analyst sentiment. The overall bullish macro environment provides a tailwind, but MP's specific technical and valuation concerns suggest a period of consolidation or correction is likely in the medium term.

$MP ( ▲ 9.31% ) 1 Year daily Chart

Read the full report in the attachment, and discover more free reports on our website.

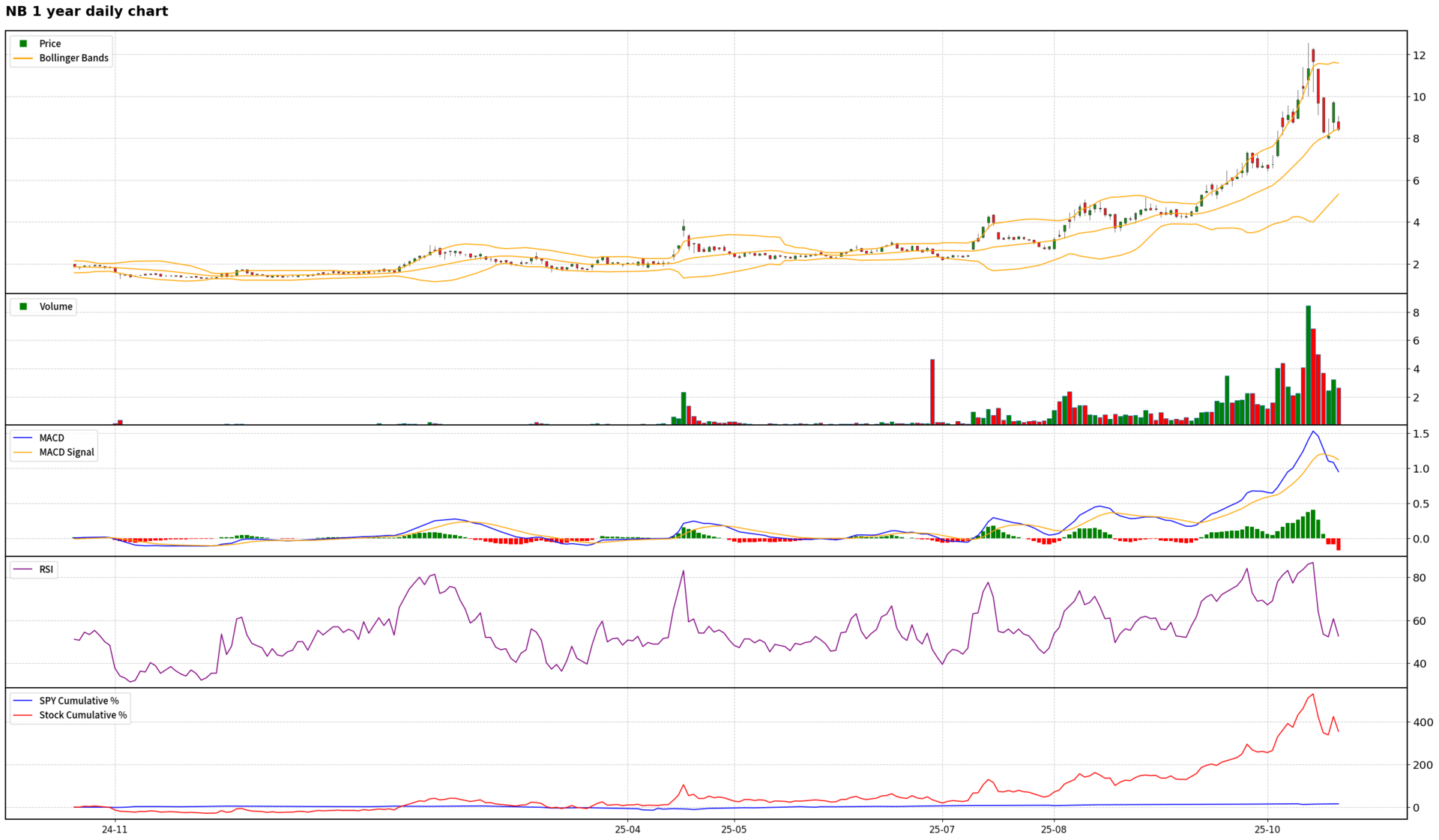

$NB ( ▲ 21.75% ) - NioCorp Developments Ltd

Scores: Fundamental 4 | Analyst Sentiment 7 | Valuation 2 | Catalyst 9 | Technical 7 | Total: 29

Direction: Long

Based on a comprehensive analysis, NioCorp presents a highly speculative but potentially rewarding long opportunity. The company is strategically positioned to benefit from geopolitical shifts in critical minerals supply chains, particularly with China's export controls on rare earths. Recent successful capital raises and ongoing government support (DoD, EXIM Bank) are strong catalysts that have fueled positive market sentiment and provided crucial funding. While the company faces significant fundamental challenges, including its pre-revenue status, a substantial funding gap for its Elk Creek Project, and highly optimistic scandium market projections, these risks are partially offset by its strategic importance and government backing. Official analyst sentiment is very bullish, despite independent skepticism regarding valuation and project economics. Technically, $NB ( ▲ 21.75% ) has been in a strong uptrend, and while short-term momentum is waning with a MACD bearish crossover, the current pullback to key support levels could offer a tactical entry point within the broader bullish trend. Given the high-risk, high-reward profile, a speculative long position is warranted, contingent on continued positive news flow regarding financing and project development, with disciplined risk management due to inherent volatility and fundamental uncertainties.

$NB ( ▲ 21.75% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Crash Expert: “This Looks Like 1929” → 70,000 Hedging Here

Mark Spitznagel, who made $1B in a single day during the 2015 flash crash, warns markets are mimicking 1929. Yeah, just another oracle spouting gloom and doom, right?

Vanguard and Goldman Sachs forecast just 5% and 3% annual S&P returns respectively for the next decade (2024-2034).

Bonds? Not much better.

Enough warning signals—what’s something investors can actually do to diversify this week?

Almost no one knows this, but postwar and contemporary art appreciated 11.2% annually with near-zero correlation to equities from 1995–2024, according to Masterworks Data.

And sure… billionaires like Bezos and Gates can make headlines at auction, but what about the rest of us?

Masterworks makes it possible to invest in legendary artworks by Banksy, Basquiat, Picasso, and more – without spending millions.

23 exits. Net annualized returns like 17.6%, 17.8%, and 21.5%. $1.2 billion invested.

Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

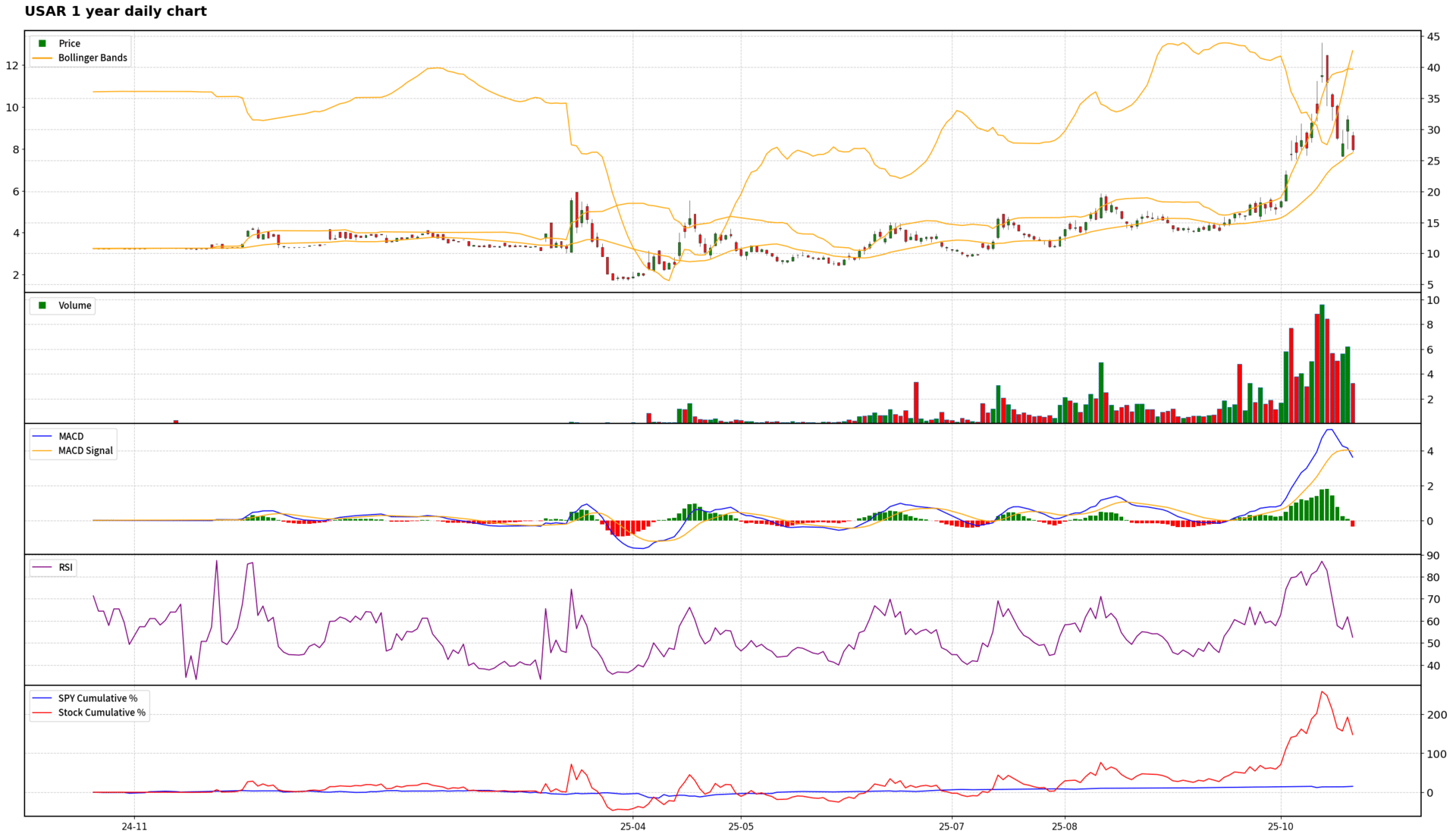

$USAR ( ▲ 17.46% ) - USA Rare Earth Inc

Scores: Fundamental 1 | Analyst Sentiment 6 | Valuation 1 | Catalyst 9 | Technical 4 | Total: 21

Direction: Long

$USAR ( ▲ 17.46% ) presents a highly speculative, yet potentially rewarding, medium-term long opportunity driven by powerful geopolitical catalysts. Fundamentally, the company is in its nascent stages with no revenue, significant losses, negative equity, and a 'going concern' warning, making its current $2.94 billion market cap and 102.8x EV/EBITDA (yr2) valuation extremely stretched and unsustainable on traditional metrics. Analyst sentiment is bullish (1.8 mean recommendation) but contradicted by downside price targets, suggesting a belief in the long-term vision rather than immediate financial performance. The critical catalysts are China's tightening rare earth export controls and renewed US trade war concerns, which create a strong, structural demand for domestic rare earth supply chains, positioning $USAR ( ▲ 17.46% ) as a key beneficiary. Technically, the stock has experienced a significant rally, but recent price action shows strong selling pressure, a bearish MACD crossover, and a break below the middle Bollinger Band, indicating a likely short-term pullback or consolidation. While the overall market (SPY) is bullish, it also shows signs of short-term overextension. Therefore, a tactical approach is recommended for the coming week: wait for a clear technical stabilization or a pullback to stronger support levels (e.g., 50-day MA around $19.70) before considering a long entry. The medium-term directional bias remains cautiously long due to the compelling geopolitical narrative, but the immediate risks from extreme valuation and short-term technical weakness necessitate patience and disciplined risk management. Confidence level for this strategy is Medium.

$USAR ( ▲ 17.46% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$IDR ( ▲ 5.12% ) - Idaho Strategic Resources Inc

Scores: Fundamental 7 | Analyst Sentiment 4 | Valuation 1 | Catalyst 6 | Technical 3 | Total: 21

Direction: Neutral

Idaho Strategic Resources presents a compelling long-term narrative as a profitable gold producer with strategic exposure to critical rare earth elements. The company has demonstrated robust revenue growth, improved profitability, and a strengthening balance sheet, driven by favorable gold prices and active exploration. Long-term catalysts, particularly the REE projects and continued operational efficiencies in gold mining, offer significant upside potential. However, the current market valuation is extremely stretched, with very high PE and PEG multiples, and poor relative and intrinsic valuation scores compared to peers. The analyst's price target implies a substantial downside from the current price, further highlighting valuation concerns. Technically, while the stock has enjoyed a strong uptrend, recent indicators suggest a loss of bullish momentum and a potential short-term reversal or consolidation. High short interest also points to market skepticism. Given the significant disconnect between strong underlying fundamentals and an extremely elevated valuation, coupled with weakening short-term technicals, a Neutral stance is recommended for the medium term (1-3 months). Investors should await a significant price correction or clearer signs of REE project viability and improved valuation metrics before considering a long position. The current risk-reward profile is unfavorable for new entries at these levels.

$IDR ( ▲ 5.12% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$UURAF ( ▼ 2.15% ) - Ucore Rare Metals Inc

Scores: Fundamental 2 | Analyst Sentiment 4 | Valuation 1 | Catalyst 7 | Technical 6 | Total: 20

Direction: Neutral

Ucore Rare Metals presents a high-risk, high-reward investment scenario. While the company operates in the critical rare earth metals sector with a promising Bokan deposit and has secured a significant off-take agreement with Critical Metals (a strong future catalyst), its current fundamentals are extremely weak. $UURAF ( ▼ 2.15% ) is a pre-revenue company with consistent operating losses, an unproven core technology (RapidSX) at commercial scale, and a valuation that appears highly speculative given its financial state. Analyst sentiment is divided, with a single 'Buy' rating contrasting sharply with detailed research highlighting significant skepticism and risks. Technically, the stock has seen an exceptional YTD rally but is currently experiencing a short-term pullback, with momentum indicators suggesting further consolidation. The overall market is bullish, but also shows signs of short-term overextension. Therefore, a Neutral stance is recommended for the medium term (1-3 months). Investors should exercise extreme caution and await concrete evidence of commercial viability, revenue generation, and sustained profitability before considering a long position. The current environment suggests a period of digestion and potential correction after its substantial gains.

$UURAF ( ▼ 2.15% ) 1 Year daily Chart

Read the full report in the attachment, and discover more free reports on our website.