Welcome equity investors—today’s edition unlocks Orion AI equity research on five US Food Tech stocks: $CART ( ▼ 4.56% ), $UBER ( ▼ 3.6% ), $DASH ( ▼ 2.73% ), $SYY ( ▲ 2.12% ) and $CMG ( ▲ 1.71% ).

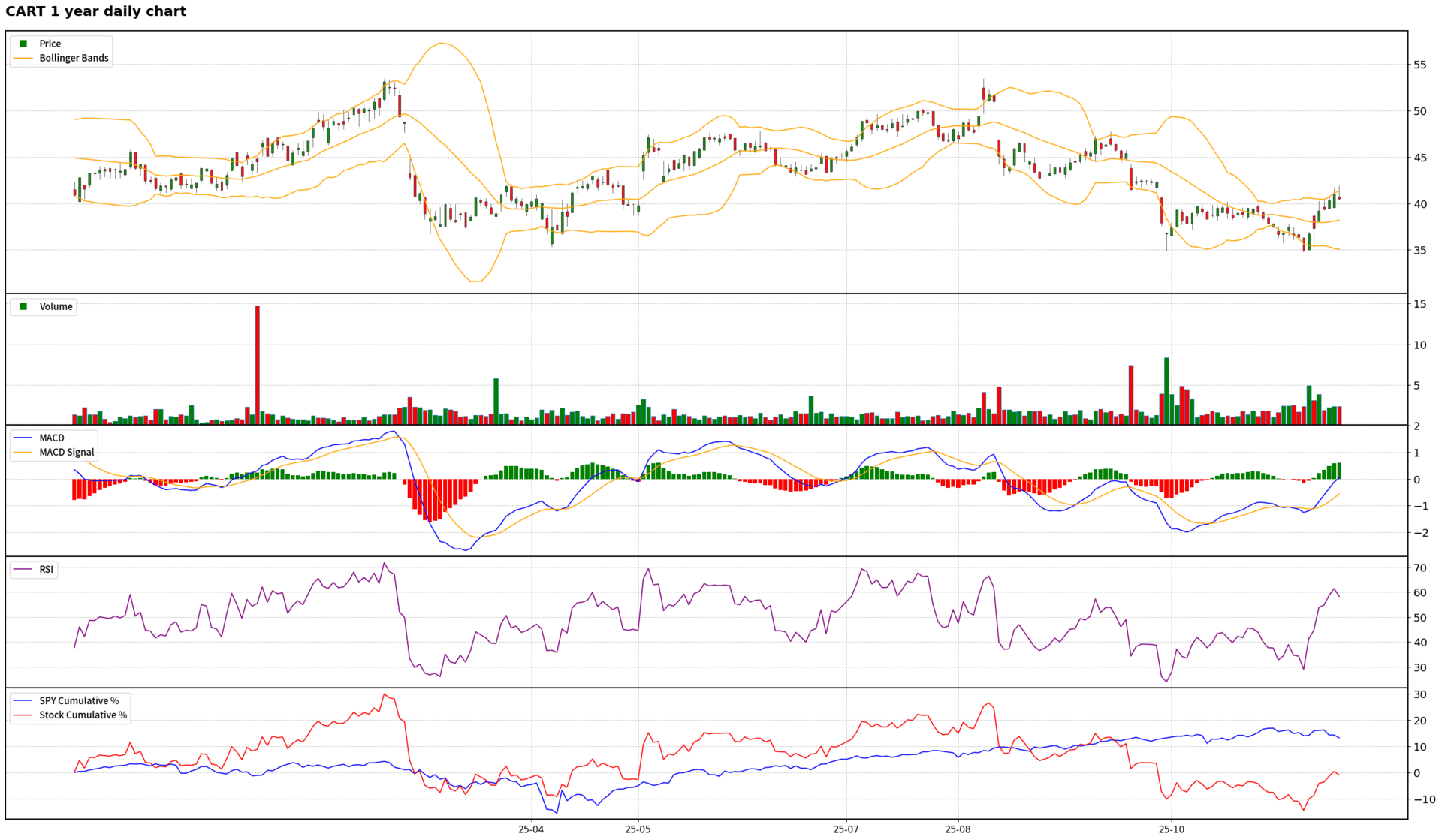

$CART ( ▼ 4.56% ) - Maplebear Inc

Scores: Fundamental 7 | Analyst Sentiment 6 | Valuation 7 | Catalyst 7 | Technical 6 | Total: 33

Direction: Long

Based on a comprehensive analysis, Instacart presents a compelling medium-term 'Long' opportunity. The company demonstrates robust fundamental performance with strong revenue and profit growth, underpinned by its dominant market position in online grocery and strategic initiatives like the Wynshop acquisition. Management's high confidence is reinforced by a substantial share repurchase program and strengthening partnerships with major retailers like Kroger, which mitigates competitive threats. While the stock faces headwinds from slowing advertising revenue growth, intense competition, and broader macroeconomic uncertainty, its attractive forward valuation multiples (especially PEG and EV/EBITDA) and significant analyst price target upside suggest it is undervalued relative to its growth prospects. Technically, $CART ( ▼ 4.56% ) is in a medium-term bullish trend with positive MACD, indicating a potential reversal of its underperformance. Although short-term technical indicators suggest it's approaching overbought conditions and the broader market is in a corrective phase, these factors are likely to lead to a temporary consolidation rather than a reversal of the underlying positive trajectory. A tactical long position is justified, with an awareness of potential short-term volatility.

$CART ( ▼ 4.56% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$UBER ( ▼ 3.6% ) - Uber Technologies Inc

Scores: Fundamental 7 | Analyst Sentiment 9 | Valuation 4 | Catalyst 6 | Technical 5 | Total: 31

Direction: Neutral

$UBER ( ▼ 3.6% ) presents a complex investment case. Fundamentally, the company is performing exceptionally well, demonstrating strong revenue and bookings growth, robust free cash flow, and a significant commitment to shareholder returns via a $20 billion share repurchase program. Management's confidence in its platform strategy and long-term AV vision is high, and analyst sentiment is overwhelmingly bullish with substantial price targets. However, these strengths are significantly challenged by critical and intensifying regulatory risks, most notably the New Zealand Supreme Court ruling on driver reclassification, which threatens Uber's core business model and could lead to substantial increases in operating costs globally. The company also faces ongoing legal/regulatory expenses and the long-term, capital-intensive nature of AV development, which is not expected to be profitable for several years. Valuation metrics suggest the stock is currently overvalued relative to peers. Technically, $UBER ( ▼ 3.6% ) is in a short-term bearish trend within a long-term bullish one, indicating consolidation, while the broader market is in a cautious, corrective phase. Therefore, for the coming week, a 'Neutral' strategy is recommended. Investors should monitor developments regarding driver classification regulations and their potential financial impact. While the long-term growth story remains compelling, the immediate regulatory overhang and mixed technical signals warrant caution. A break above $94.13 (middle Bollinger Band) could signal short-term strength, while a break below $90.00 (major support) could indicate further downside. Confidence level for this strategy is Medium.

$UBER ( ▼ 3.6% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$DASH ( ▼ 2.73% ) - DoorDash Inc

Scores: Fundamental 7 | Analyst Sentiment 8 | Valuation 3 | Catalyst 7 | Technical 6 | Total: 31

Direction: Cautiously Long

DoorDash presents a compelling, albeit cautiously approached, long opportunity for investors with a medium-term horizon. The company's fundamental strength is undeniable, characterized by robust revenue growth, a significant turnaround in profitability, and strategic acquisitions aimed at expanding its market leadership in local commerce globally. Analyst sentiment is overwhelmingly positive, projecting substantial upside. While the stock's valuation is currently stretched and recent aggressive investment plans have impacted short-term net income, the market appears to be re-evaluating these factors. Technically, $DASH ( ▼ 2.73% ) is showing promising signs of a bullish reversal from oversold conditions, with increasing buying pressure. Given the strong underlying business, positive catalysts, and improving technical setup, a tactical long position is warranted. However, investors should remain mindful of the cautious macroeconomic environment and the stock's premium valuation, employing disciplined risk management and monitoring for a confirmed break above key resistance levels to validate a sustained upward trajectory.

$DASH ( ▼ 2.73% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$SYY ( ▲ 2.12% ) - Sysco Corp

Scores: Fundamental 5 | Analyst Sentiment 6 | Valuation 5 | Catalyst 6 | Technical 5 | Total: 27

Direction: Neutral

Based on a comprehensive analysis, Sysco warrants a Neutral stance for the medium term. The company benefits from its market leadership, resilient business model, and management's confidence in strategic growth initiatives, which are reflected in solid adjusted Q1 FY26 earnings and recent acquisitions. However, these positives are significantly counterbalanced by critical fundamental weaknesses, including deteriorating GAAP profitability and a concerning trend of negative free cash flow, alongside a high debt load and the suspension of share repurchases. Analyst sentiment is mixed, mirroring these conflicting signals, with some upside potential noted but also significant caution regarding valuation and operational challenges. Technically, the stock is at a pivotal point, showing early signs of a potential bullish reversal but still trading below key moving averages, requiring a confirmed breakout above resistance with strong volume. The prevailing cautious to moderately bearish macroeconomic environment further complicates the outlook. Therefore, while $SYY ( ▲ 2.12% )'s long-term defensive characteristics and dividend reliability are appealing, the immediate fundamental concerns, particularly around cash flow generation, combined with an unconfirmed technical setup and a challenging macro backdrop, suggest a wait-and-see approach. Investors should monitor for clear improvements in free cash flow and a decisive technical breakout before taking a more aggressive directional position.

$SYY ( ▲ 2.12% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$CMG ( ▲ 1.71% ) - Chipotle Mexican Grill Inc

Scores: Fundamental 4 | Analyst Sentiment 5 | Valuation 1 | Catalyst 3 | Technical 5 | Total: 18

Direction: Neutral

Based on a comprehensive analysis, Chipotle Mexican Grill presents a complex investment picture with significant near-term challenges. Fundamentally, the company is experiencing a notable deceleration in growth, with comparable sales forecast to decline and transactions falling. Profitability is under pressure from rising costs and increased marketing, while management acknowledges a critical 'value perception disconnect' with consumers amidst persistent inflation. Despite a nearly 50% YTD share price decline, $CMG ( ▲ 1.71% ) remains severely overvalued on both intrinsic and relative metrics, with premium multiples that are unsustainable given its slowing forward EPS growth. Analyst sentiment, while officially positive, is undermined by significant negative revisions to estimates. Technically, the stock is in a strong bearish trend, trading well below key moving averages and underperforming the broader market. However, it is currently deeply oversold on several indicators (RSI, Stochastic), suggesting a potential for a short-term relief bounce. This potential bounce is further supported by its identification as a 'tax loss candidate' for the November-January period. The broader market's current corrective phase adds to the overall cautious outlook. Trading Strategy for the coming week (Confidence Level: Moderate): Given the strong fundamental and valuation headwinds, coupled with a bearish long-term technical trend, the overall outlook for $CMG ( ▲ 1.71% ) is negative. However, the deeply oversold short-term technicals and the 'tax loss candidate' catalyst suggest a potential for a temporary bounce. Therefore, for the coming week, a Neutral strategy is recommended. Traders should monitor for a potential short-term relief rally towards the $34.69 resistance level, but be prepared for renewed selling pressure if fundamental issues persist or the broader market continues its correction. A short-term tactical long position could be considered only if there is clear confirmation of a bounce from current oversold levels, with strict risk management and a tight stop-loss, targeting the immediate resistance. However, the high risk-reward imbalance due to valuation and fundamental deterioration makes a strong directional conviction difficult for the medium term.

$CMG ( ▲ 1.71% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Research any US or Hong Kong stock in seconds using Orion AI.