Welcome equity investors—today’s edition unlocks Orion equity research on the five large-cap US energy stocks: $COP ( ▲ 3.07% ), $EOG ( ▲ 1.86% ), $XOM ( ▲ 3.85% ), $CVX ( ▲ 2.3% ) and $SLB ( ▲ 3.56% ).

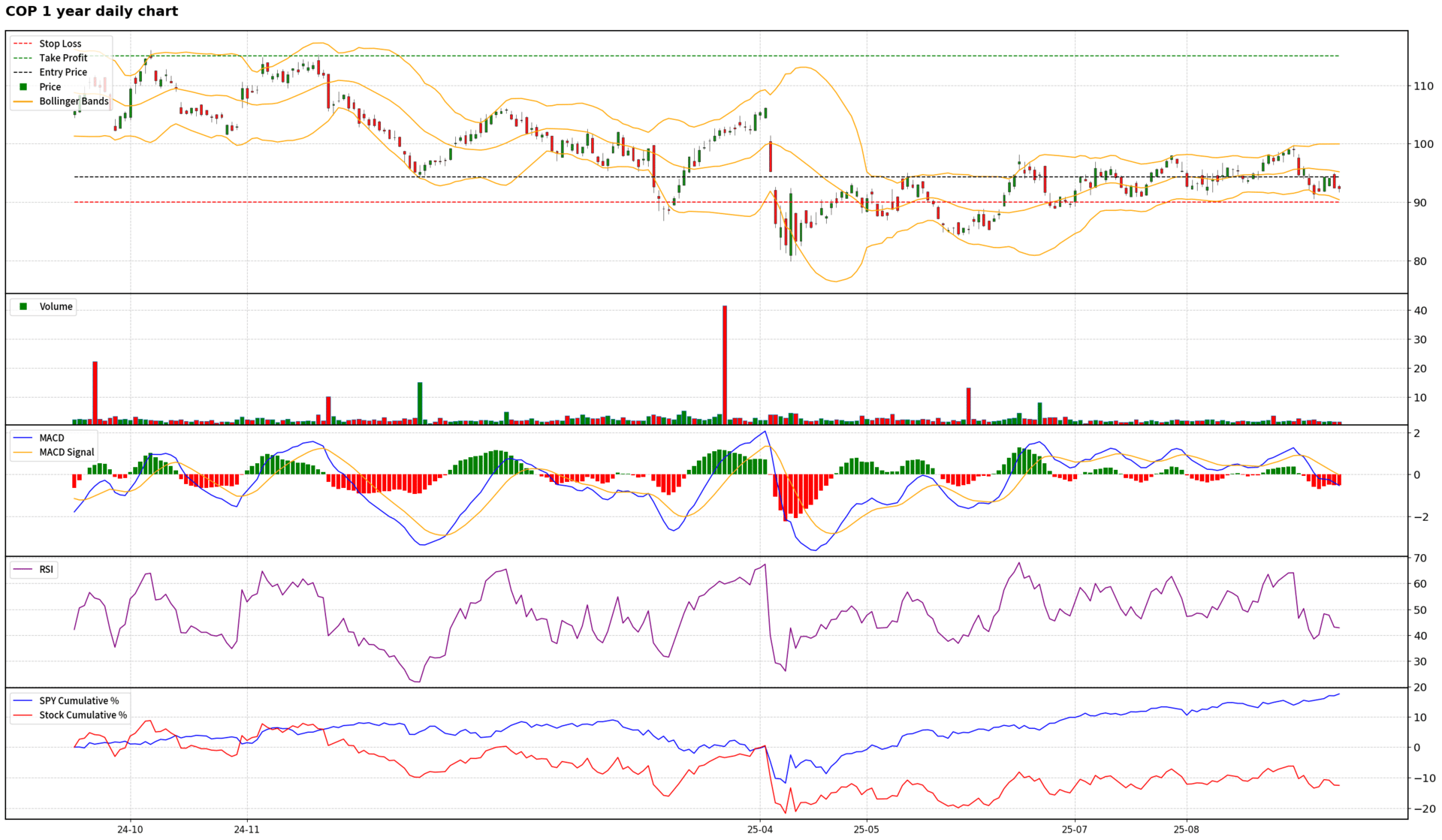

$COP ( ▲ 3.07% ) - ConocoPhillips

Scores: Fundamental 8 | Analyst Sentiment 9 | Valuation 8 | Catalyst 8 | Technical 4 | Total: 37

Trade Suggestions: Long Normal | Entry: 94.35 | TP: 115.0 | SL: 90.0 | Confidence: 7

ConocoPhillips presents a compelling long-term investment opportunity, underpinned by robust operational execution, a clear strategic vision, and an attractive valuation. The company has demonstrated exceptional success in integrating the Marathon Oil acquisition, exceeding synergy targets, and is poised for significant free cash flow growth, targeting a $7 billion inflection by 2029. Its differentiated, high-quality asset base and expanding LNG strategy position it favorably for future energy demand. Analyst sentiment is overwhelmingly bullish, with substantial upside indicated by price targets. While short-term technicals show consolidation and a slight bearish bias, and the oil macro remains 'choppy,' these factors are outweighed by the strong fundamental narrative and long-term catalysts. A tactical long position with disciplined risk management is justified, anticipating a breakout from current consolidation to realize the significant intrinsic value.

$COP ( ▲ 3.07% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

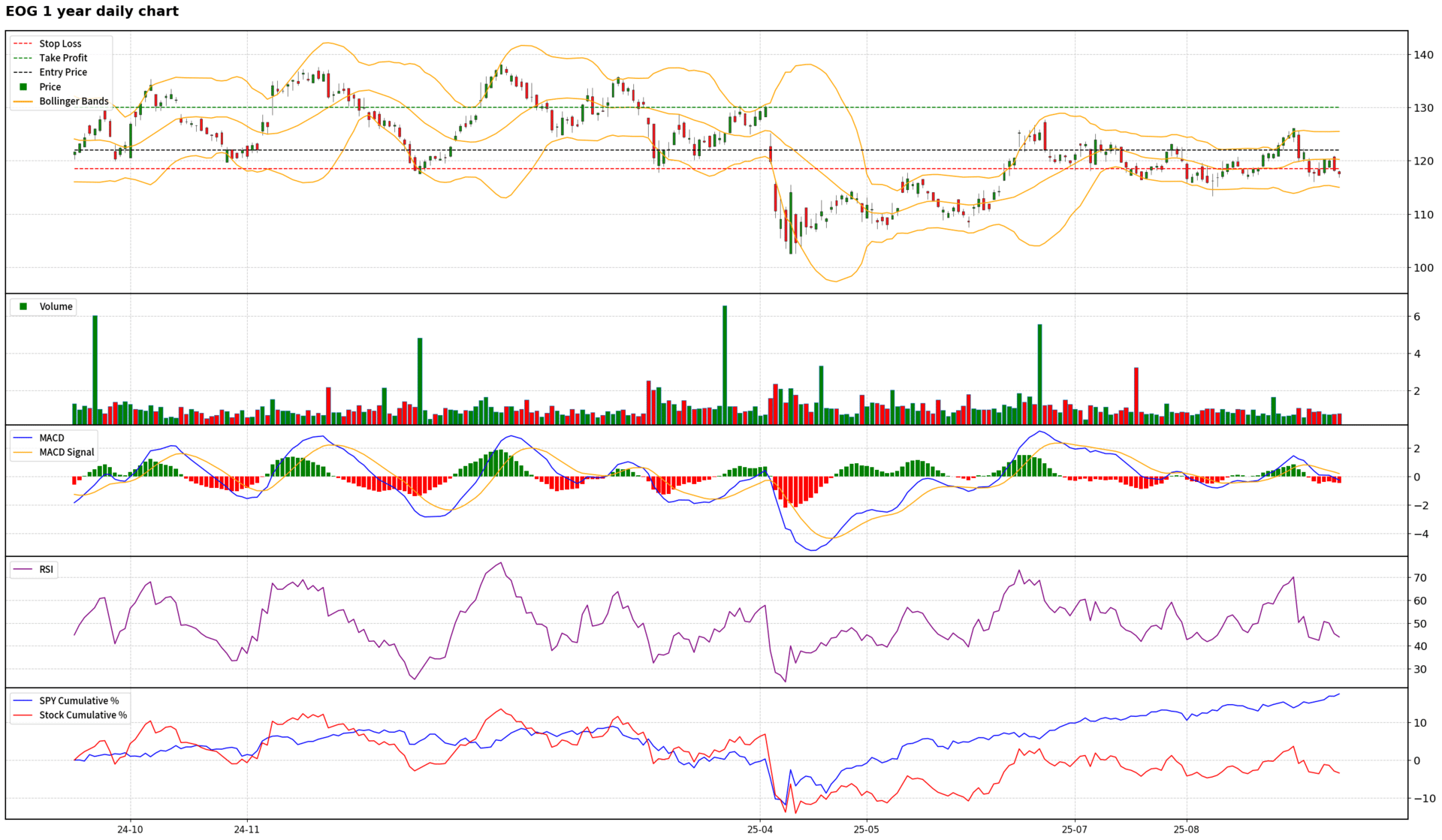

$EOG ( ▲ 1.86% ) - EOG Resources Inc

Scores: Fundamental 7 | Analyst Sentiment 8 | Valuation 7 | Catalyst 8 | Technical 7 | Total: 37

Trade Suggestions: Long Breakthrough | Entry: 122.0 | TP: 130.0 | SL: 118.5 | Confidence: 8

EOG Resources presents a compelling long opportunity, underpinned by robust fundamentals, strategic growth initiatives, and a strong commitment to shareholder returns. Despite recent quarterly financial headwinds, management's high confidence in its diversified portfolio, operational excellence, and the accretive Encino acquisition (expanding Utica acreage) underpins future growth. Analyst sentiment is overwhelmingly bullish, with significant upside potential indicated by price targets and attractive valuation multiples relative to peers. Key catalysts, including successful international exploration (UAE, Bahrain), increased capital expenditure signaling confidence, and the integration of Encino assets, are expected to drive performance. Technically, the stock has shown a strong bullish reversal, moving above key short-term moving averages and challenging the 200-day MA, suggesting a continuation of upward momentum. While near-term FCF headwinds and commodity price volatility exist, EOG's pristine balance sheet and consistent dividend growth provide a strong foundation. A tactical long position with disciplined risk management is warranted.

$EOG ( ▲ 1.86% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

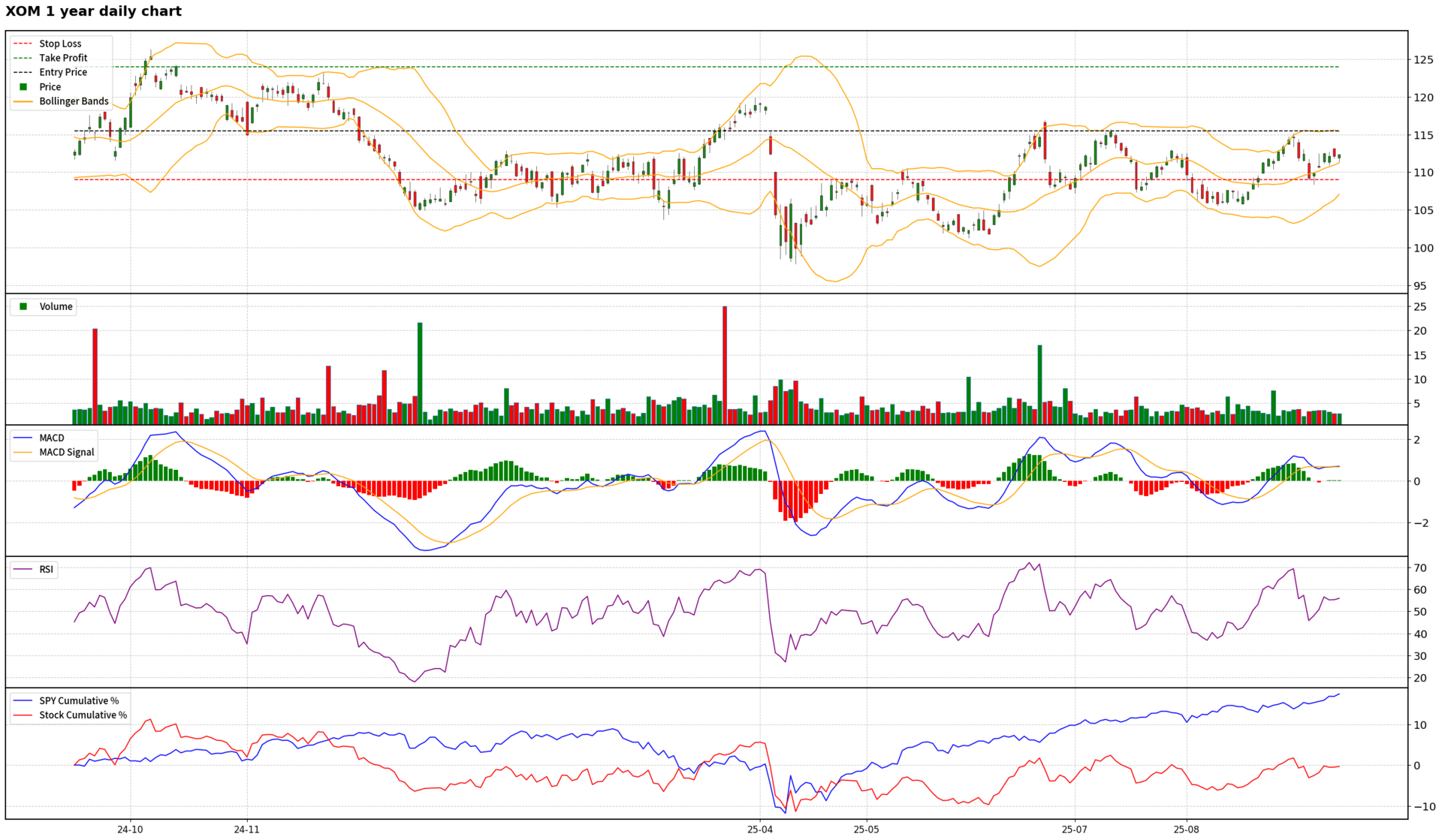

$XOM ( ▲ 3.85% ) - Exxon Mobil Corp

Scores: Fundamental 7 | Analyst Sentiment 7 | Valuation 6 | Catalyst 8 | Technical 6 | Total: 34

Trade Suggestions: Long Breakthrough | Entry: 115.5 | TP: 124.0 | SL: 109.0 | Confidence: 7

Exxon Mobil presents a compelling long opportunity driven by robust core operations, particularly in its high-growth Upstream (Guyana, Permian) and expanding LNG segments. Management's confident execution of strategic initiatives, coupled with significant structural cost savings and a strong balance sheet, underpins future earnings and cash flow growth. While analyst sentiment is generally positive, the stock is currently trading at a fair valuation, not cheap, and faces some headwinds in its chemical segment and uncertainties in its nascent low-carbon ventures. Technically, $XOM ( ▲ 3.85% ) is in a bullish trend but is approaching a critical resistance level. A confirmed breakout above $115.41 would signal a continuation of the upward momentum, justifying a tactical long position with a disciplined risk management approach, targeting the analyst consensus price range.

$XOM ( ▲ 3.85% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

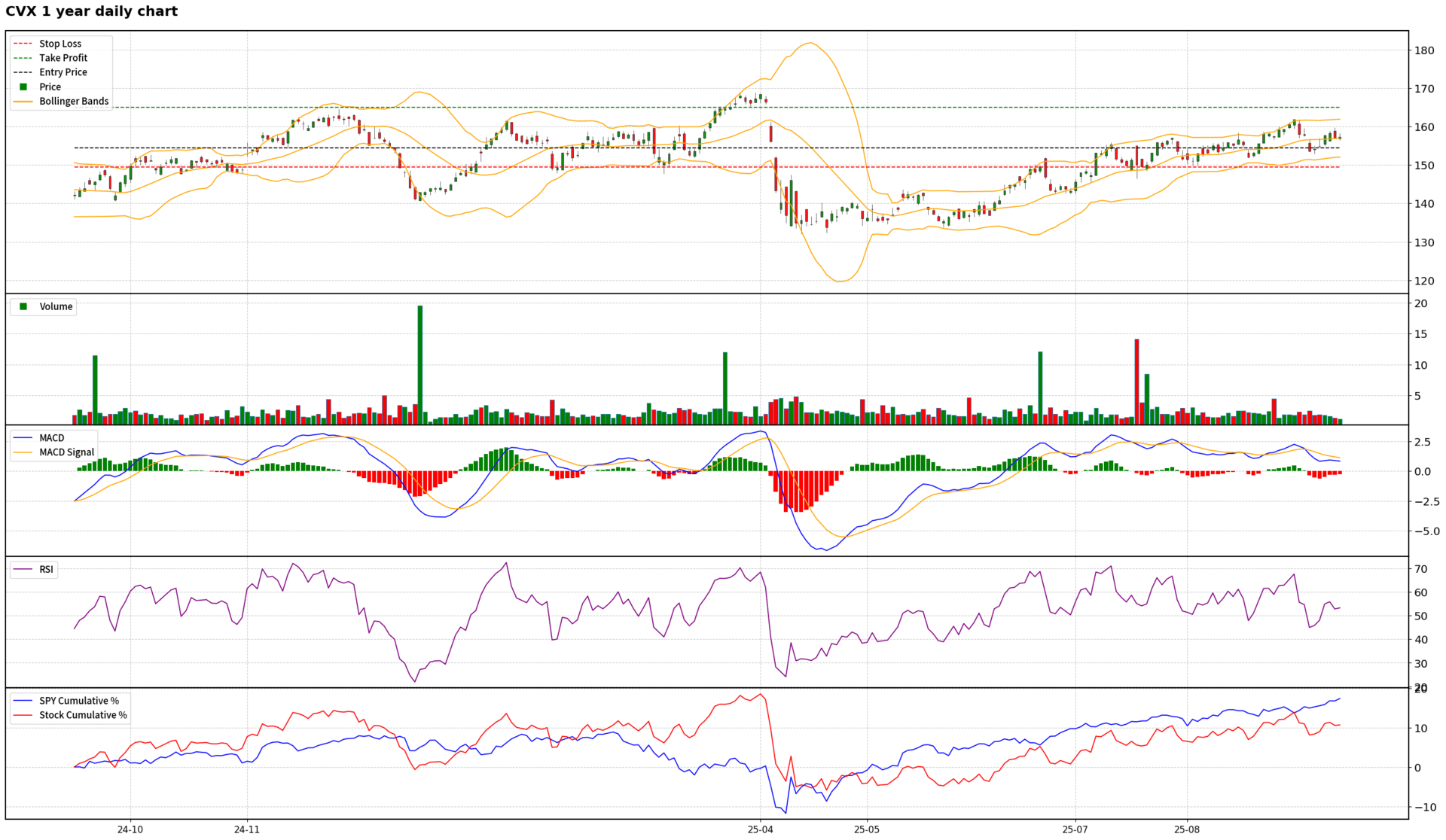

$CVX ( ▲ 2.3% ) - Chevron Corp

Scores: Fundamental 7 | Analyst Sentiment 7 | Valuation 5 | Catalyst 8 | Technical 6 | Total: 33

Trade Suggestions: Long Normal | Entry: 154.5 | TP: 165.0 | SL: 149.5 | Confidence: 7

Based on a comprehensive analysis, Chevron presents a compelling long-term investment opportunity, despite some short-term valuation and technical caution. The company's strategic direction is robust, highlighted by the transformative Hess acquisition, which is already delivering accelerated synergies and promises significant free cash flow growth from world-class Guyana assets. Management's high confidence, coupled with aggressive shareholder return policies (dividends and buybacks) and strategic investments in LNG, new exploration, and energy transition plays, underpins a strong fundamental outlook. While recent quarterly financials show some headwinds from commodity prices, the operational momentum and long-term catalysts are powerful. Technically, $CVX ( ▲ 2.3% ) is in a confirmed uptrend, and a tactical entry on a pullback offers an attractive risk/reward profile, making it a strong candidate for a long position with disciplined risk management.

$CVX ( ▲ 2.3% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

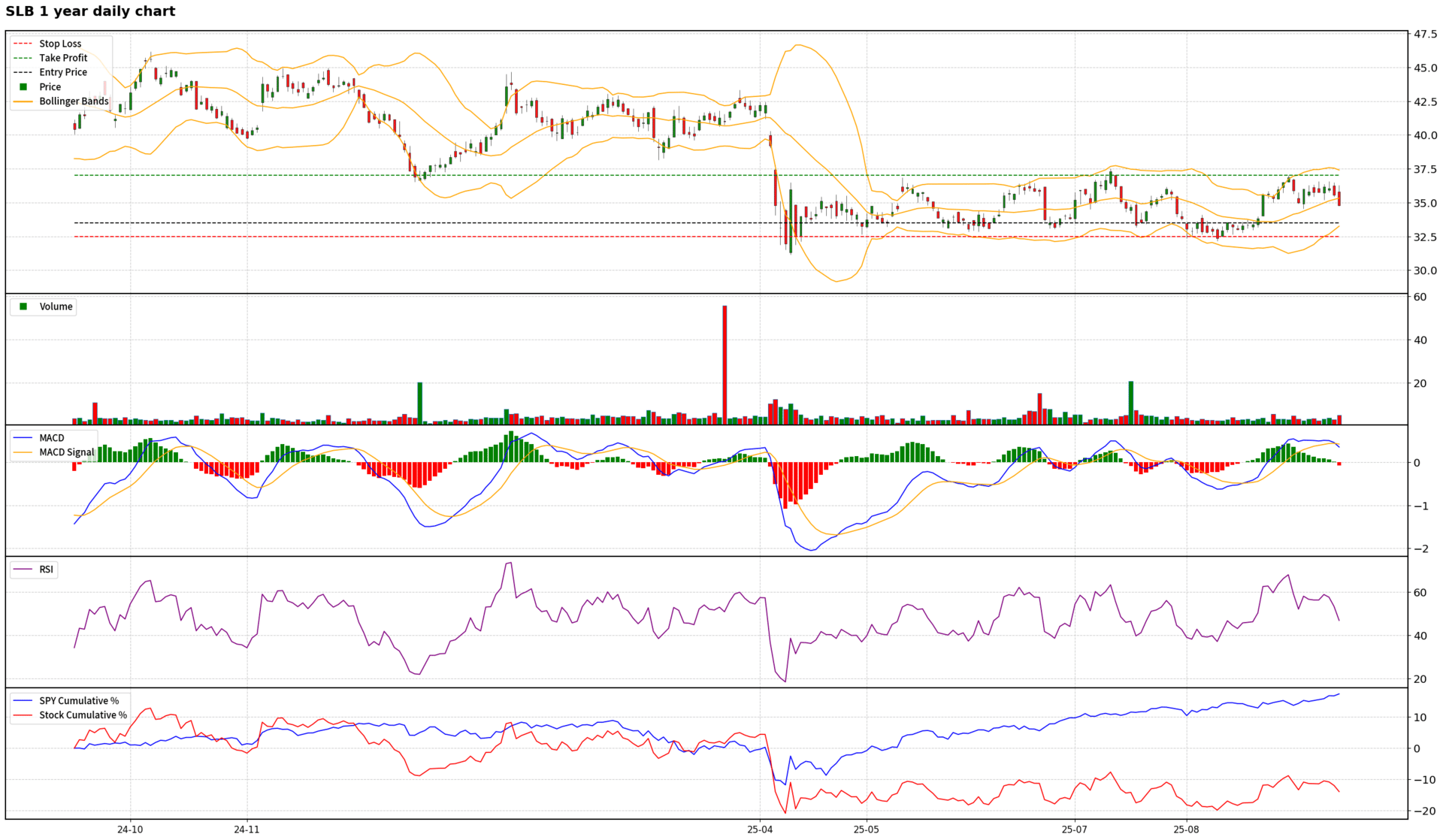

$SLB ( ▲ 3.56% ) - Schlumberger NV

Scores: Fundamental 5 | Analyst Sentiment 8 | Valuation 8 | Catalyst 6 | Technical 3 | Total: 30

Trade Suggestions: Long Normal | Entry: 33.5 | TP: 37.0 | SL: 32.5 | Confidence: 6

$SLB ( ▲ 3.56% ) presents a compelling long-term investment opportunity, despite facing near-term headwinds and exhibiting bearish technicals. Fundamentally, the company is undergoing a strategic transformation towards higher-margin, less cyclical production and digital segments, significantly enhanced by the ChampionX acquisition. Management confidence is high, and the company demonstrates robust free cash flow generation. Analyst sentiment is overwhelmingly bullish, with strong buy ratings and significant upside price targets, driven by an attractive valuation (low P/E and EV/EBITDA multiples relative to peers). While recent financial performance has shown some weakness and the forward EPS growth is low, these factors appear to be priced into the current undervaluation. The recommended trade strategy is a tactical long position on a pullback to strong technical support, aiming to capture a rebound in line with the strong underlying fundamental and analyst conviction, while managing short-term risks with a disciplined stop-loss.

$SLB ( ▲ 3.56% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Research any US or Hong Kong stock in seconds using Orion AI.

Need FREE access? Reply FREE to this email.

Not interested in US/HK stocks? Reply to this email with any stock exchange of your interest and we will contact you when we launch for that stock exchange.

If you are not interested in receiving our FREE reports, kindly unsubscribe below.