Welcome equity investors—today’s edition unlocks Orion AI equity research on five largest Bitcoin and Crypto related US stocks: $CLSK ( ▲ 2.9% ), $RIOT ( ▲ 0.13% ), $COIN ( ▼ 4.37% ), $MARA ( ▼ 0.77% ) and $MSTR ( ▼ 4.56% ).

$CLSK ( ▲ 2.9% ) - CleanSpark Inc

Scores: Fundamental 7 | Analyst Sentiment 9 | Valuation 8 | Catalyst 8 | Technical 7 | Total: 39

Direction: Long

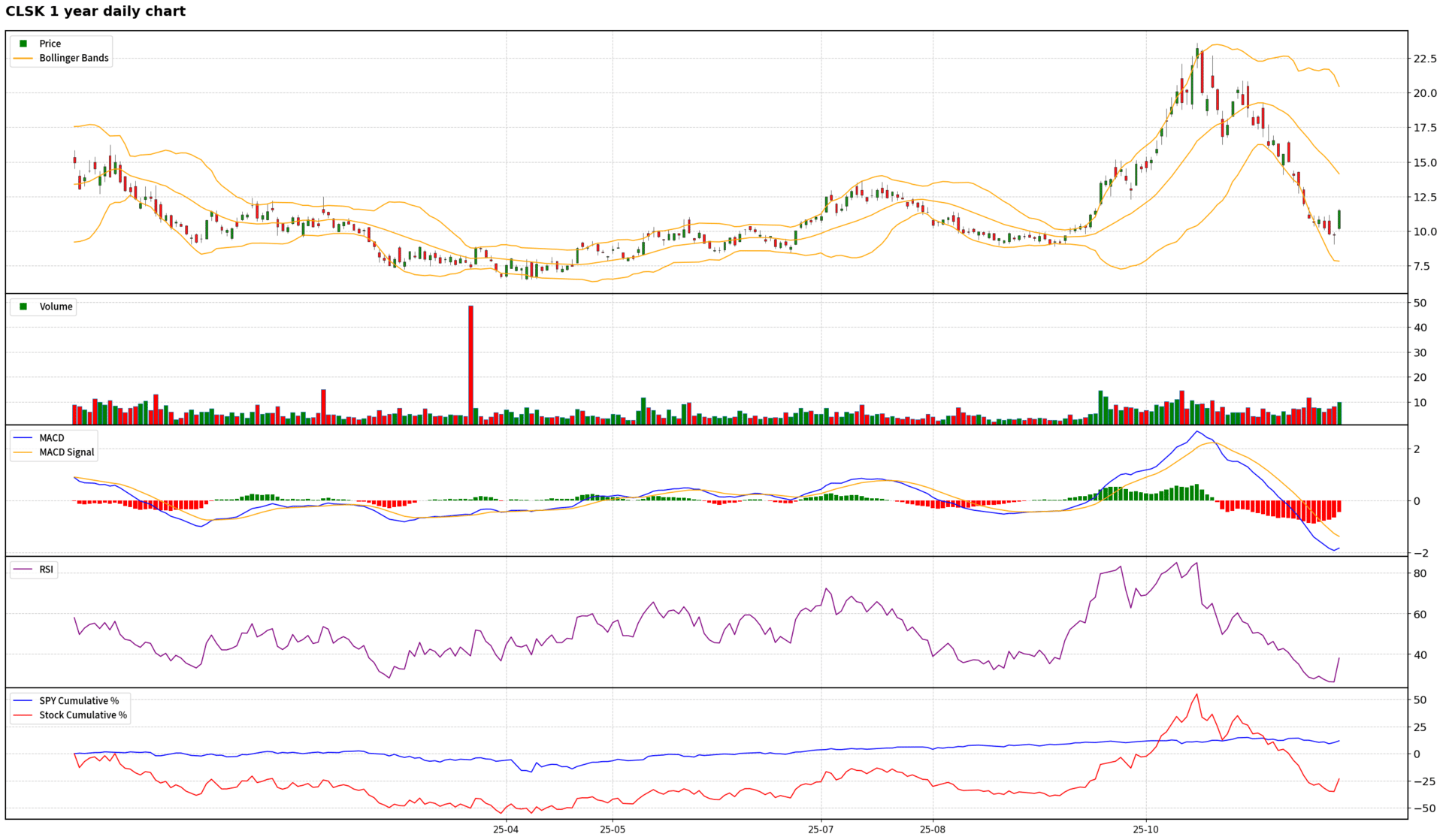

Based on a comprehensive analysis, CleanSpark presents a compelling long opportunity for the medium term (1-3 months). The company is demonstrating robust operational momentum, marked by industry-leading Bitcoin mining efficiency and aggressive hashrate expansion, with growth to 50 EH/s fully funded without relying on equity. A significant strategic pivot into the high-growth AI/HPC data center market positions $CLSK ( ▲ 2.9% ) for long-term diversification and value creation. Analyst sentiment is overwhelmingly bullish, with a strong consensus for 'Buy' and substantial upside potential to price targets. Valuation appears attractive, especially considering the very low PEG ratio and the company's growth trajectory. Technically, $CLSK ( ▲ 2.9% ) is showing signs of renewed bullish momentum, with a recent price rally on increased volume and a potential bullish MACD crossover, suggesting a continuation of its uptrend. While the broader market is in a short-term consolidation, $CLSK ( ▲ 2.9% )'s strong company-specific catalysts, including a recent bullish call from J.P. Morgan on crypto miners, are expected to drive outperformance. Key risks include Bitcoin price volatility, potential future dilution from convertible notes, and operational challenges such as rising energy costs and identified internal control weaknesses. However, the strong fundamental growth, strategic clarity, positive analyst outlook, and improving technical setup collectively support a high-conviction long position.

$CLSK ( ▲ 2.9% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$RIOT ( ▲ 0.13% ) - Riot Platforms Inc

Scores: Fundamental 4 | Analyst Sentiment 6 | Valuation 2 | Catalyst 5 | Technical 4 | Total: 21

Direction: Neutral

Based on a comprehensive analysis, Riot Platforms presents a complex investment case, leading to a Neutral stance for the medium term (1-3 months). While management's strategic pivot towards AI/HPC data centers and the company's substantial power assets offer compelling long-term growth potential, the immediate outlook is clouded by several factors. Fundamentally, core Bitcoin mining profitability remains challenged, evidenced by negative operating profits and volatile net income heavily reliant on Bitcoin revaluation. Forecasted EPS is negative and declining, and the company scores very poorly on relative valuation and earnings quality against peers. The recent news flow is overwhelmingly negative, with $RIOT ( ▲ 0.13% )'s share price directly mirroring Bitcoin's recent declines. Technically, the stock is in a bearish momentum phase, trading below its 50-day moving average and underperforming the broader market, although it is currently in oversold territory, suggesting a potential for a short-term bounce. The macro environment, with the S&P 500 in a short-to-medium term consolidation, does not provide a strong tailwind for high-beta, speculative stocks. While analyst sentiment is overwhelmingly bullish with high price targets, this appears to be a long-term conviction that has yet to be validated by consistent financial performance or a clear path to significant data center revenue. Until there is clearer evidence of sustained profitability from the data center pivot, a significant and sustained rebound in Bitcoin prices, or a confirmed technical reversal, the risks outweigh the immediate upside potential, warranting a neutral position.

$RIOT ( ▲ 0.13% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$COIN ( ▼ 4.37% ) - Coinbase Global Inc

Scores: Fundamental 6 | Analyst Sentiment 6 | Valuation 2 | Catalyst 4 | Technical 2 | Total: 20

Direction: Short

Based on a comprehensive analysis, Coinbase Global presents a compelling short opportunity for the medium term (1-3 months), with a high confidence level. The stock is currently facing a perfect storm of negative catalysts: a deepening and intensifying crypto market downturn, overwhelmingly bearish technical indicators, and a high valuation that is not justified by its current fundamentals or forward growth prospects. While management expresses long-term confidence and the company is making strategic moves like the Deribit acquisition and Texas reincorporation, these long-term positives are severely overshadowed by immediate market realities. The significant investment in Kraken signals intensifying competition, further pressuring $COIN ( ▼ 4.37% )'s market share and margins. Technically, the stock is in a strong downtrend, trading well below key moving averages, with bearish MACD signals. Although oversold indicators suggest a potential for a short-term bounce, this is likely to be a temporary correction within a larger bearish trend. The broader market's (SPY) short-term consolidation and bearish momentum provide no supportive tailwind for this high-beta crypto-dependent asset. Therefore, a tactical short position is warranted, targeting further downside towards technical support levels, with disciplined risk management to account for potential short-term oversold bounces.

$COIN ( ▼ 4.37% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$MARA ( ▼ 0.77% ) - MARA Holdings Inc

Scores: Fundamental 4 | Analyst Sentiment 5 | Valuation 3 | Catalyst 4 | Technical 2 | Total: 18

Direction: Short

Based on a comprehensive analysis, $MARA ( ▼ 0.77% ) presents a compelling short opportunity over the medium term. The stock is currently experiencing significant downward pressure, primarily due to the intensifying bearish trend in Bitcoin, which has fallen to multi-month lows and is approaching critical support. $MARA ( ▼ 0.77% )'s high correlation and beta to Bitcoin mean it will likely continue to underperform in this environment, exacerbated by a broader market 'flight from riskier assets'. Technically, $MARA ( ▼ 0.77% ) exhibits strong bearish momentum, trading well below key moving averages with a bearish MACD, and has broken down from a previous pattern. While oversold indicators suggest a potential for a temporary bounce, the underlying trend is decisively negative. Fundamentally, despite management's strategic pivot towards AI/HPC and strong revenue growth, the company struggles with negative gross and operating profits, increasing debt, and ongoing legal challenges. Its very low relative rankings against peers across multiple metrics further highlight its weak positioning. The long-term AI narrative, while promising, faces significant execution and competitive risks that are unlikely to offset the immediate headwinds from Bitcoin and the cautious macro environment. Therefore, a tactical short position is warranted, with a high confidence level, anticipating further downside in $MARA ( ▼ 0.77% )'s share price.

$MARA ( ▼ 0.77% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$MSTR ( ▼ 4.56% ) - Strategy Inc

Scores: Fundamental 3 | Analyst Sentiment 6 | Valuation 2 | Catalyst 1 | Technical 2 | Total: 14

Direction: Short

Based on a comprehensive analysis, MicroStrategy, now Strategy Inc., presents a compelling short opportunity for the medium term (1-3 months). The company's strategy as a leveraged Bitcoin proxy is facing severe headwinds from the ongoing and intensifying Bitcoin price plunge, which directly impacts its core asset value. This is exacerbated by the critical and imminent risk of MSCI index exclusion, which could trigger significant forced selling by institutional funds, creating a powerful, independent downward pressure on the stock. Fundamentally, $MSTR ( ▼ 4.56% ) relies heavily on continuous shareholder dilution through equity and debt offerings to acquire Bitcoin, leading to substantial and growing preferred dividend obligations that strain its liquidity. An insider selling plan further adds to the negative sentiment. Technically, while the stock is oversold, indicating a potential for a temporary mean-reversal bounce, the overall trend is strongly bearish, with the price trading well below key moving averages and a bearish MACD. Any short-term rally is likely to be a 'dead cat bounce' within the broader downtrend. The broader market's current consolidation phase also offers no supportive tailwind. Despite overwhelmingly bullish analyst sentiment, this appears disconnected from the immediate and severe risks. Therefore, a tactical short position is justified, with a high confidence level, given the confluence of fundamental weaknesses, powerful negative catalysts, and bearish technical signals.

$MSTR ( ▼ 4.56% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Research any US or Hong Kong stock in seconds using Orion AI.

Daily News for Curious Minds

Be the smartest person in the room by reading 1440! Dive into 1440, where 4 million Americans find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.