Welcome equity investors—today’s edition unlocks Orion equity research on top 10 $QQQ ( ▲ 0.41% ) stocks in the US market.

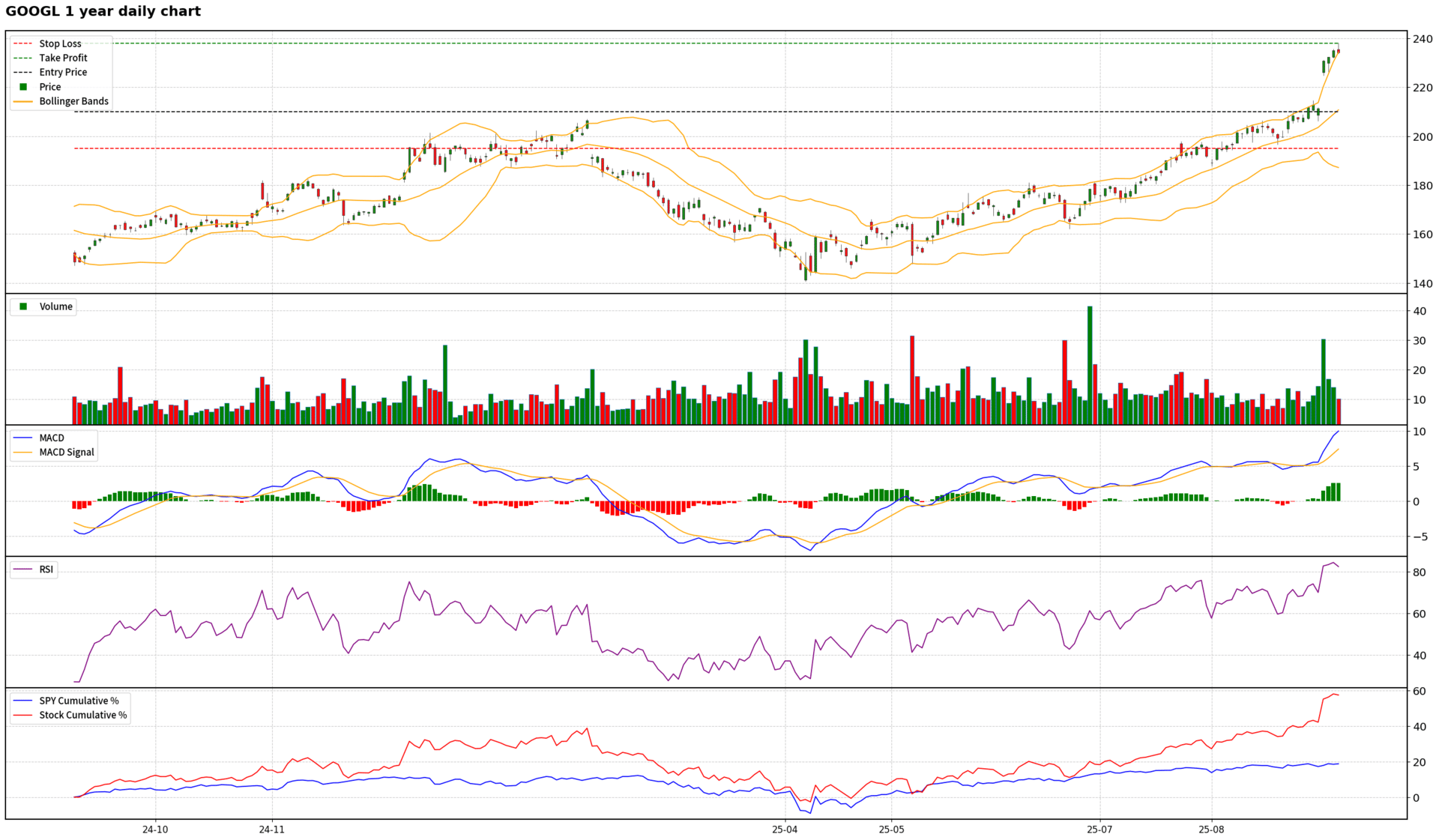

Scores: Fundamental 7 | Analyst Sentiment 8 | Valuation 8 | Catalyst 7 | Technical 6 | Total: 36

Trade Suggestions: Long Normal | Entry: 210.0 | TP: 238.0 | SL: 195.0 | Confidence: 7

Alphabet presents a compelling long-term investment opportunity, driven by its dominant position in AI and the explosive growth of Google Cloud. The company's Q2 2025 results showcased robust revenue growth across its core segments, underpinned by significant strategic investments in AI infrastructure. Analyst sentiment is overwhelmingly bullish, viewing the recent favorable antitrust ruling as a major de-risking event that justifies a re-rating of the stock, which is currently perceived as undervalued relative to its growth and peers. While the company faces challenges from accelerating depreciation, specific H2 advertising headwinds, and intensifying regulatory scrutiny with substantial fines, its strong balance sheet and commitment to innovation provide resilience. Technically, $GOOGL ( ▲ 0.99% ) is in a strong uptrend with significant momentum, but overbought indicators suggest a near-term pullback is likely. Therefore, a tactical long entry on a retracement to key support levels is recommended, offering an attractive risk/reward profile for investors looking to capitalize on its long-term growth trajectory.

$GOOGL ( ▲ 0.99% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

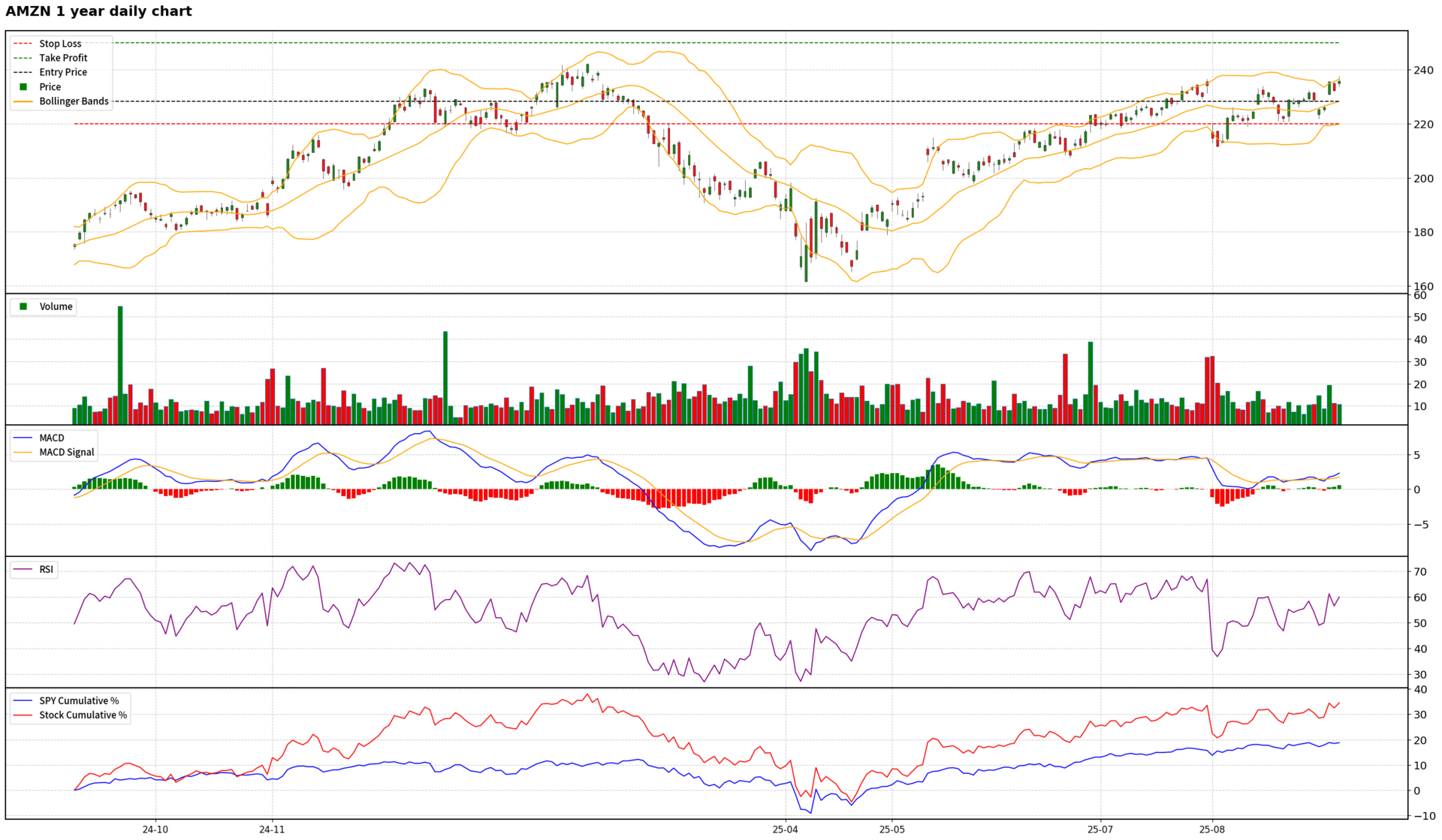

Scores: Fundamental 7 | Analyst Sentiment 9 | Valuation 4 | Catalyst 8 | Technical 7 | Total: 35

Trade Suggestions: Long Normal | Entry: 228.25 | TP: 250.0 | SL: 220.0 | Confidence: 7

Amazon presents a compelling long-term investment opportunity, driven by its dominant position in cloud computing (AWS) and aggressive, strategic investments in artificial intelligence. Despite high current valuation multiples and some short-term technical overextension, the company's robust financial performance, strong operational execution, and a massive AWS backlog underscore its growth potential. Management's high confidence in strategic initiatives like AI, Project Kuiper, and advertising, coupled with overwhelmingly bullish analyst sentiment, provides a strong foundation. While regulatory scrutiny, AWS supply constraints, and tariff uncertainties pose risks, Amazon's diversified revenue streams, competitive moat, and ability to generate substantial earnings growth for an extended period make it an attractive proposition. A tactical long position, initiated on a short-term pullback to key support levels, is recommended to capitalize on the strong underlying momentum and long-term catalysts.

$AMZN ( ▲ 1.69% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

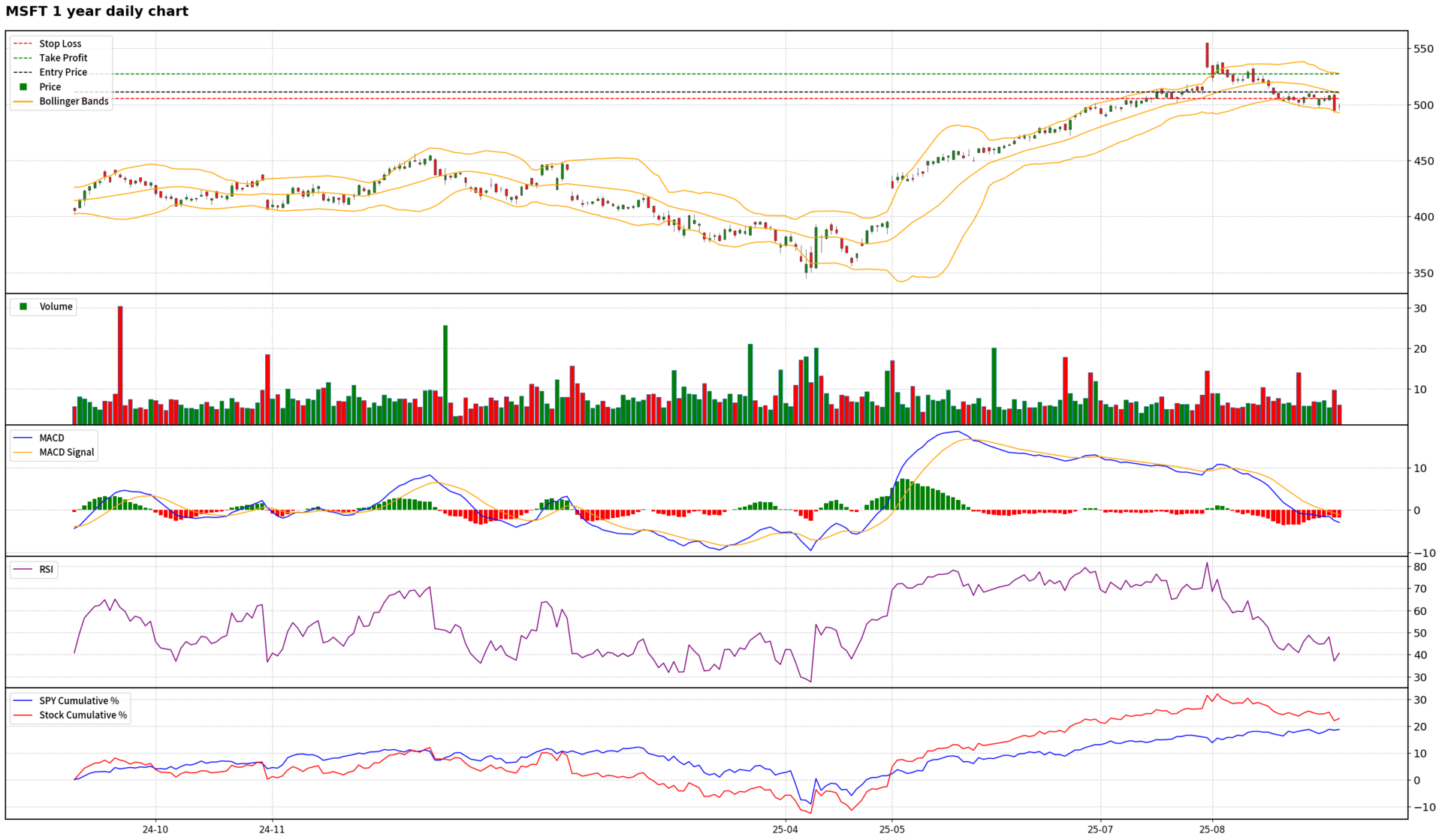

Scores: Fundamental 9 | Analyst Sentiment 9 | Valuation 4 | Catalyst 8 | Technical 5 | Total: 35

Trade Suggestions: Long Breakthrough | Entry: 511.0 | TP: 527.0 | SL: 505.0 | Confidence: 6

Microsoft presents a compelling long-term investment opportunity driven by its unparalleled leadership in AI and cloud computing, robust financial performance, and strong management confidence. The company's strategic investments in infrastructure and product innovation, coupled with a massive contracted backlog, provide a clear runway for sustained double-digit growth. Analyst sentiment is overwhelmingly positive, reinforcing the high-conviction narrative. However, the stock currently trades at a premium valuation, and intensifying regulatory scrutiny, along with the evolving financial dynamics of the OpenAI partnership, pose short-term risks. Technically, the stock is showing bearish momentum and consolidating near a critical support level. Therefore, a tactical 'Breakthrough' long strategy is recommended, waiting for a clear break above the $510 resistance to confirm a reversal of the short-term downtrend, aligning with the strong underlying fundamentals and long-term growth catalysts while managing immediate technical risks.

$MSFT ( ▼ 2.74% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

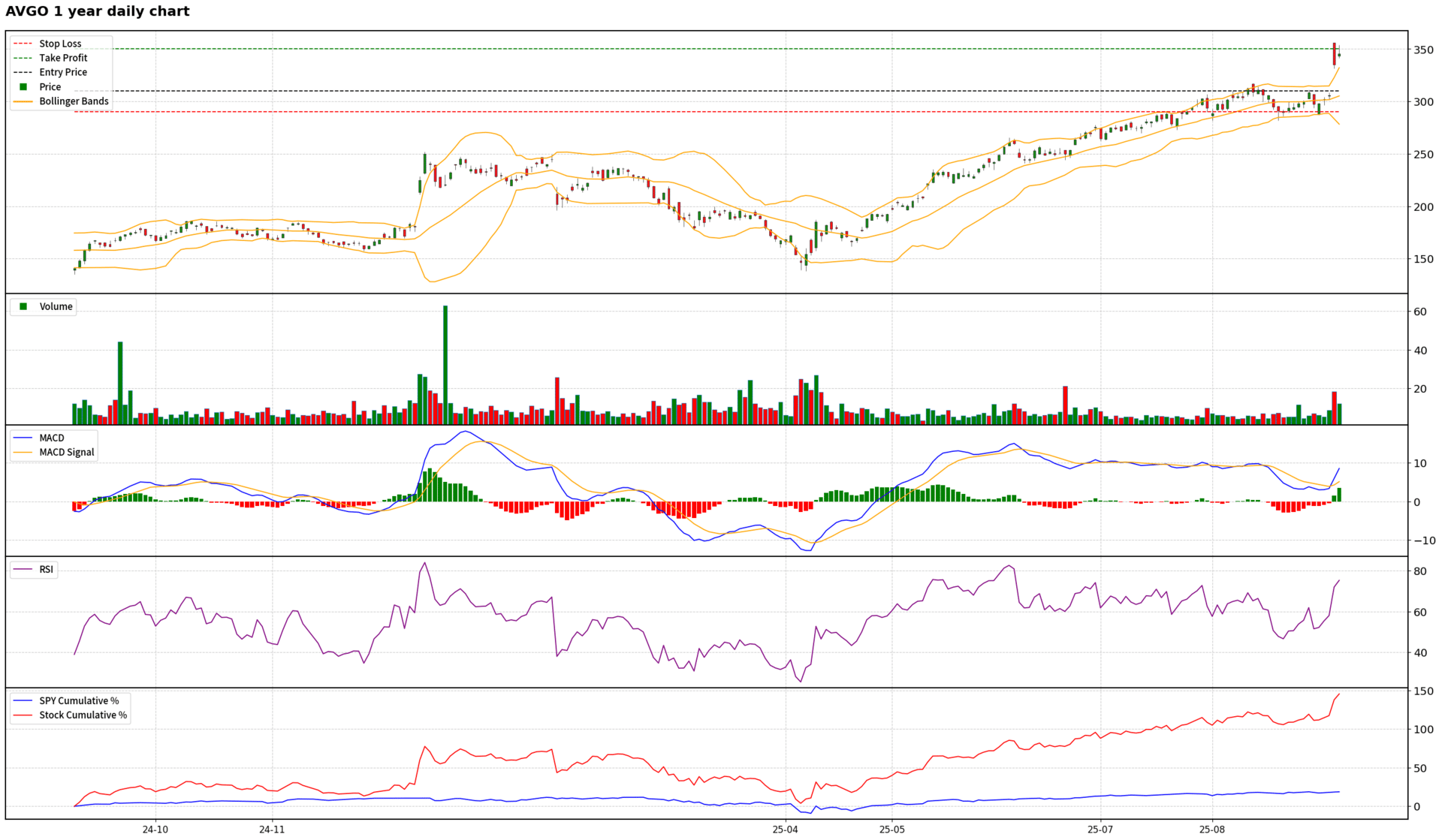

Scores: Fundamental 9 | Analyst Sentiment 8 | Valuation 2 | Catalyst 9 | Technical 7 | Total: 35

Trade Suggestions: Long Normal | Entry: 310.0 | TP: 350.0 | SL: 290.0 | Confidence: 6

Broadcom presents a compelling long-term investment opportunity driven by its dominant position in custom AI semiconductors and robust infrastructure software growth. The company's recent $10 billion OpenAI deal, strong Q3 financials, and optimistic FY2026 AI revenue projections underscore its critical role in the burgeoning AI ecosystem. Management's strategic clarity and extended tenure further bolster confidence. While analyst sentiment is overwhelmingly positive, the stock's valuation is exceptionally high, with P/E and EV/EBITDA multiples indicating significant overvaluation relative to peers. Technically, $AVGO ( ▲ 1.64% ) is in a strong uptrend but is currently overbought, suggesting a near-term pullback is likely. Therefore, a tactical long position initiated on a significant pullback to establish a more favorable risk-reward profile is recommended, allowing investors to capitalize on its powerful growth catalysts while mitigating valuation and short-term technical risks.

$AVGO ( ▲ 1.64% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

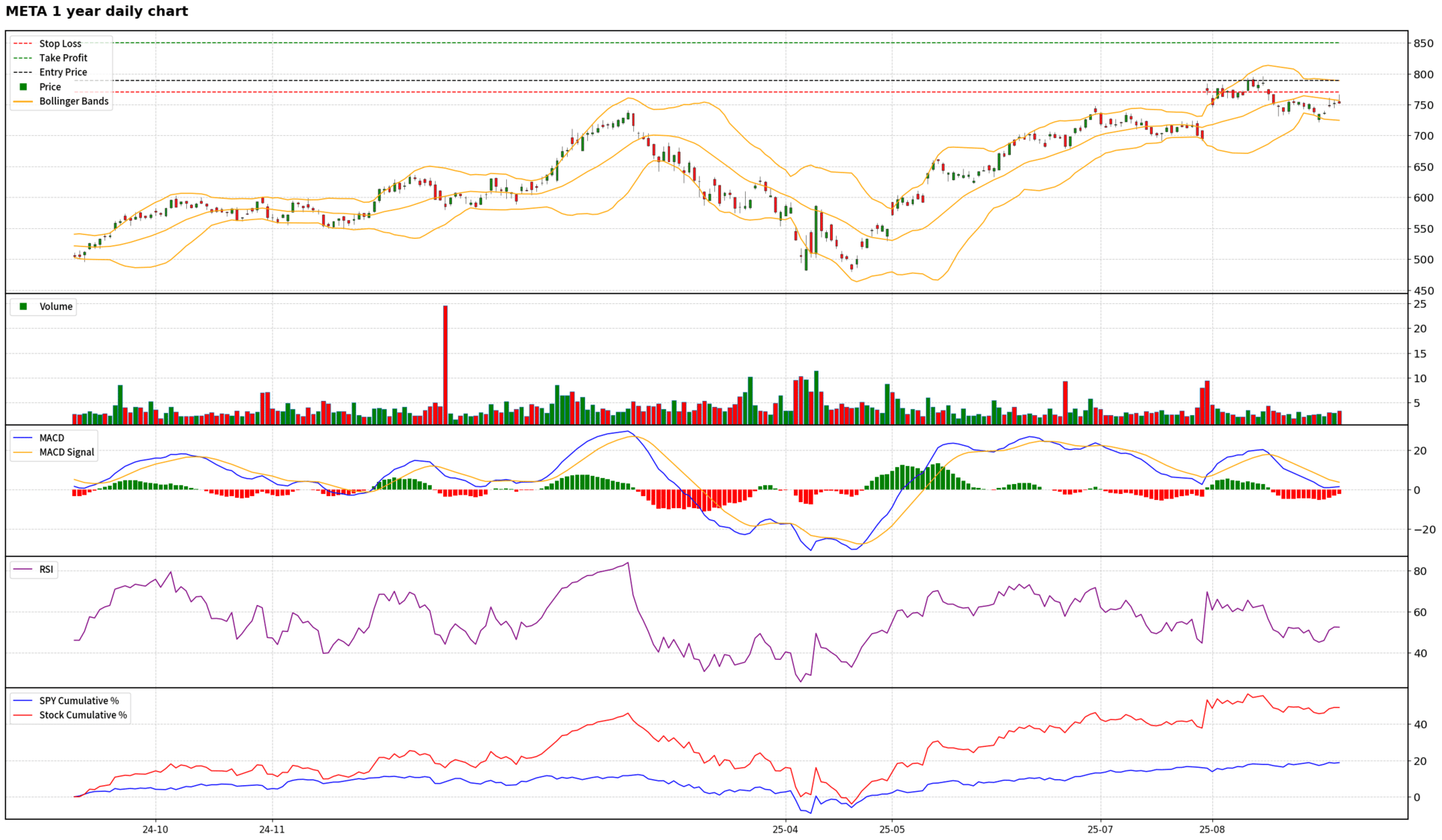

Scores: Fundamental 7 | Analyst Sentiment 8 | Valuation 5 | Catalyst 6 | Technical 6 | Total: 32

Trade Suggestions: Long Breakthrough | Entry: 789.0 | TP: 850.0 | SL: 770.0 | Confidence: 6

Meta Platforms presents a compelling long-term investment opportunity, underpinned by its aggressive and strategic pivot towards AI and Superintelligence, which is already yielding significant improvements in its core, highly profitable advertising business. Despite massive capital expenditures and ongoing losses from Reality Labs, management's high confidence and demonstrated execution in AI provide a strong growth narrative. Analyst sentiment is overwhelmingly bullish, with significant upside potential indicated by price targets. While current valuation metrics appear stretched relative to peers, the company's robust earnings growth and future AI-driven opportunities could justify this premium. Technically, the stock is in a strong bullish trend, though recent indecision and weakening momentum near resistance suggest a cautious approach. A breakthrough above key resistance levels would confirm renewed bullish momentum, making a tactical long position with disciplined risk management a viable strategy, despite the significant regulatory and legal headwinds that pose near-term risks.

$META ( ▼ 1.04% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

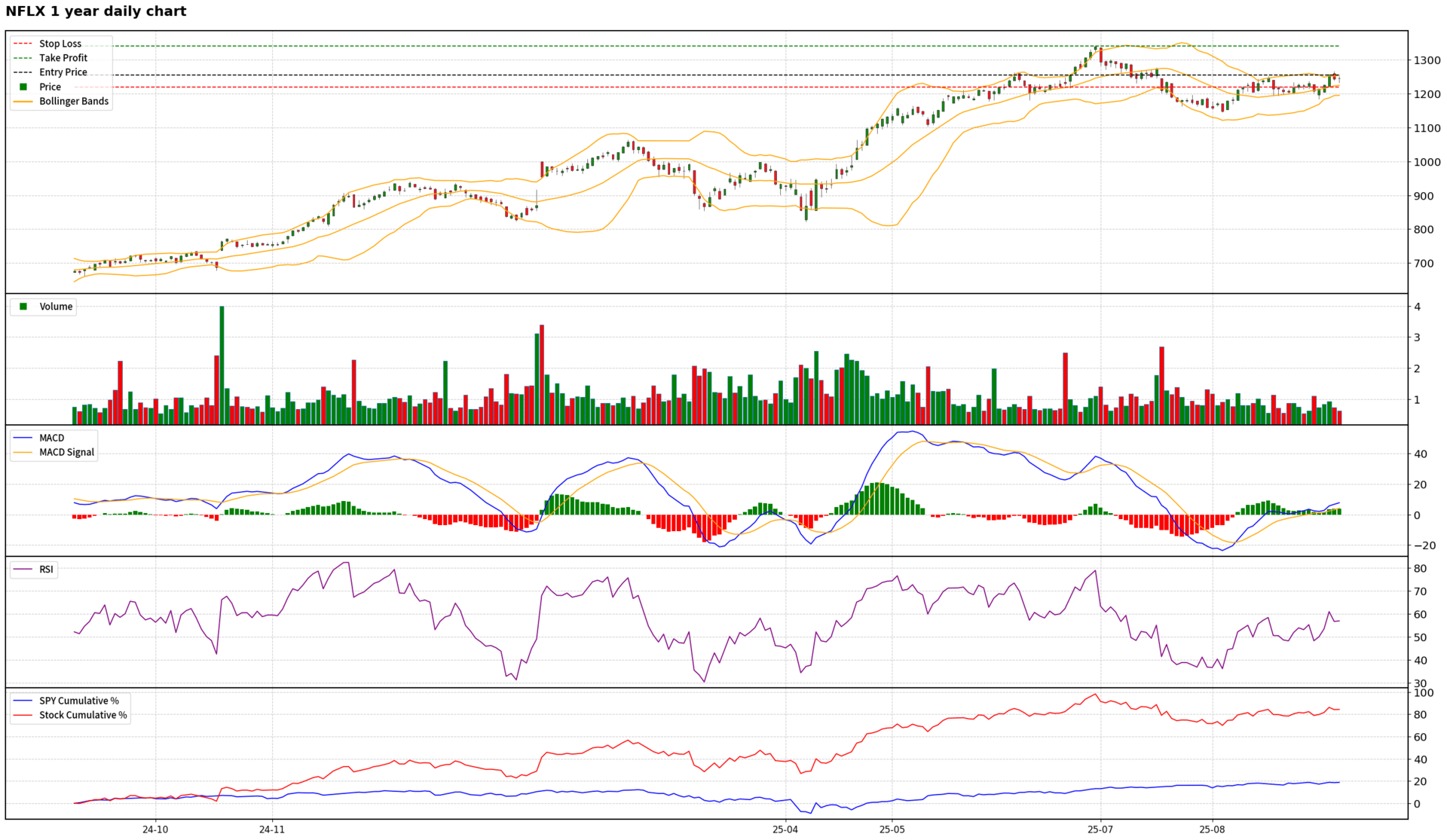

Scores: Fundamental 7 | Analyst Sentiment 8 | Valuation 3 | Catalyst 7 | Technical 6 | Total: 31

Trade Suggestions: Long Breakthrough | Entry: 1255.0 | TP: 1340.0 | SL: 1220.0 | Confidence: 6

Netflix presents a compelling long-term growth narrative, underpinned by strong financial performance, successful strategic initiatives like the ad-supported tier, and a robust content pipeline that continues to drive subscriber engagement. Management's high confidence and raised guidance, coupled with overwhelmingly positive analyst sentiment, reinforce its market leadership. However, the stock is significantly overvalued, trading at premium multiples that largely price in future growth, posing a risk of P/E compression. Technically, $NFLX ( ▼ 4.14% ) is at a critical juncture, consolidating near key resistance levels with a potential double top formation. While numerous catalysts exist, intensifying competition and regulatory scrutiny are notable headwinds. Therefore, a tactical long position is recommended only upon a confirmed breakthrough above the 1255.00 resistance, with disciplined risk management essential to navigate the stretched valuation and potential for increased volatility.

$NFLX ( ▼ 4.14% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

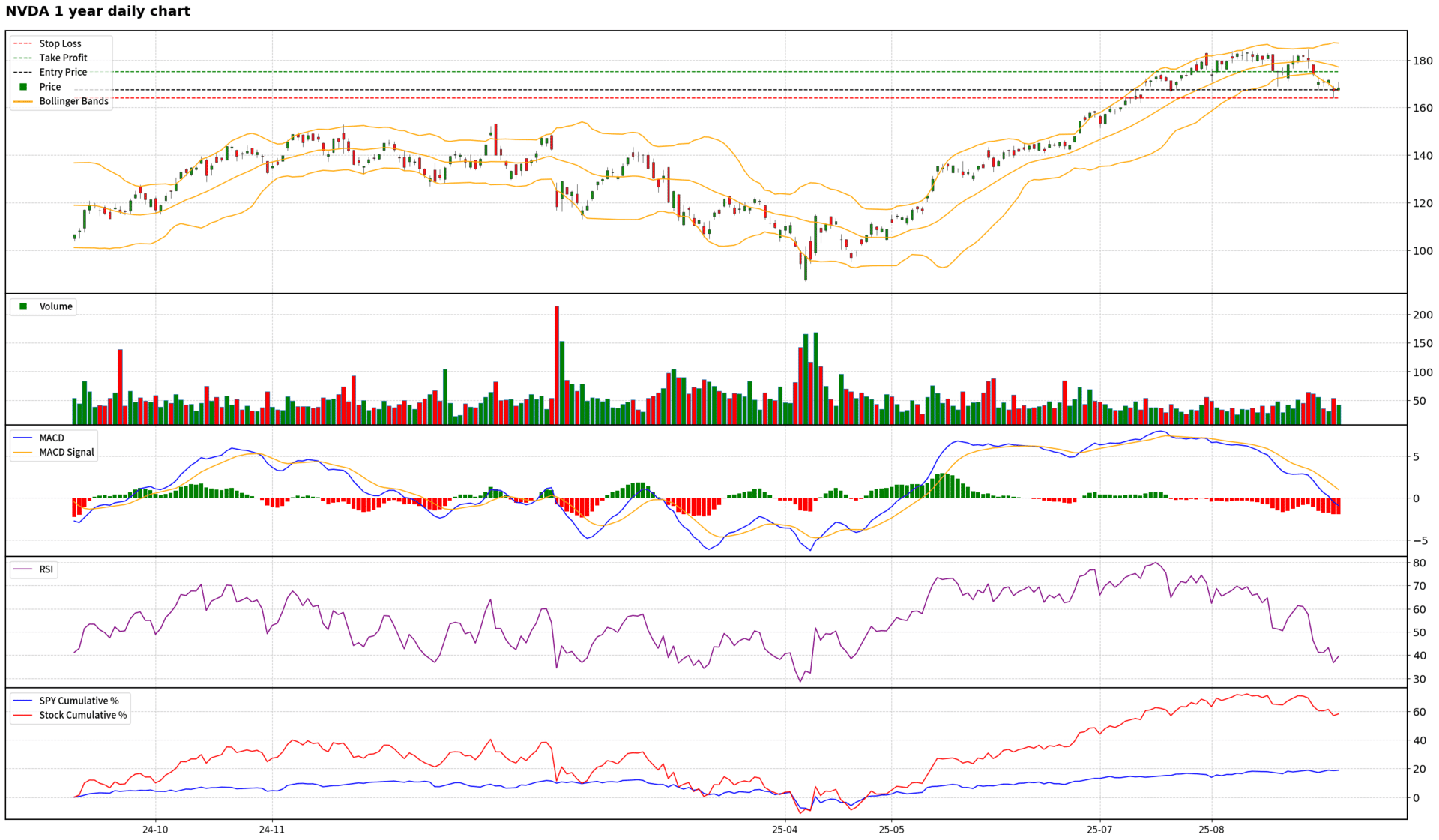

Scores: Fundamental 7 | Analyst Sentiment 8 | Valuation 2 | Catalyst 7 | Technical 6 | Total: 30

Trade Suggestions: Long Normal | Entry: 167.5 | TP: 175.0 | SL: 164.0 | Confidence: 6

NVIDIA remains a powerhouse at the forefront of the AI revolution, boasting exceptional financial performance, a robust product roadmap (Blackwell, Rubin), and overwhelming analyst support. Management's confidence in the multi-trillion-dollar AI infrastructure market is well-founded, and the company's full-stack approach provides a strong competitive moat. However, the stock's valuation is extremely stretched, trading at a significant premium to peers, and faces intensifying headwinds from US-China geopolitical tensions, which directly impact revenue and market access. Growing competition from major customers developing in-house chips also poses a long-term threat. Technically, the stock is in a short-term downtrend with bearish momentum, but oversold indicators suggest a potential bounce from current support levels. A tactical long position is recommended to capture a short-term rebound, but disciplined risk management with a conservative position size is crucial given the high volatility and significant external risks that could temper future growth.

$NVDA ( ▼ 0.64% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

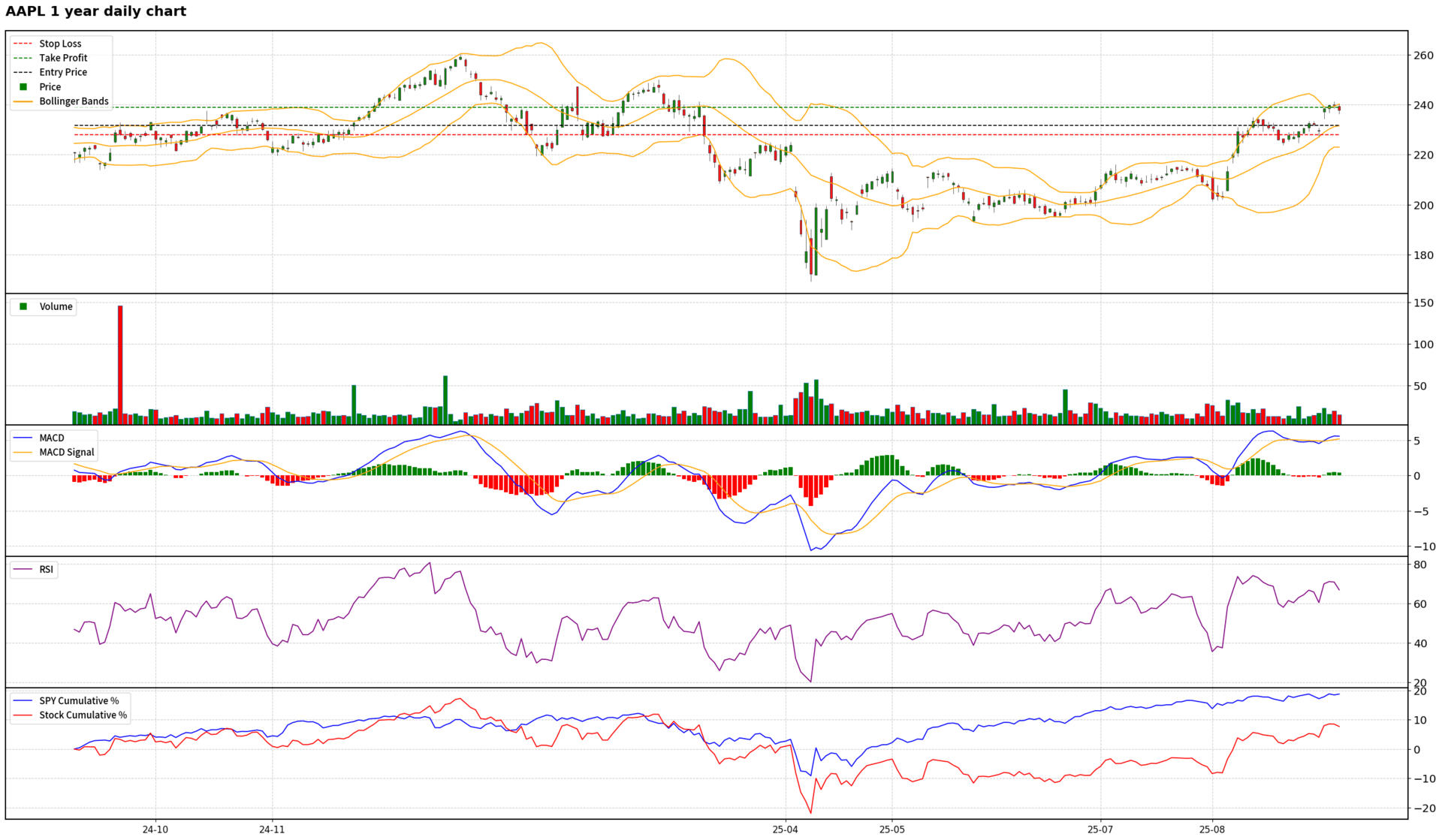

Scores: Fundamental 7 | Analyst Sentiment 7 | Valuation 3 | Catalyst 6 | Technical 7 | Total: 30

Trade Suggestions: Long Normal | Entry: 231.6 | TP: 239.0 | SL: 228.0 | Confidence: 6

Apple presents a complex investment case. Fundamentally, the company continues to deliver robust financial performance, driven by strong product sales (iPhone, Mac) and accelerating services growth, with a clear strategic focus on AI integration. However, this strength is overshadowed by significant and intensifying global regulatory scrutiny, substantial tariff costs, and a high valuation that appears stretched relative to peers. While upcoming product launches (iPhone 17) and AI advancements offer compelling catalysts, the material financial and operational risks from legal challenges and trade policies cannot be ignored. Technically, the stock is in a strong uptrend but shows signs of being overbought, suggesting a potential near-term pullback. Therefore, a tactical long position on a pullback to key support levels is recommended, emphasizing disciplined risk management due to the prevailing uncertainties and high valuation.

$AAPL ( ▲ 0.58% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

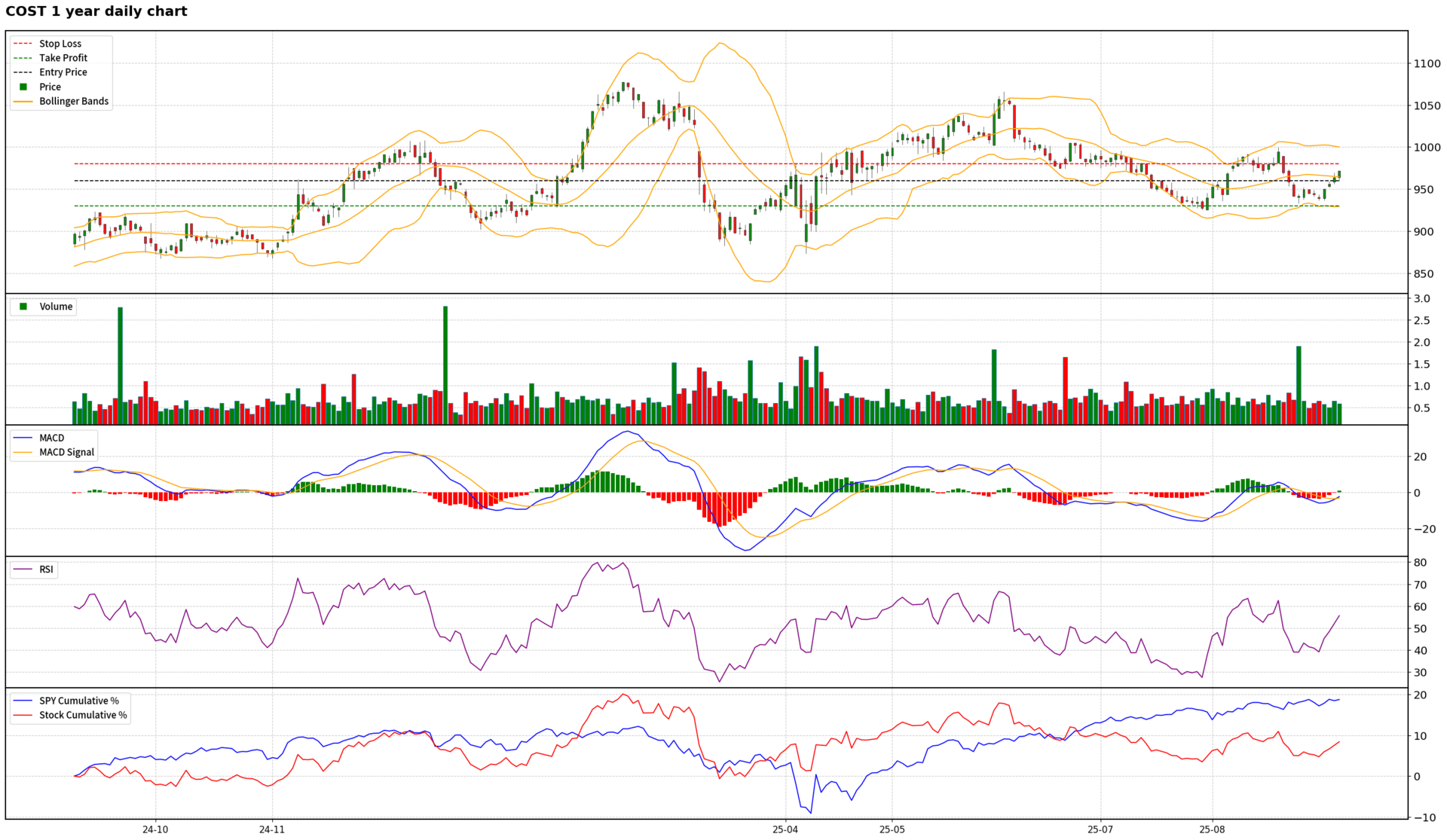

Scores: Fundamental 8 | Analyst Sentiment 7 | Valuation 2 | Catalyst 8 | Technical 5 | Total: 30

Trade Suggestions: Short Normal | Entry: 960.0 | TP: 930.0 | SL: 980.0 | Confidence: 5

Costco presents a complex investment case. Fundamentally, the company is exceptionally strong, demonstrating robust financial performance, impressive operational growth in membership and e-commerce, and effective management of its value proposition amidst a challenging macroeconomic backdrop. Positive catalysts, including international expansion and a consumer shift towards value, reinforce its long-term resilience. However, the stock is severely overvalued, trading at multiples far exceeding its growth prospects and peer comparisons, as highlighted by extremely low relative valuation scores and analyst concerns. Technically, the stock is in a consolidation phase, showing mixed signals with a potential for a short-term pullback after recent highs, and is currently trading below its 200-day MA. Given the significant valuation overhang and neutral-to-slightly-bearish short-term technicals, a tactical short position is recommended for the coming week, targeting a move towards established support levels. This strategy acknowledges the company's quality but prioritizes disciplined risk management against an unsustainable valuation.

$COST ( ▼ 1.58% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

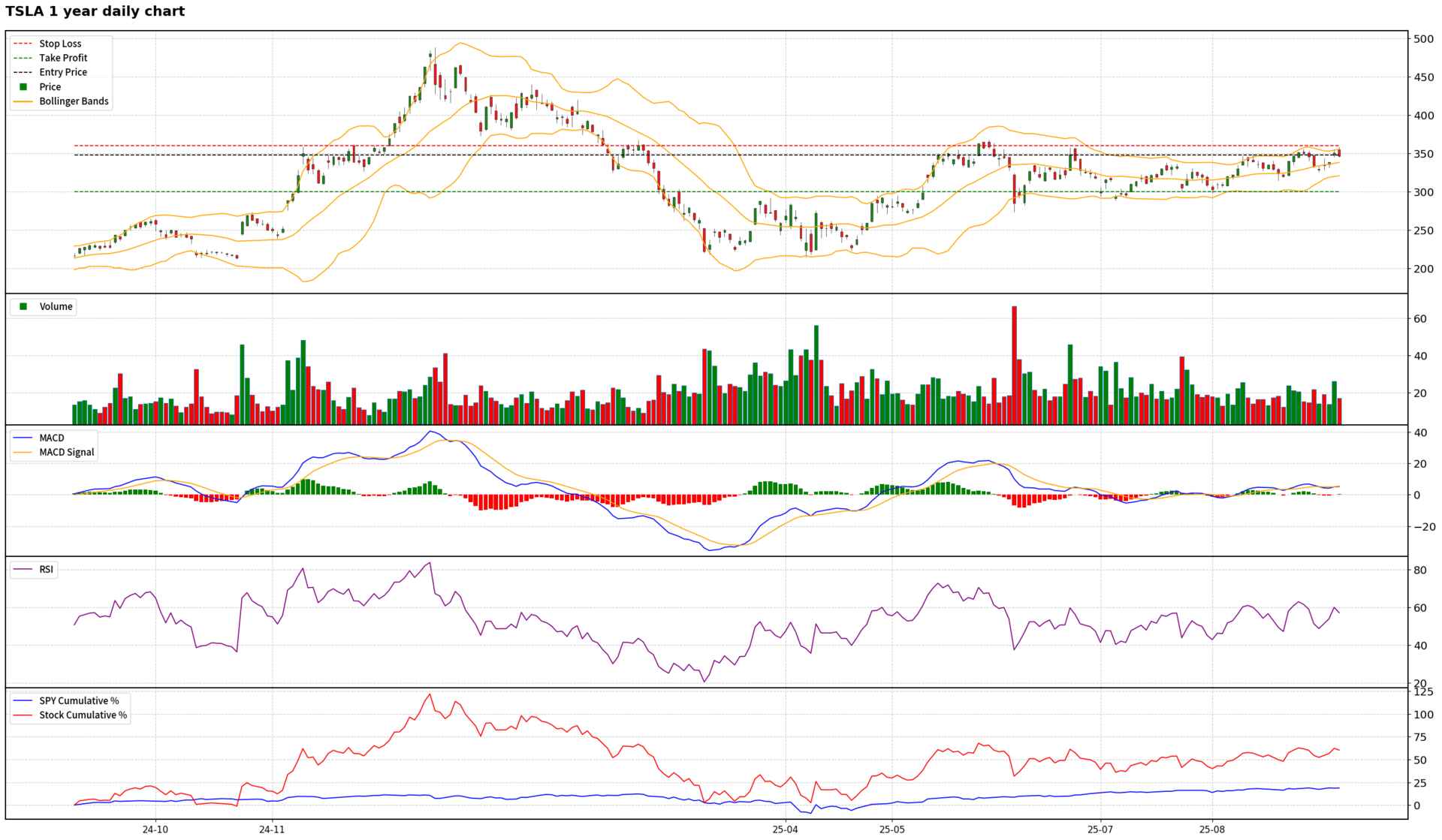

Scores: Fundamental 4 | Analyst Sentiment 3 | Valuation 1 | Catalyst 3 | Technical 5 | Total: 16

Trade Suggestions: Short Normal | Entry: 348.0 | TP: 300.0 | SL: 360.0 | Confidence: 8

Tesla presents a compelling short opportunity for the coming week. The company's core automotive business is experiencing significant deterioration, marked by declining revenues, profits, and market share amidst intense competition and an aging product lineup. Despite management's highly optimistic long-term vision for AI and robotics, these initiatives are speculative, distant, and already priced into an 'extremely stretched' valuation that is fundamentally unjustifiable. Analyst sentiment is predominantly neutral to bearish, with price targets indicating substantial downside. Technically, the stock shows signs of weakening bullish momentum and a potential short-term mean-reversal, with strong resistance levels overhead. Given these factors, a tactical short position with disciplined risk management is warranted, targeting a correction towards more realistic valuation levels and key technical supports.

$TSLA ( ▲ 1.41% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Research any US or Hong Kong stock in seconds using Orion AI.

Need FREE access? Reply FREE to this email.

Not interested in US/HK stocks? Reply to this email with any stock exchange of your interest and we will contact you when we launch for that stock exchange.

If you are not interested in receiving our FREE reports, kindly unsubscribe below.