Welcome equity investors—today’s edition unlocks Orion equity research on the four Robotics stocks: $TER ( ▲ 2.02% ), $ISRG ( ▼ 0.4% ), $ROK ( ▲ 2.4% ) and $IRBT ( ▲ 48.44% ).

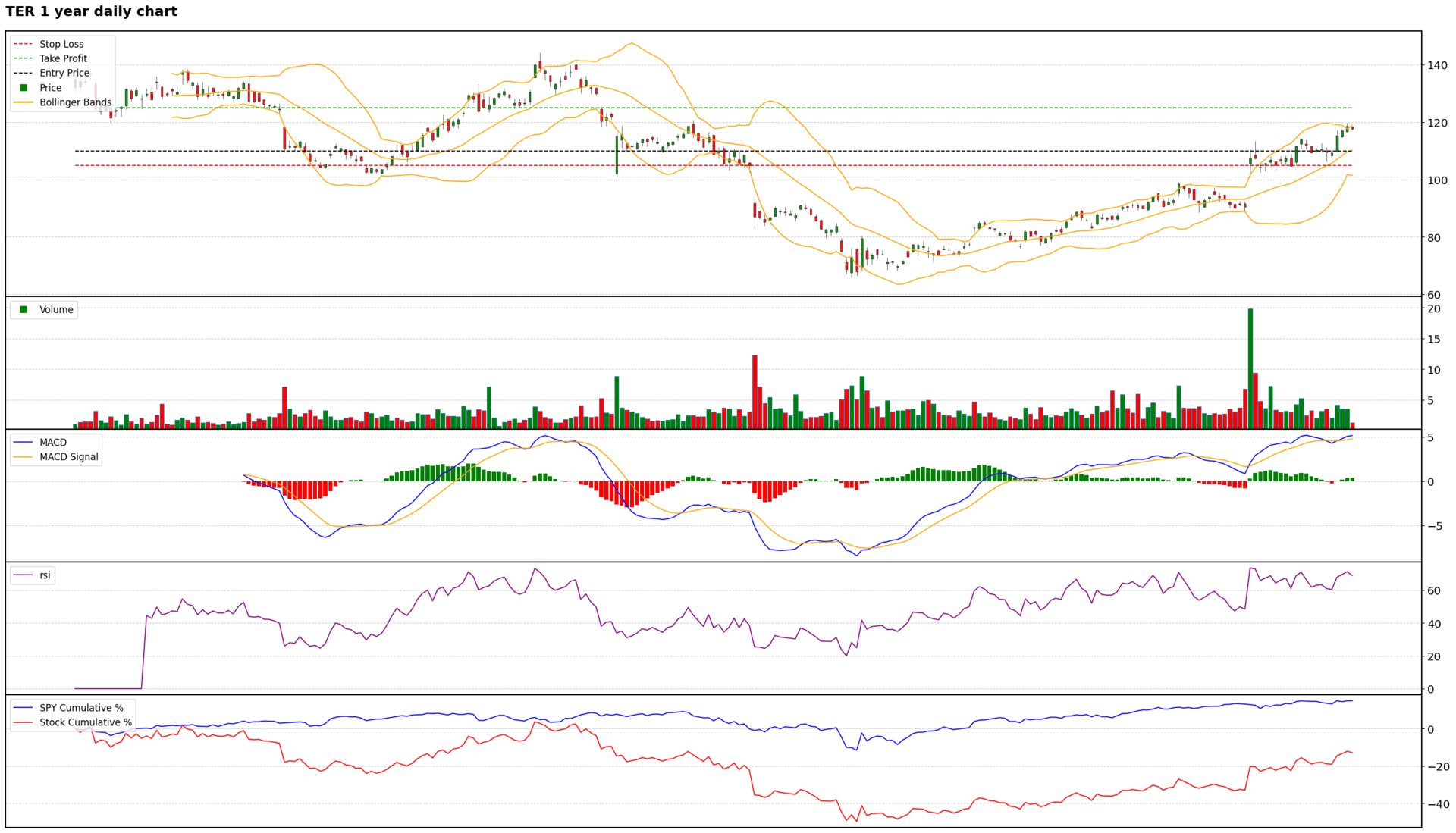

Scores: Fundamental 6 | Analyst Sentiment 7 | Valuation 4 | Catalyst 8 | Technical 6 | Total: 31

Trade Suggestions: Long Normal | Entry: 110.0 | TP: 125.0 | SL: 105.0 | Confidence: 6

Teradyne presents a compelling long-term investment opportunity, primarily driven by its pivotal role in the expanding AI-driven semiconductor testing market and strategic acquisitions that enhance its product offerings. Despite recent quarterly financial headwinds and weakness in its robotics segment, the company's forward EPS growth and high ROE forecasts underscore its robust potential. Analyst sentiment is overwhelmingly bullish, supported by significant institutional interest, although current valuation multiples appear elevated and technical indicators suggest the stock is overbought in the short term. Therefore, a tactical long position is recommended, contingent on a pullback to a more favorable entry point, allowing investors to capitalize on the strong underlying growth narrative while managing short-term risks associated with valuation and technical overextension. The trade offers a favorable risk/reward ratio, suitable for a moderately sized position.

$TER ( ▲ 2.02% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

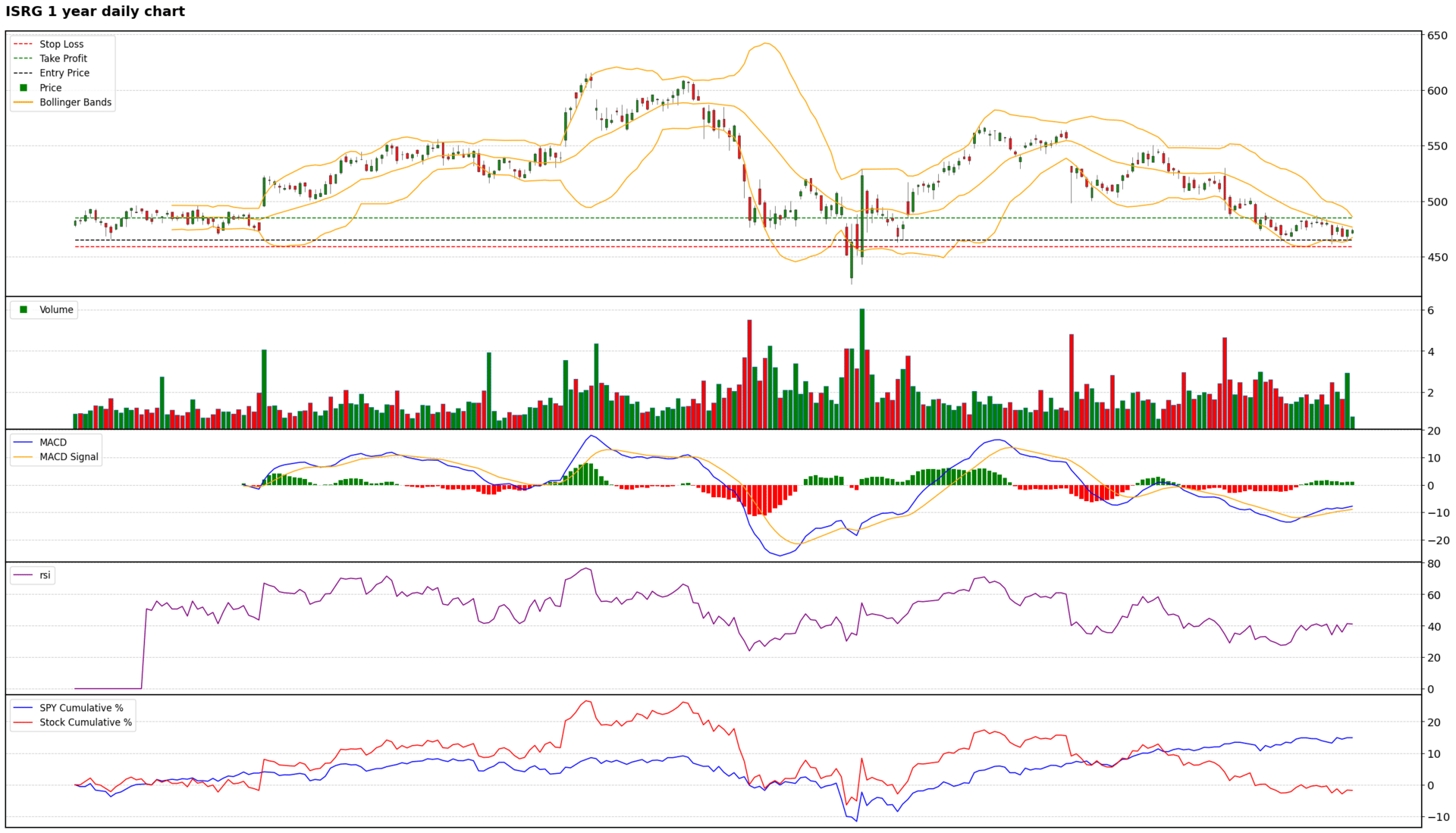

Scores: Fundamental 7 | Analyst Sentiment 8 | Valuation 2 | Catalyst 7 | Technical 6 | Total: 30

Trade Suggestions: Long Normal | Entry: 465.0 | TP: 485.0 | SL: 459.0 | Confidence: 6

Intuitive Surgical (ISRG) remains a high-quality, market-leading company with a strong competitive moat, robust financial performance, and a clear innovation roadmap, particularly with the da Vinci 5 system. Management's confidence and proactive strategies, coupled with largely bullish analyst sentiment, underscore its long-term growth potential. However, the stock's current valuation is exceptionally high, pricing in significant future growth and posing a considerable risk to short-term returns. While technicals suggest nascent bullish momentum, a potential short-term pullback is indicated. Therefore, a tactical 'Long' position is recommended only on a dip to strong support levels, allowing investors to benefit from the company's fundamental strength while managing valuation risk. The trade setup offers a favorable risk/reward ratio, but position sizing should be conservative given the overall market sensitivity and valuation concerns.

$ISRG ( ▼ 0.4% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

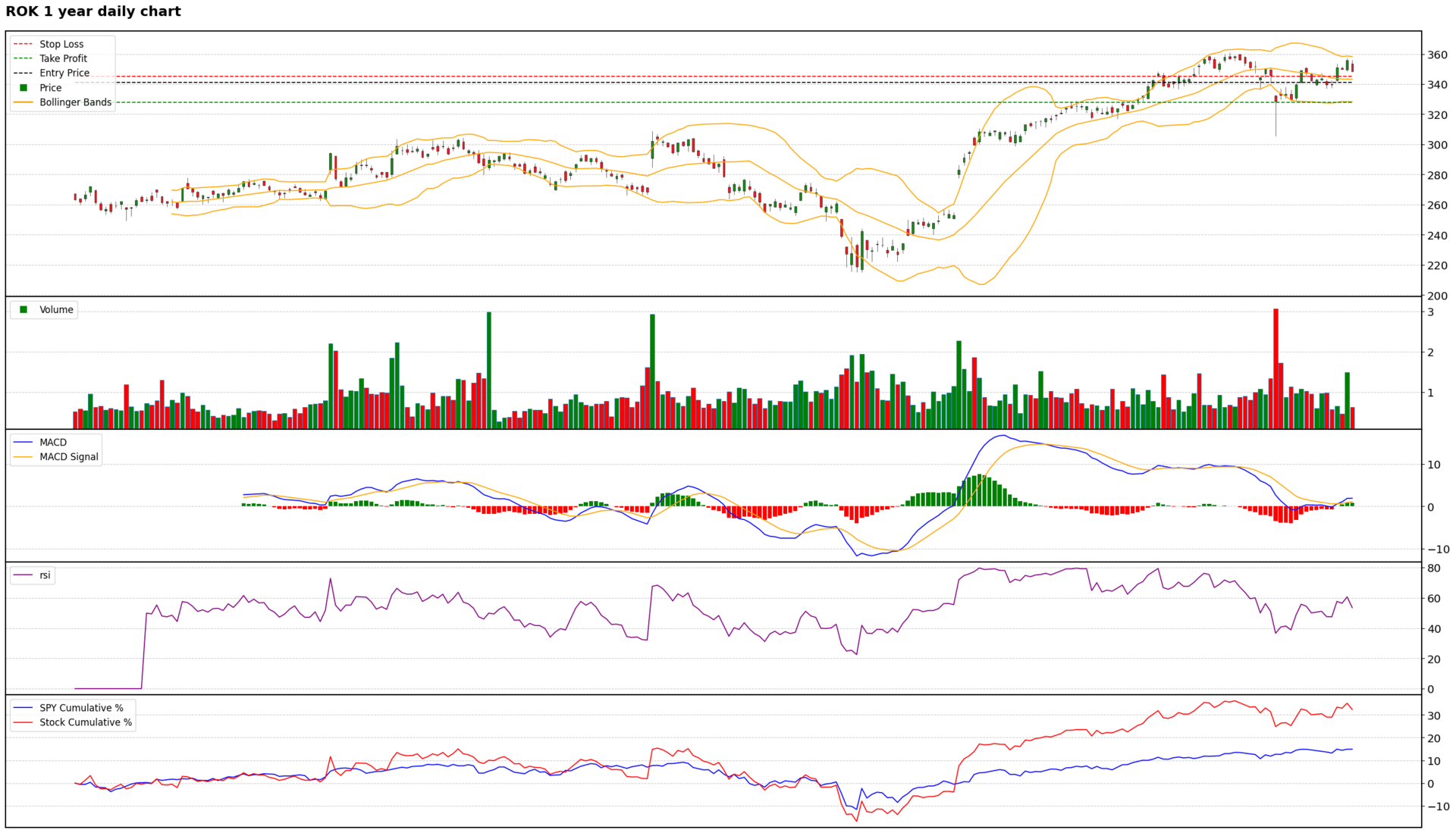

Scores: Fundamental 6 | Analyst Sentiment 5 | Valuation 2 | Catalyst 5 | Technical 4 | Total: 22

Trade Suggestions: Short Breakthrough | Entry: 341.0 | TP: 328.0 | SL: 345.0 | Confidence: 3

Rockwell Automation presents a complex investment profile. While the company is executing well operationally, particularly in its Software & Control segment, and is strategically positioned for long-term growth in industrial automation, its current valuation is excessively high and not justified by its modest organic growth or near-term challenges. Analyst sentiment is cautious, and the stock faces significant headwinds from customer project delays, macro uncertainties, and potential revenue pull-ins. Technically, the stock is overbought and showing signs of indecision near resistance, with a risk of mean-reversal. Therefore, a short-term bearish strategy is recommended, targeting a breakdown below key support levels. Long-term investors should await a more attractive entry point that better reflects the company's fundamentals and growth prospects.

$ROK ( ▲ 2.4% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

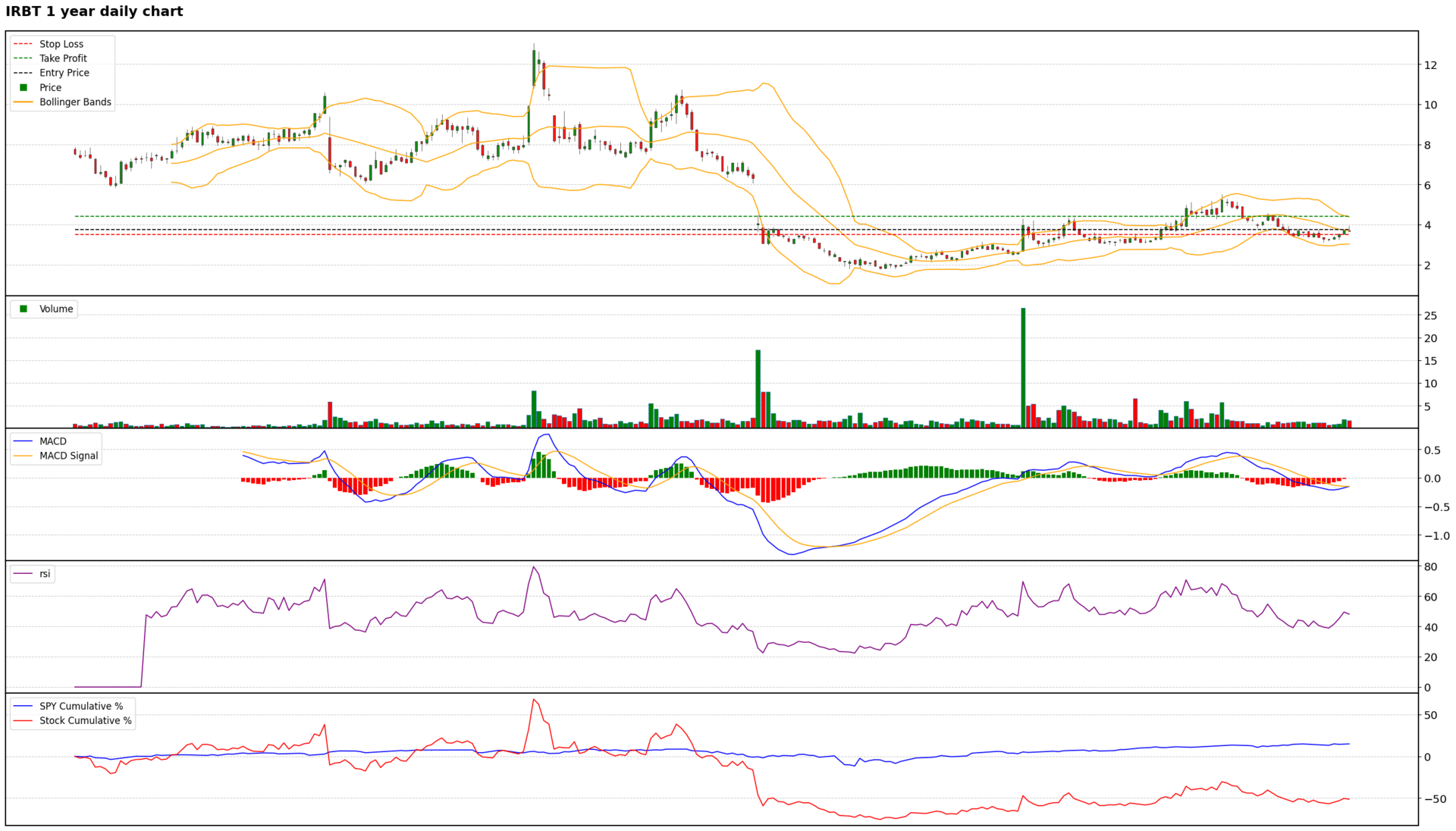

Scores: Fundamental 1 | Analyst Sentiment 1 | Valuation 1 | Catalyst 1 | Technical 4 | Total: 8

Trade Suggestions: Long Breakthrough | Entry: 3.8 | TP: 4.4 | SL: 3.5 | Confidence: 1

iRobot (IRBT) presents an extremely high-risk investment proposition. The company is in severe financial distress, marked by consistent revenue declines, significant operating losses, negative shareholder's equity, and a 'going concern' warning from management. It faces imminent default on its term loan covenants by September 19, 2025, without further waivers, which could lead to bankruptcy and a complete loss for shareholders. Analyst sentiment is overwhelmingly bearish, and valuation metrics are either unavailable or indicate overvaluation relative to peers despite the low absolute price. While technical indicators suggest a potential short-term bounce from extreme lows, this is likely a speculative movement against overwhelming fundamental headwinds. Any investment in IRBT at this juncture is purely speculative, with a high probability of significant capital loss. Prudent investors should avoid this stock, or consider a short position if the technical bounce fails, given the dire fundamental outlook.

$IRBT ( ▲ 48.44% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Research any US stock in seconds using Orion AI.