Welcome equity investors—today’s edition unlocks Orion equity research on the three longevity and aging related stocks $ABBV ( ▲ 0.98% ), $CRSP ( ▲ 0.96% ) and $TDOC ( ▼ 0.13% ).

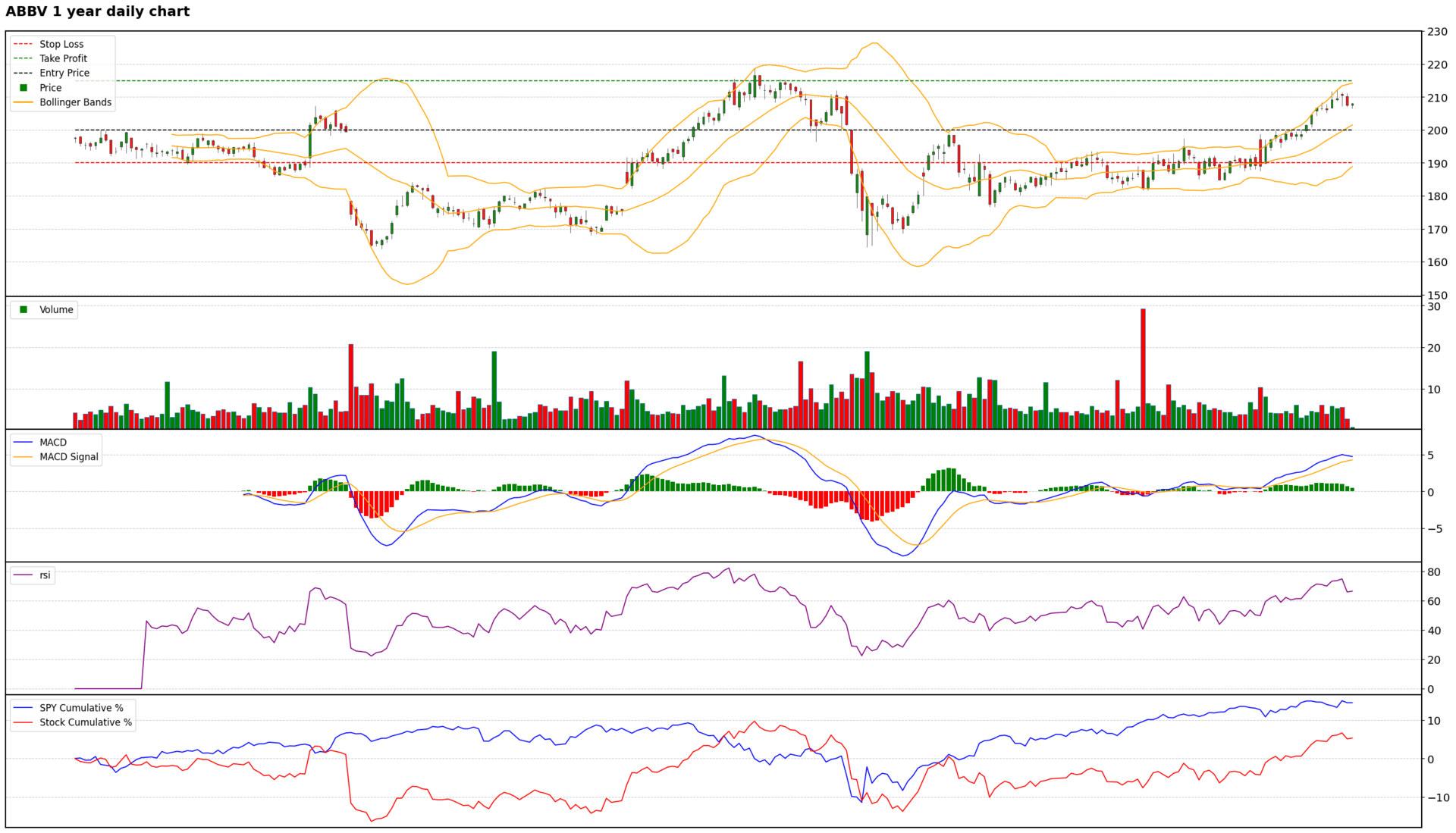

Scores: Fundamental 8 | Analyst Sentiment 9 | Valuation 7 | Catalyst 9 | Technical 6 | Total: 39

Trade Suggestions: Long Normal | Entry: 200.0 | TP: 215.0 | SL: 190.0 | Confidence: 8

Based on a comprehensive analysis, AbbVie presents a compelling long-term investment opportunity. The company has successfully navigated the HUMIRA biosimilar challenge, demonstrating robust growth from its ex-HUMIRA portfolio (Skyrizi, Rinvoq) and aggressively diversifying its pipeline into high-growth areas like neuroscience and obesity through strategic acquisitions and R&D. Management confidence is high, reflected in raised guidance and strong operational performance. Analyst sentiment is overwhelmingly bullish, and the stock's forward valuation appears attractive given its strong growth prospects and exceptional dividend yield. While the balance sheet shows negative shareholder equity and increasing debt, the company's strong operating cash flow and strategic initiatives mitigate these concerns. Technically, the stock is in a strong uptrend, though short-term overbought signals suggest a tactical entry on a pullback is advisable. This strategy aims to capture the significant upside potential while managing short-term risks.

$ABBV ( ▲ 0.98% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

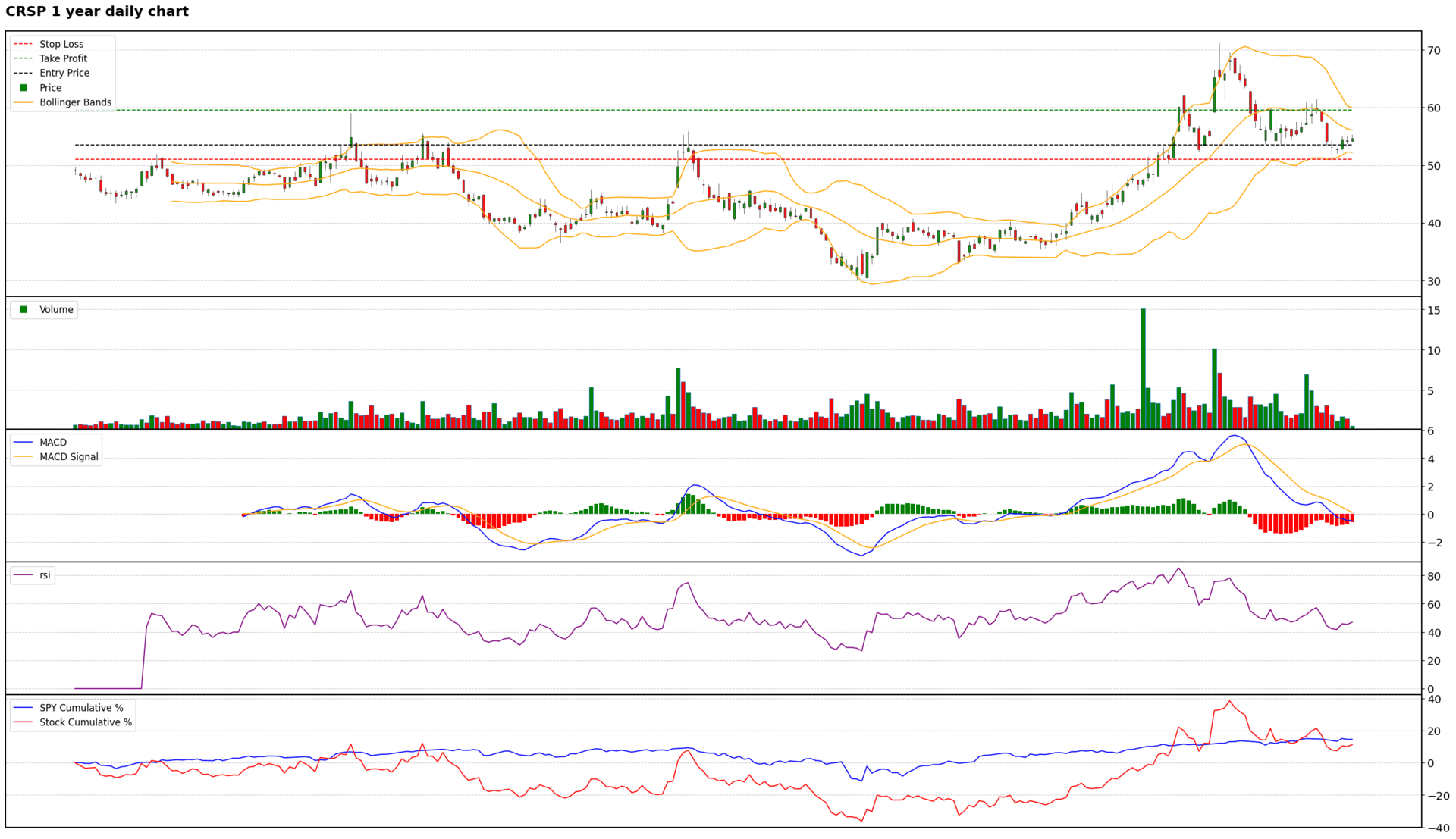

Scores: Fundamental 5 | Analyst Sentiment 7 | Valuation 2 | Catalyst 8 | Technical 4 | Total: 26

Trade Suggestions: Long Normal | Entry: 53.5 | TP: 59.5 | SL: 51.0 | Confidence: 5

CRISPR Therapeutics presents a compelling, albeit highly speculative, long-term investment opportunity driven by its pioneering gene-editing technology and a robust pipeline with significant upcoming clinical catalysts in H2 2025. The company's first approved CRISPR therapy, CASGEVY, and promising in vivo programs like CTX310, underpin its future growth. However, CRSP faces considerable short-term headwinds, including persistent net losses, high cash burn, and a stretched valuation, which are reflected in recent negative financial reports and a decline in institutional ownership. While analyst sentiment is cautiously optimistic, technical indicators suggest short-term bearish momentum, though the stock is currently oversold. Given the high-risk, high-reward profile, a tactical long position with disciplined risk management is justified, betting on positive clinical data to catalyze a rebound and validate its long-term potential.

$CRSP ( ▲ 0.96% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

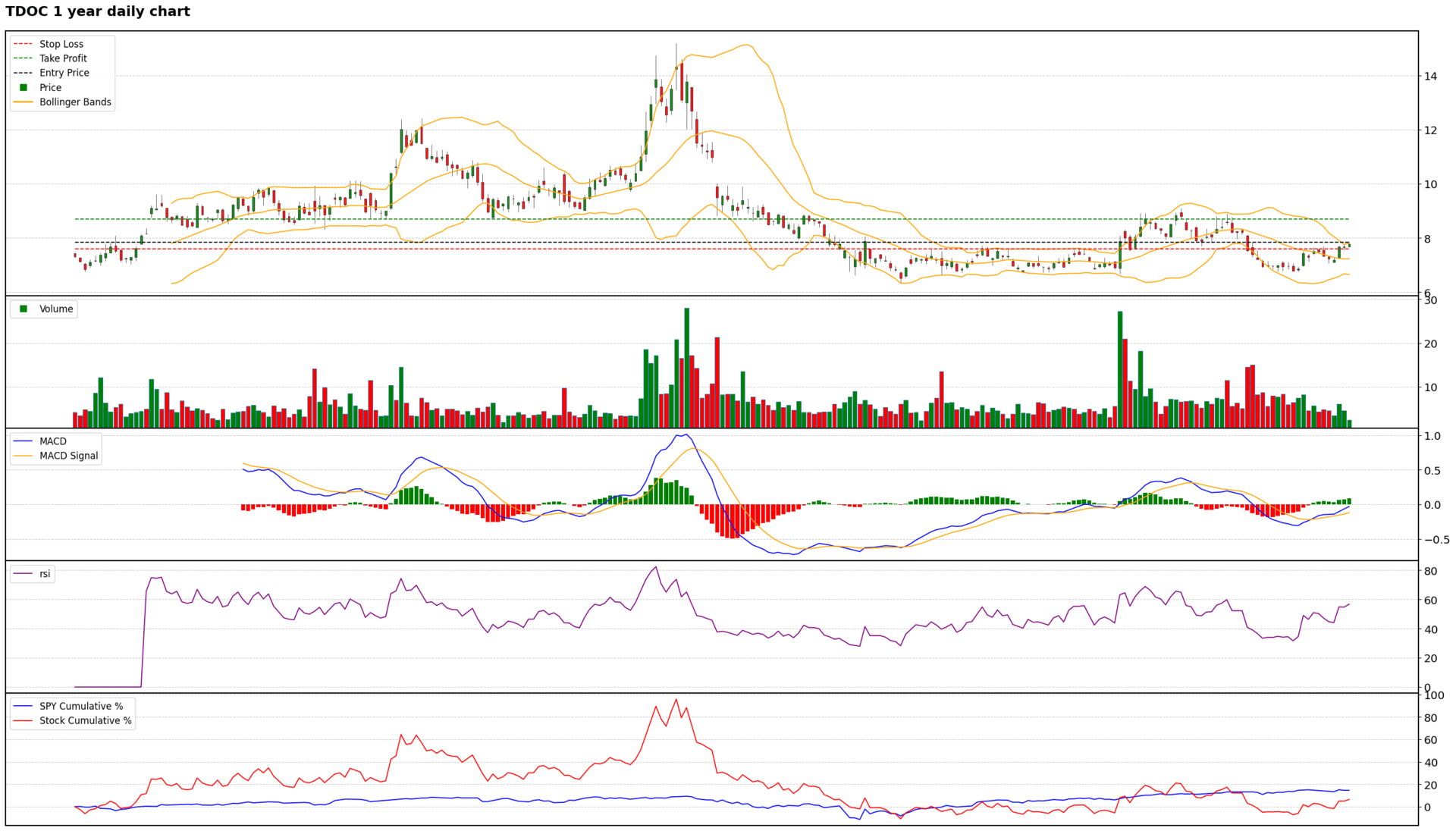

Scores: Fundamental 4 | Analyst Sentiment 3 | Valuation 6 | Catalyst 4 | Technical 6 | Total: 23

Trade Suggestions: Long Breakthrough | Entry: 7.8 | TP: 8.7 | SL: 7.6 | Confidence: 4

Teladoc Health presents a complex investment scenario. While the stock appears undervalued based on EV/EBITDA multiples and has recently demonstrated strong short-term technical momentum and relative strength against the broader market, its fundamental health remains challenged. Key concerns include declining revenue in the BetterHelp segment, persistent net losses, and a cautious analyst sentiment. Management is actively pursuing a strategic turnaround with new product launches, acquisitions, and a pivot to insurance for BetterHelp, but these initiatives are long-term in nature and their immediate financial impact is limited. The stock is currently testing a significant resistance level, and while a tactical long position on a confirmed breakout could capture short-term momentum, the long-term bearish trend and fundamental headwinds necessitate a conservative approach with strict risk management. A sustained recovery will depend on clear and consistent improvements in core business performance and profitability.

$TDOC ( ▼ 0.13% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Research any US stock in seconds using Orion AI.