Welcome equity investors—today’s edition unlocks Orion equity research on five industrial and infrastructure stocks: $J ( ▼ 1.48% ), $FAST ( ▲ 1.46% ), $CSX ( ▲ 1.98% ), $OTIS ( ▲ 0.87% ) and $ODFL ( ▲ 5.66% ).

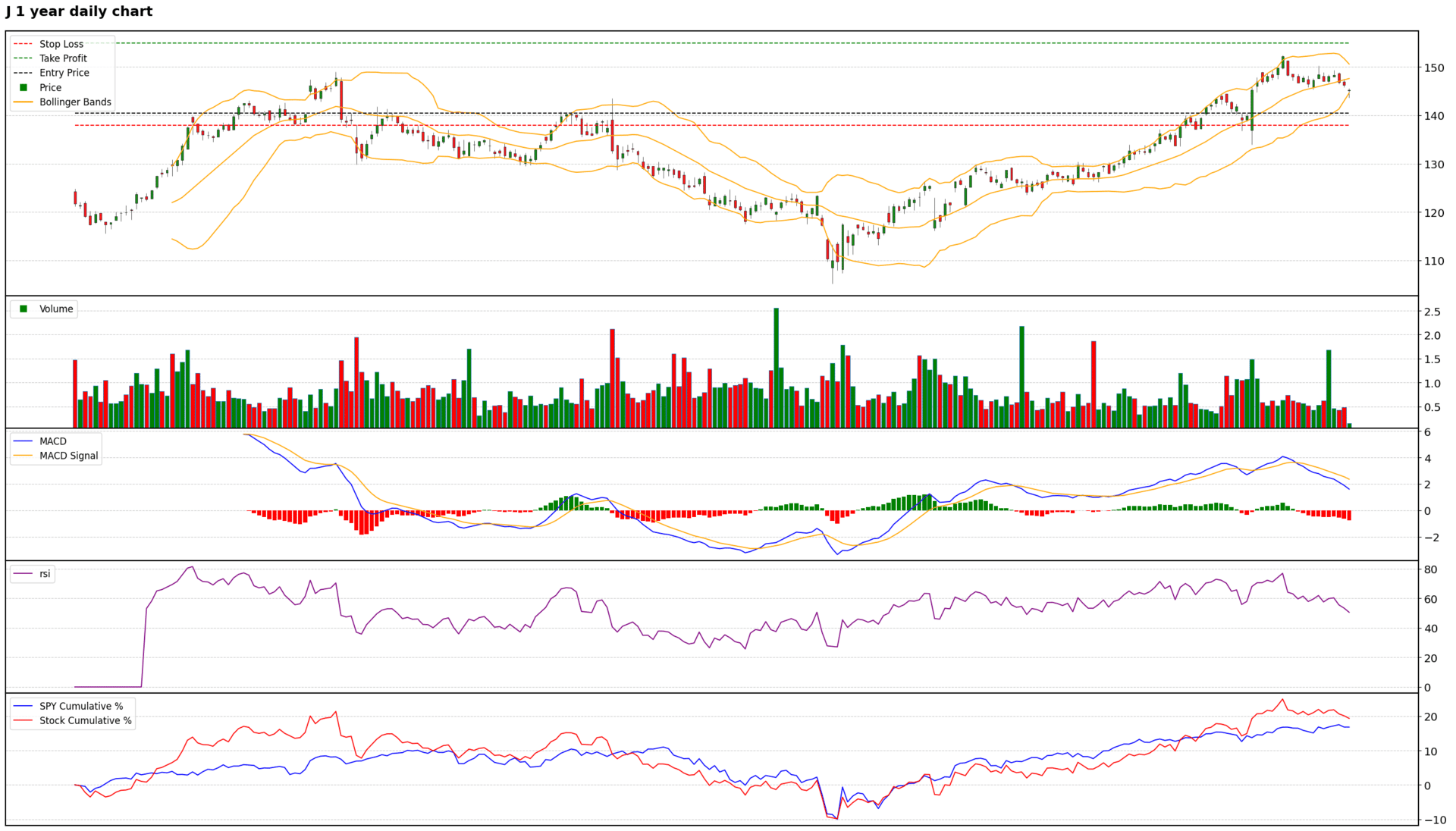

Scores: Fundamental 7 | Analyst Sentiment 8 | Valuation 5 | Catalyst 8 | Technical 6 | Total: 34

Trade Suggestions: Long Normal | Entry: 140.5 | TP: 155.0 | SL: 138.0 | Confidence: 7

Jacobs Solutions presents a compelling long-term investment opportunity, underpinned by its successful strategic transformation into a high-margin, tech-driven consulting and advisory leader. The company's robust Q3 FY25 performance, record backlog, and confident management outlook for FY26 underscore its operational strength and future growth potential in secularly growing markets like water, advanced manufacturing, life sciences, and data centres. While recent technical indicators suggest short-term indecision and potential for a pullback, and valuation appears mixed, the overwhelmingly positive analyst sentiment, significant institutional interest, and strong long-term catalysts provide a solid foundation. A tactical long position, initiated on a pullback to key support levels, offers an attractive risk/reward profile, capitalizing on the company's strategic momentum and commitment to shareholder returns.

$J ( ▼ 1.48% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

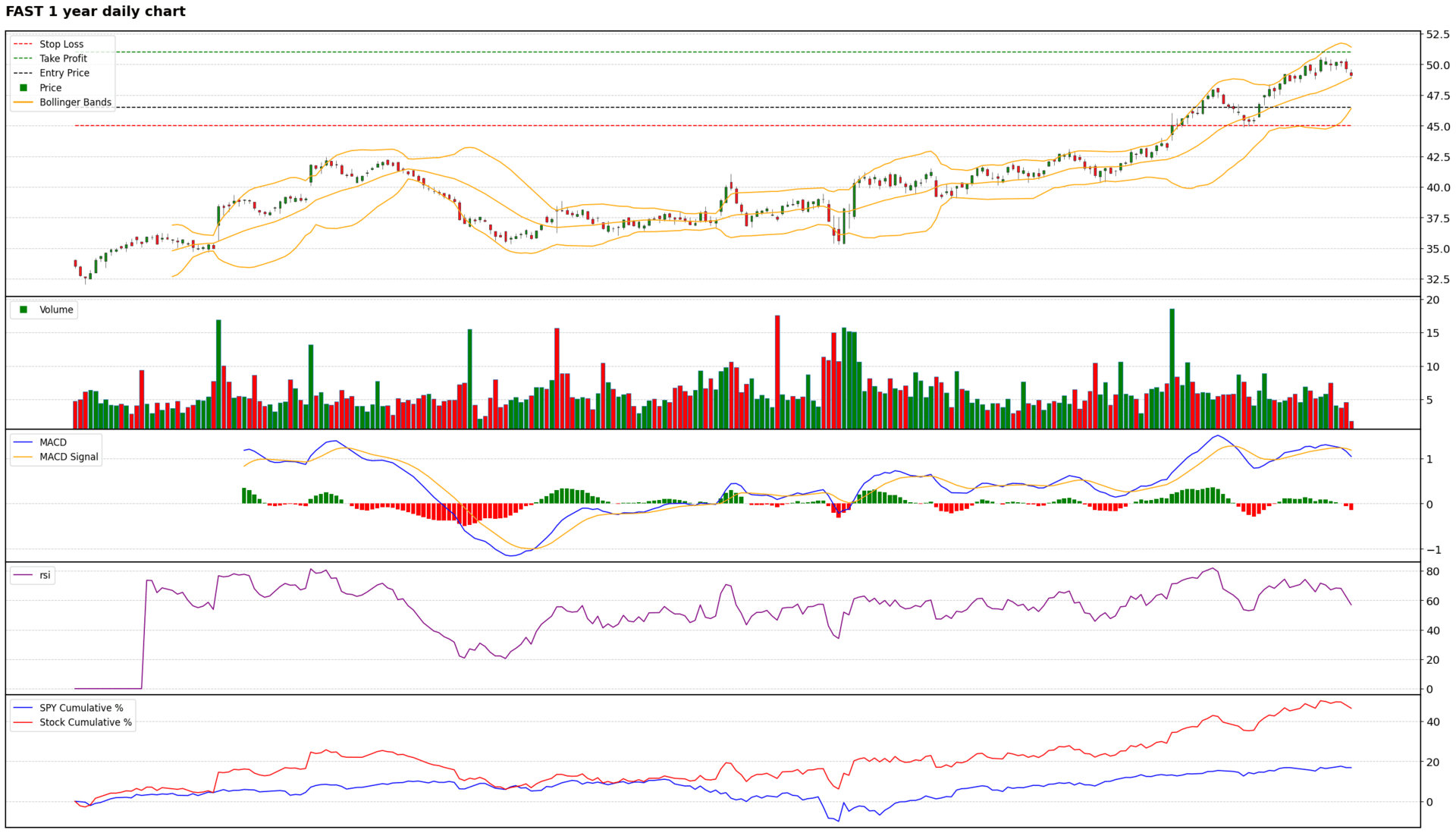

Scores: Fundamental 8 | Analyst Sentiment 6 | Valuation 2 | Catalyst 7 | Technical 6 | Total: 29

Trade Suggestions: Long Normal | Entry: 46.5 | TP: 51.0 | SL: 45.0 | Confidence: 5

Fastenal presents a compelling long-term growth story driven by robust operational execution, successful digital transformation, and effective market share gains in high-value customer segments. The company's Q2 2025 results showcased accelerating revenue and EPS growth, alongside improved margins, demonstrating resilience amidst a challenging macroeconomic backdrop. Management's confidence in strategic initiatives and consistent shareholder returns further bolster its appeal. However, the stock's current valuation is exceptionally high, trading at a significant premium to historical averages and peers, which is a major concern highlighted by analysts and valuation metrics. While technicals indicate a strong bullish trend, short-term momentum indicators suggest a potential for consolidation or a minor pullback. The recent insider selling also warrants caution. Therefore, a tactical long position is recommended on a pullback to a more favorable entry point, allowing for participation in the company's strong fundamentals while managing the risks associated with its elevated valuation.

$FAST ( ▲ 1.46% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

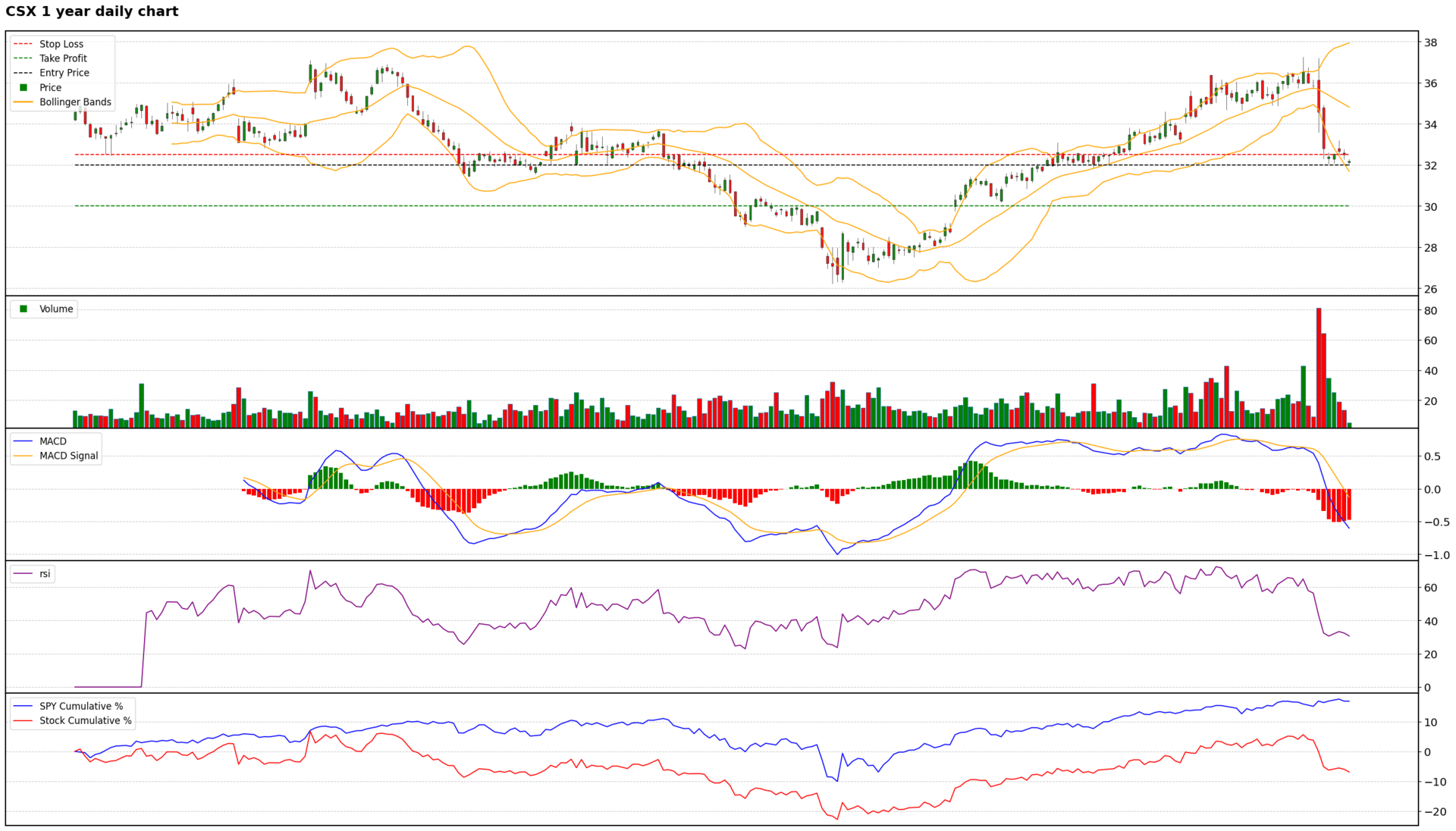

Scores: Fundamental 4 | Analyst Sentiment 7 | Valuation 4 | Catalyst 3 | Technical 2 | Total: 20

Trade Suggestions: Short Breakthrough | Entry: 32.0 | TP: 30.0 | SL: 32.5 | Confidence: 3

Based on a comprehensive analysis, $CSX ( ▲ 1.98% ) presents a compelling short opportunity for the coming week. The company's Q2 2025 financials revealed significant declines in revenue, earnings, and operational metrics, indicating a period of weak performance. Crucially, the definitive rejection of merger prospects by potential partners has removed a major speculative catalyst, leading to immediate share price pressure. This is compounded by intensifying activist investor demands and deteriorating technical indicators, including a sharp price drop on high volume, bearish MACD crossover, and price trading below key moving averages. While analysts maintain a long-term positive outlook and some see undervaluation, the immediate fundamental and technical signals are overwhelmingly bearish. A tactical short position, initiated on a breakthrough below key support, is justified given the high probability of further downside in the near term.

$CSX ( ▲ 1.98% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Scores: Fundamental 4 | Analyst Sentiment 5 | Valuation 3 | Catalyst 4 | Technical 4 | Total: 20

Trade Suggestions: Short Breakthrough | Entry: 85.4 | TP: 82.0 | SL: 87.0 | Confidence: 3

Based on a comprehensive analysis, Otis Worldwide Corporation presents a challenging investment case. While its high-margin Service segment remains a robust and resilient core, driving consistent profitability and strong cash flow, it is currently insufficient to offset significant headwinds in the New Equipment business, particularly in the crucial Chinese market. Fundamental red flags, including deeply negative and worsening shareholder equity, a substantial reduction in cash, and declining overall revenue, signal underlying financial stress. Valuation appears stretched relative to peers and growth prospects. Analyst sentiment is cautious, and recent news indicates intensifying negative pressures on the top line. Technically, the stock is in a clear downtrend, and while showing oversold conditions, a break below key support at $85.41 could lead to further downside. Given the confluence of these factors, a short position on a confirmed breakdown below support is recommended, with disciplined risk management.

$OTIS ( ▲ 0.87% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

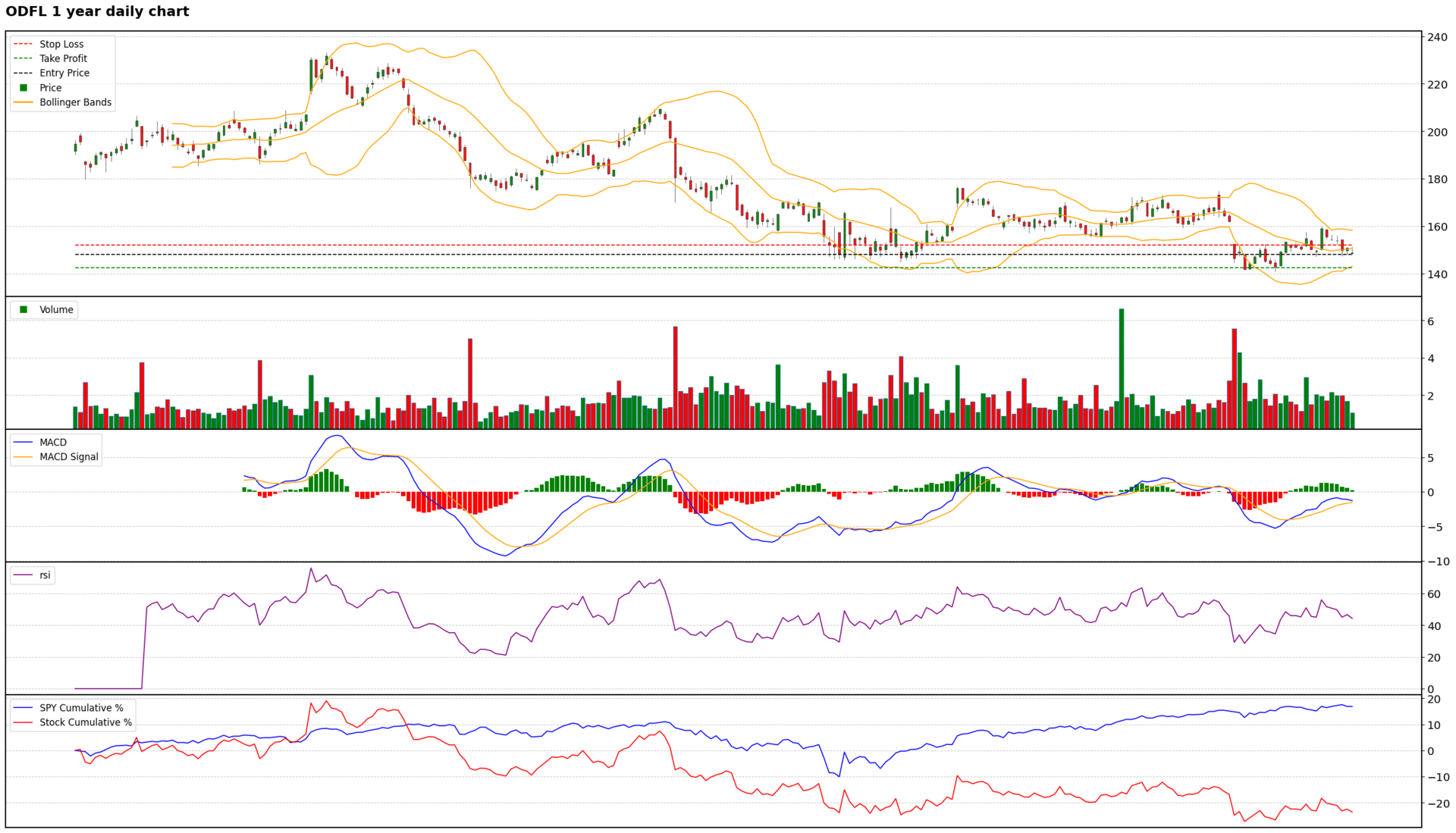

Scores: Fundamental 5 | Analyst Sentiment 3 | Valuation 2 | Catalyst 4 | Technical 4 | Total: 18

Trade Suggestions: Short Normal | Entry: 148.0 | TP: 142.5 | SL: 152.0 | Confidence: 3

Based on a comprehensive analysis, Old Dominion Freight Line presents a compelling short opportunity in the near term. Despite its strong long-term business model and management's confidence, the company is facing significant short-term operational headwinds, including declining revenue, profitability, and deteriorating liquidity. Analyst sentiment has turned largely negative, with widespread downgrades and price target cuts. The stock's valuation remains highly elevated, appearing overvalued relative to its peers and its modest forward growth prospects. Technically, $ODFL ( ▲ 5.66% ) is in a bearish trend, underperforming the broader market and recently hitting a 52-week low. While there are some nascent signs of weakening bearish momentum in technical indicators, the confluence of negative short-term fundamentals, bearish sentiment, high valuation, and weak technicals suggests further downside is likely. A short position with disciplined risk management is therefore recommended.

$ODFL ( ▲ 5.66% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Research any US stock in seconds using Orion AI.