Welcome equity investors—today’s edition unlocks Orion equity research on the three Healthcare stocks: $CAH ( ▲ 0.11% ), $MCK ( ▲ 2.28% ) and $COR ( ▲ 1.04% ).

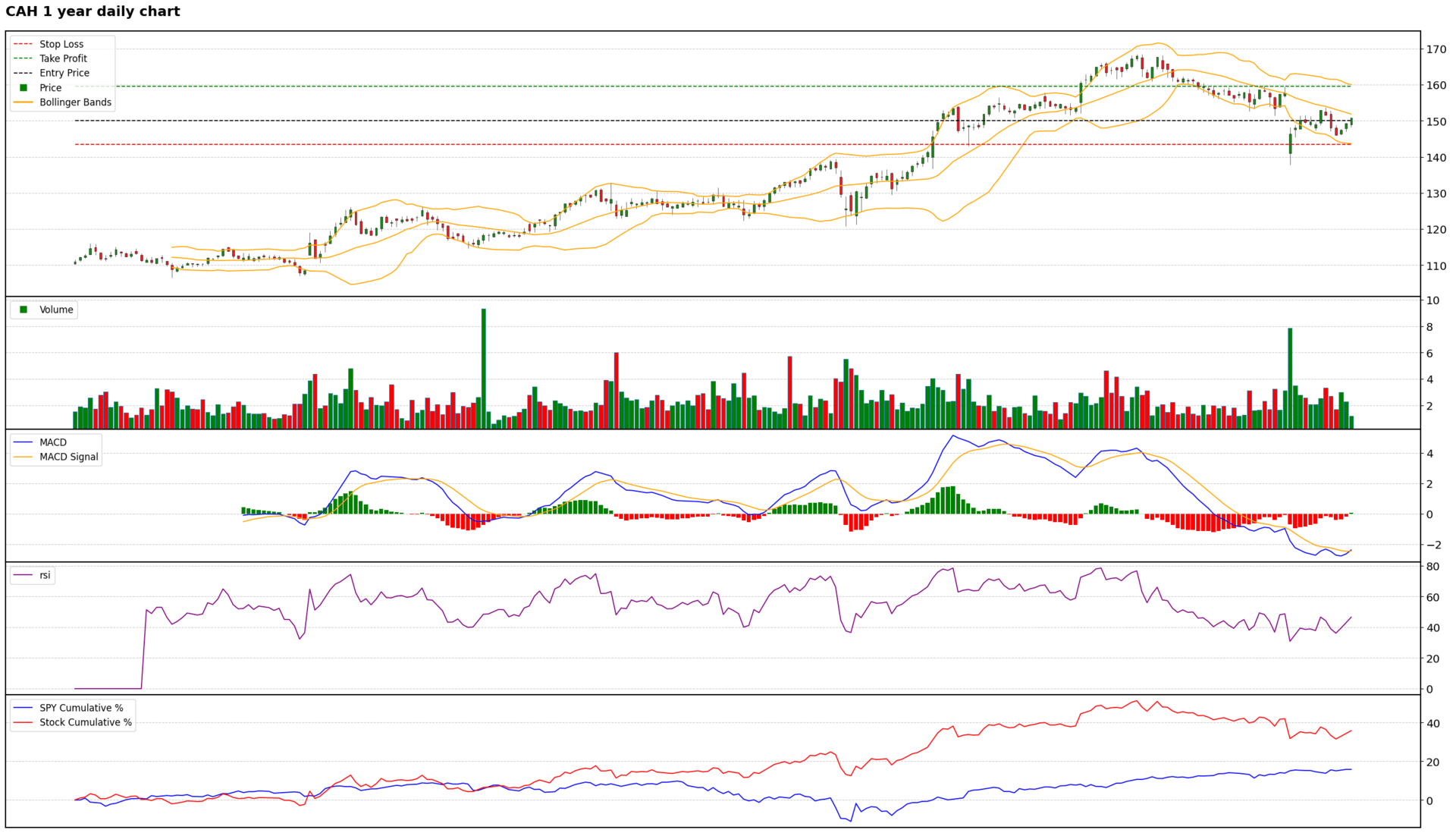

Scores: Fundamental 7 | Analyst Sentiment 8 | Valuation 4 | Catalyst 7 | Technical 5 | Total: 31

Trade Suggestions: Long Normal | Entry: 150.0 | TP: 159.5 | SL: 143.5 | Confidence: 6

Cardinal Health presents a compelling long opportunity, underpinned by robust operational performance and a clear strategic direction towards high-growth specialty pharmaceutical markets. The company's ability to consistently exceed earnings expectations, raise guidance, and execute strategic acquisitions like Solaris Health demonstrates strong management and resilience. While the current valuation appears stretched relative to peers and the balance sheet carries significant debt, the overwhelmingly positive analyst sentiment and substantial upside potential in price targets reflect confidence in the company's long-term growth trajectory. Technically, the stock is in a long-term bullish trend and is attempting a recovery from a key support zone. A tactical long position is justified, aiming to capitalize on this fundamental strength and technical bounce, but disciplined risk management is crucial given the valuation concerns and mixed short-term technical signals.

$CAH ( ▲ 0.11% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

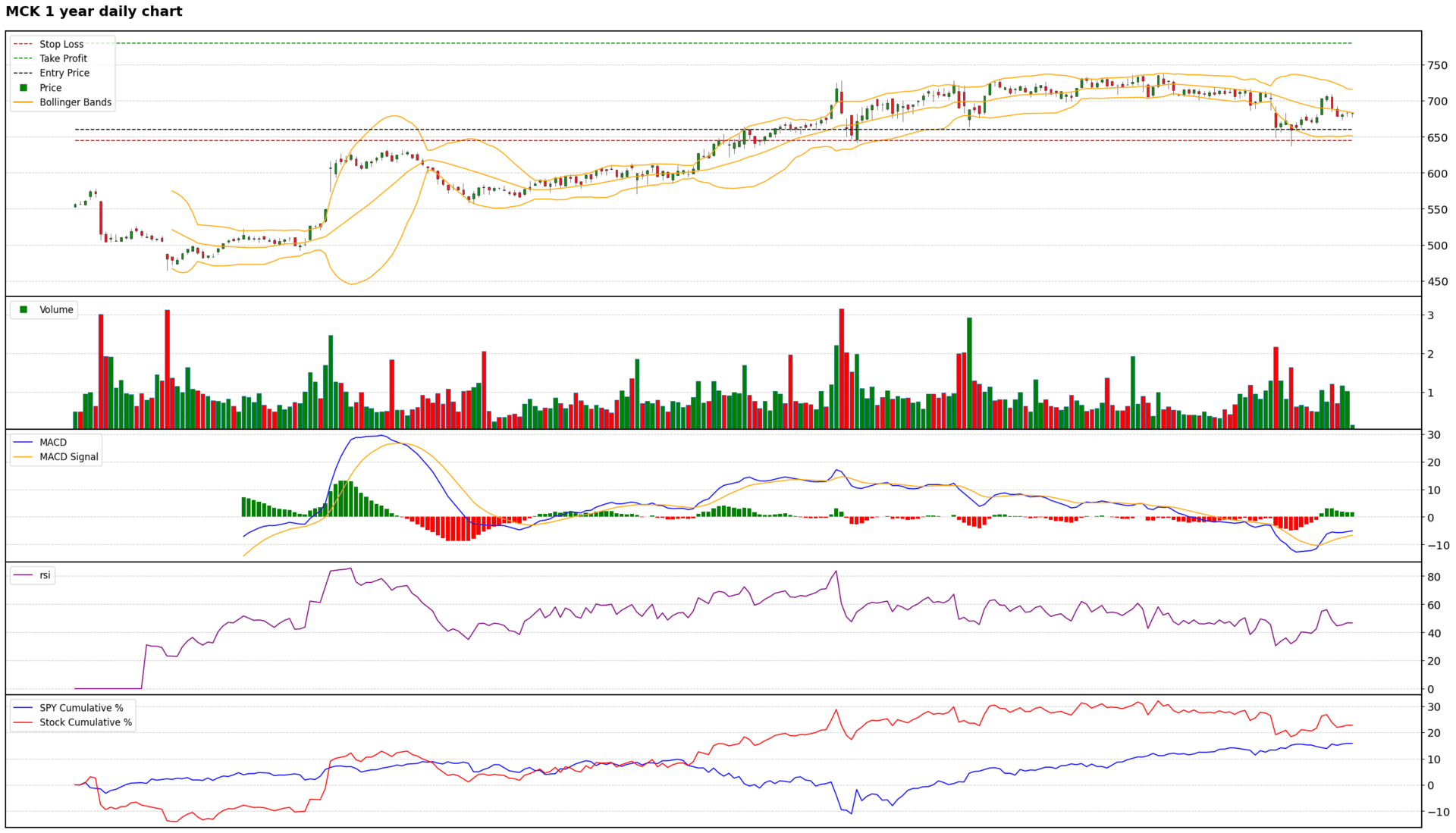

Scores: Fundamental 6 | Analyst Sentiment 7 | Valuation 4 | Catalyst 7 | Technical 5 | Total: 29

Trade Suggestions: Long Normal | Entry: 660.0 | TP: 780.0 | SL: 645.0 | Confidence: 6

Based on a comprehensive analysis, McKesson presents a compelling long-term opportunity driven by its strategic focus on high-growth healthcare segments like oncology and biopharma, coupled with strong operational execution and a commitment to shareholder returns. Management's confidence, robust forecast EPS growth, and strategic acquisitions underscore its fundamental strength. However, significant financial concerns, including persistent negative shareholder equity, a recent decline in Q1 net income/EPS, and substantial opioid liabilities, introduce considerable risk. While analyst sentiment is quantitatively bullish, valuation appears stretched relative to peers, and technicals indicate a period of consolidation. Given these mixed signals, a tactical long position initiated on a pullback to strong support levels (around the 200-day MA) is recommended to optimize the risk-reward, allowing for participation in the long-term growth story while managing short-term volatility and fundamental risks.

$MCK ( ▲ 2.28% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

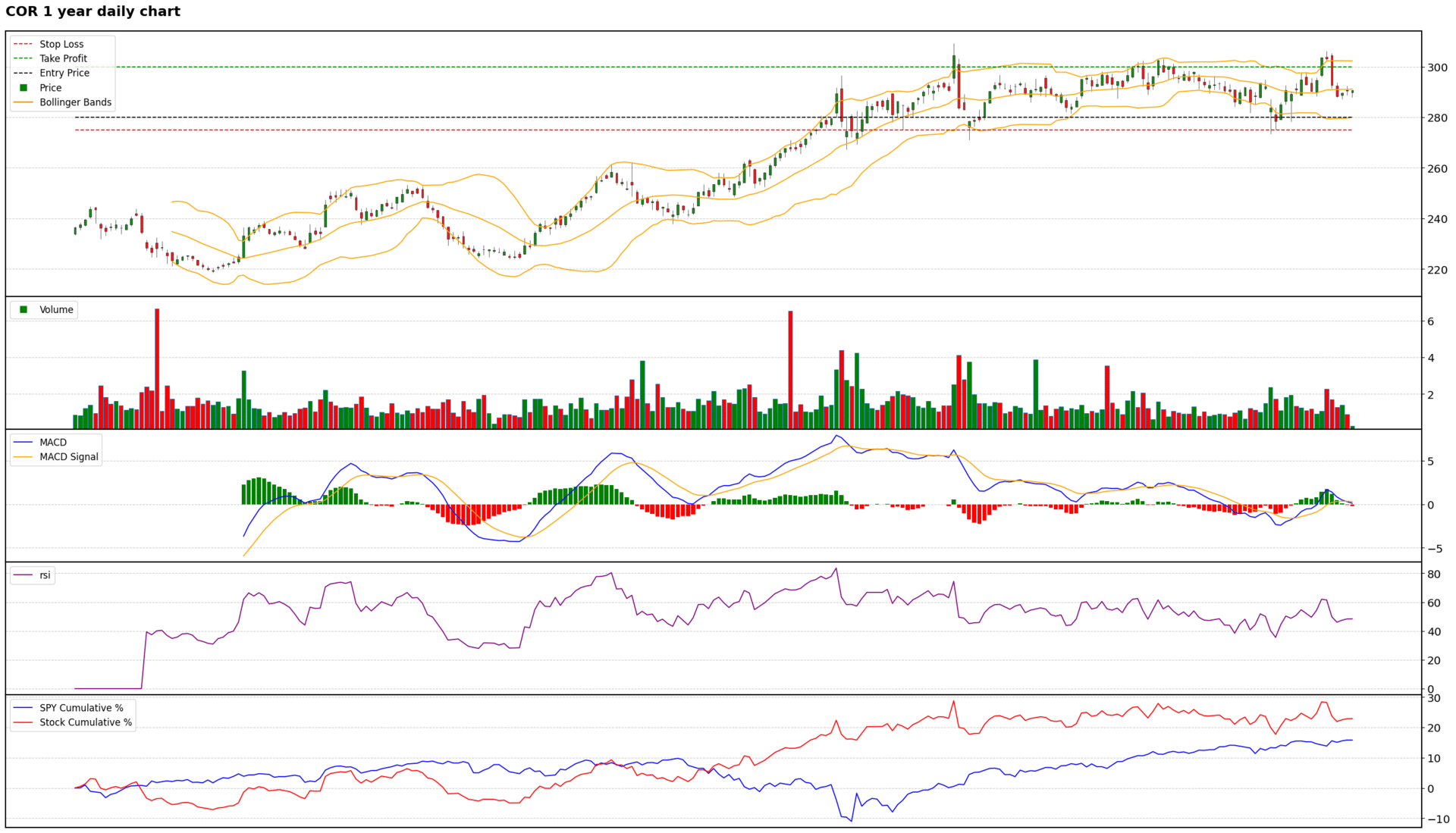

Scores: Fundamental 6 | Analyst Sentiment 7 | Valuation 3 | Catalyst 6 | Technical 5 | Total: 27

Trade Suggestions: Long Normal | Entry: 280.0 | TP: 300.0 | SL: 275.0 | Confidence: 5

Cencora presents a compelling long-term growth story driven by its strong position in pharmaceutical distribution, particularly in specialty drugs and the burgeoning GLP-1 market, further bolstered by strategic acquisitions like Retina Consultants of America. The company demonstrates robust revenue and earnings growth, supported by a largely bullish analyst consensus and significant price target upside. However, the stock's current valuation appears elevated relative to peers and historical averages, with much of the positive outlook potentially already priced in. Furthermore, the company faces substantial financial risks from increased debt to fund acquisitions, ongoing opioid litigation liabilities, and customer concentration. Technically, COR is experiencing a period of consolidation with weakening short-term momentum, suggesting a potential pullback. Therefore, a tactical long position initiated on a dip to key support levels (around $280.00) is recommended to capitalize on the strong underlying fundamentals and long-term growth trajectory, while prudently managing the risks associated with valuation and short-term technical headwinds.

$COR ( ▲ 1.04% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Research any US stock in seconds using Orion AI.