Welcome equity investors—today’s edition unlocks Orion equity research on four companies with commodities and Gold exposure: $B ( ▲ 2.08% ), $AEM ( ▼ 1.31% ), $NEM ( ▲ 0.33% ) and $FNV ( ▲ 2.46% ).

Scores: Fundamental 8 | Analyst Sentiment 9 | Valuation 9 | Catalyst 9 | Technical 7 | Total: 42

Trade Suggestions: Long Normal | Entry: 26.0 | TP: 28.0 | SL: 24.5 | Confidence: 8

Barrick Mining Corporation presents a highly compelling long investment opportunity, driven by robust fundamental performance, an attractive valuation, and a strong pipeline of catalysts. The company delivered exceptional Q2 2025 results, showcasing significant growth in revenue, earnings, and free cash flow, while maintaining a net cash position. Management's high confidence in its Tier 1 assets and major growth projects like Fourmile, Lumwana, and Reko Diq, further de-risked by recent ADB financing and infrastructure commitments, underpins a strong multi-year growth trajectory. Analyst sentiment is overwhelmingly bullish, and valuation metrics (low P/E, EV/EBITDA, and PEG) indicate the stock is significantly undervalued relative to its growth prospects. While technical indicators suggest the stock is currently overbought, this is a tactical consideration in an otherwise strong uptrend. The combination of operational excellence, strategic asset management, and a favorable macro environment for gold and copper positions Barrick for substantial revaluation and sustained long-term value creation, making it a strong buy on any short-term dips.

$B ( ▲ 2.08% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

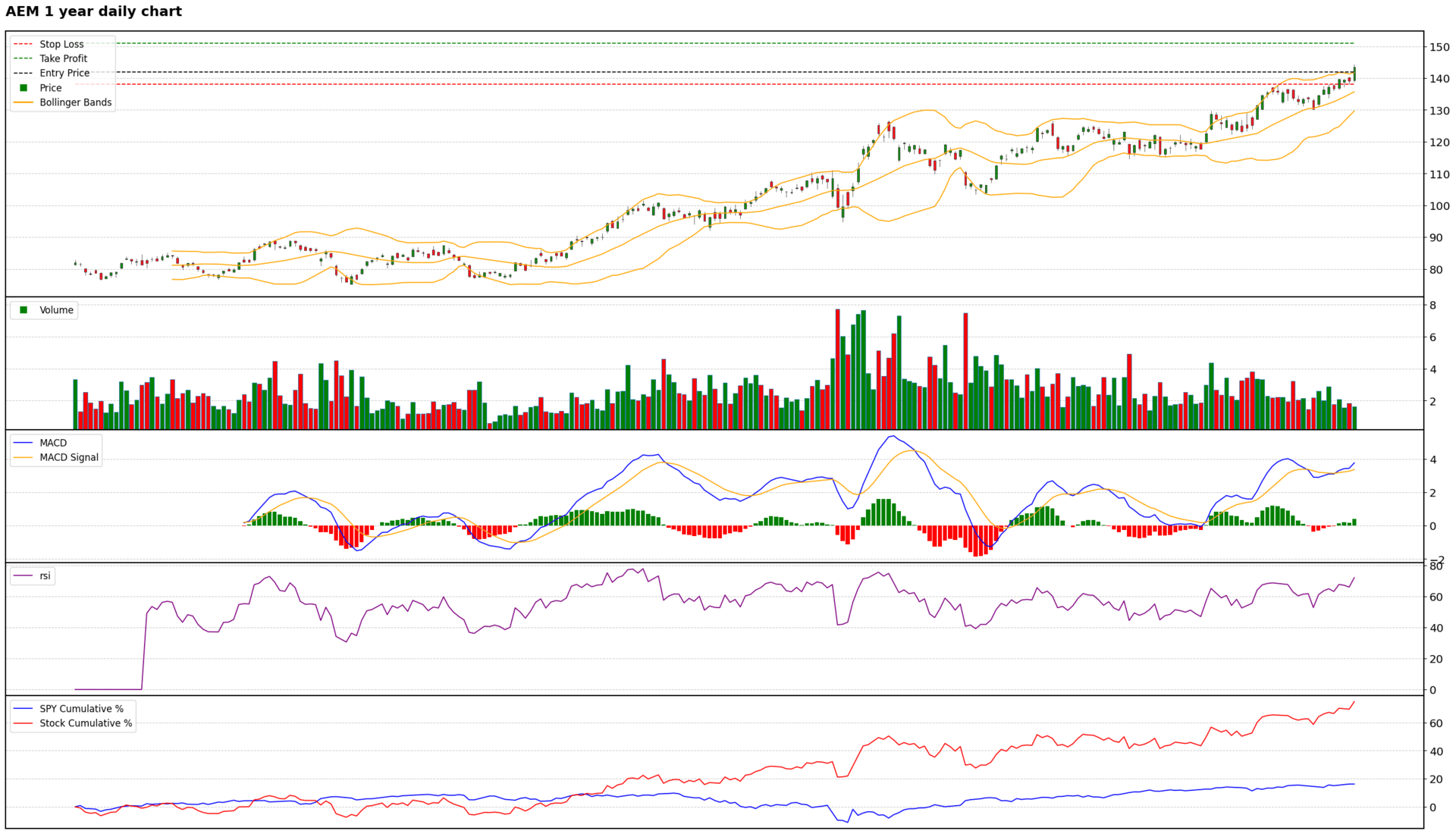

Scores: Fundamental 8 | Analyst Sentiment 9 | Valuation 6 | Catalyst 8 | Technical 7 | Total: 38

Trade Suggestions: Long Normal | Entry: 142.0 | TP: 151.0 | SL: 138.0 | Confidence: 8

Based on a comprehensive analysis, Agnico Eagle Mines presents a compelling long opportunity. The company exhibits exceptional fundamental strength, marked by record free cash flow, a robust balance sheet, and consistent operational outperformance across its high-quality assets in safe jurisdictions. Management's confidence is very high, supported by a clear and extensive organic growth pipeline. Analyst sentiment is overwhelmingly bullish, reinforced by recent significant price target upgrades. While some relative valuation metrics suggest a premium, the attractive PEG ratio indicates that AEM's strong growth is available at a reasonable price, justifying its sector leadership. Numerous catalysts, both short-term (share buybacks, dividend review, BofA upgrade) and long-term (project expansions, exploration success, favorable gold macro), are in play. Technically, AEM is in a powerful bullish trend, although short-term overbought conditions suggest a prudent entry strategy, waiting for a minor pullback. Given the strong alignment across all analytical pillars, AEM is well-positioned for continued capital appreciation.

$AEM ( ▼ 1.31% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

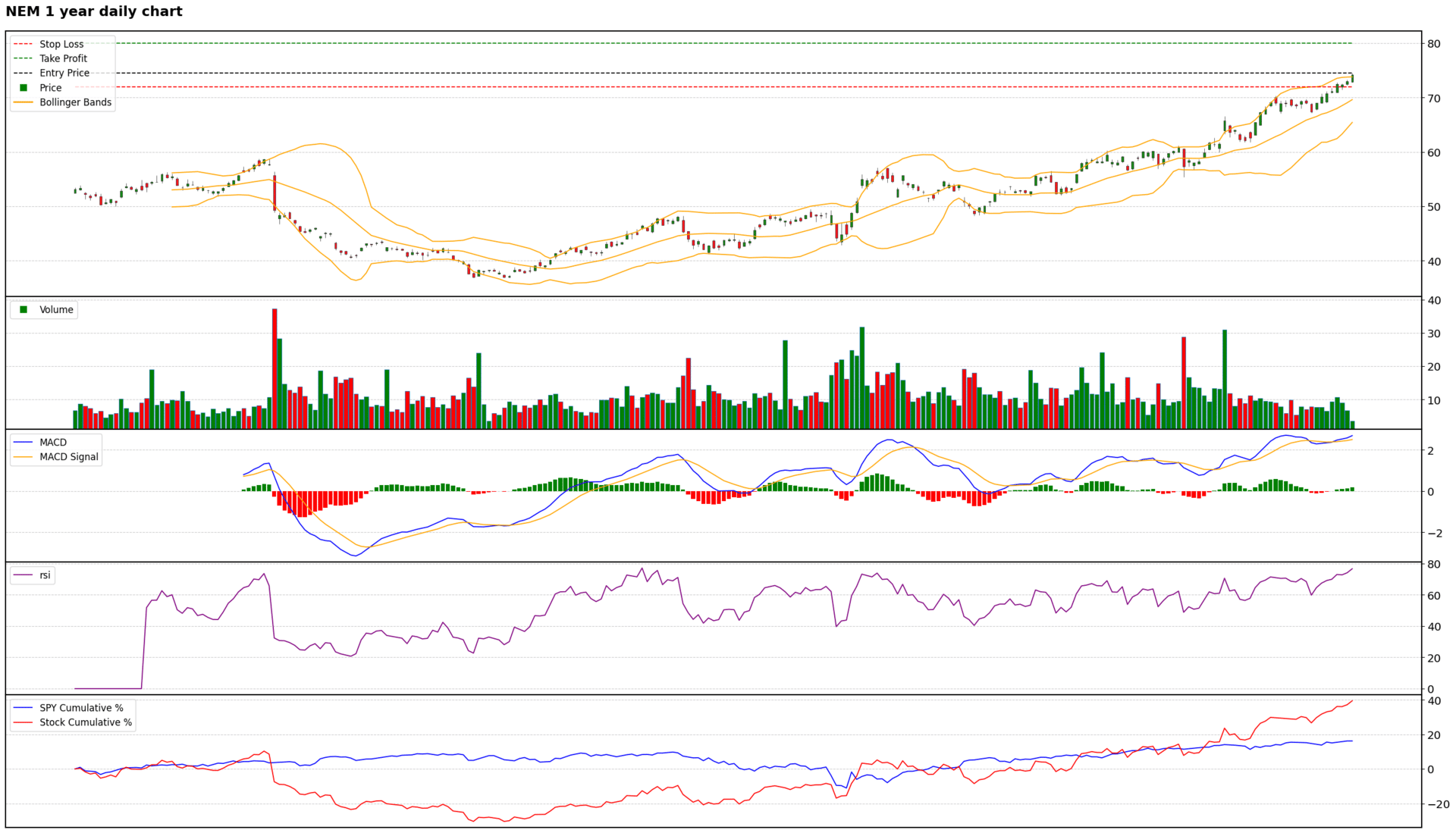

Scores: Fundamental 8 | Analyst Sentiment 8 | Valuation 7 | Catalyst 9 | Technical 6 | Total: 38

Trade Suggestions: Long Breakthrough | Entry: 74.5 | TP: 80.0 | SL: 72.0 | Confidence: 7

Based on a comprehensive analysis, Newmont presents a compelling long opportunity driven by robust financial performance, strategic operational improvements, and a highly favorable long-term outlook for gold. The company's Q2 2025 results showcased exceptional cash generation, a strengthened balance sheet, and a clear commitment to shareholder returns through an increased buyback program. Management's confidence in achieving full-year guidance, coupled with an aggressive cost-cutting initiative, positions NEM for enhanced profitability. Analyst sentiment is overwhelmingly bullish, with significant price target upgrades reflecting strong institutional conviction. While some valuation metrics suggest relative expensiveness, the low PEG ratio and strong growth prospects indicate an attractive value proposition. The primary short-term risk stems from the technical picture, which shows the stock in overbought territory, suggesting a potential for a near-term pullback or consolidation. Therefore, a tactical long position on a confirmed breakthrough, with disciplined risk management, is justified to capitalize on the strong fundamental and catalytic tailwinds.

$NEM ( ▲ 0.33% ) 1 Year daily Chart

Read the full report in the attachment, and discover more free reports on our website.

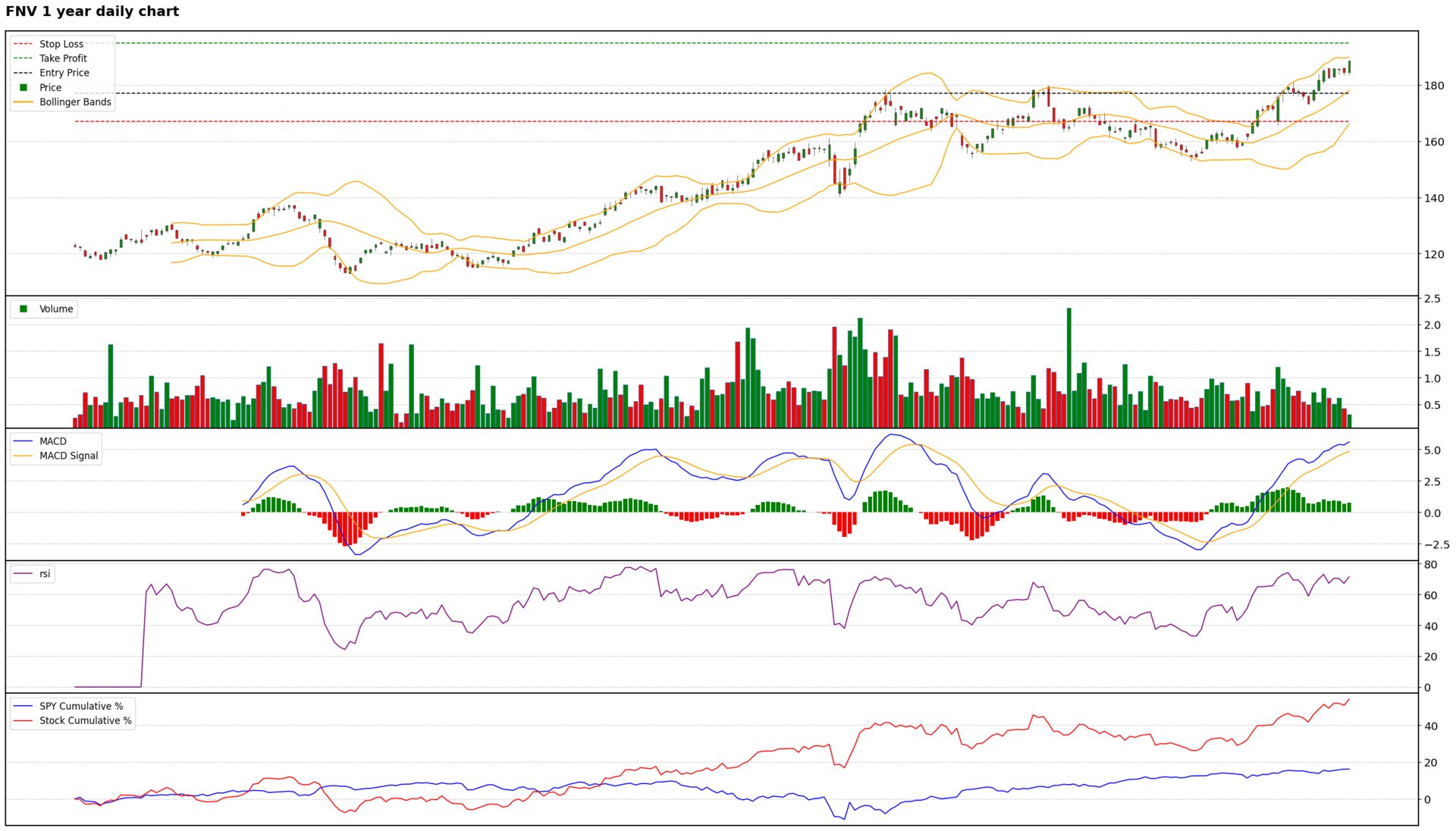

Scores: Fundamental 8 | Analyst Sentiment 7 | Valuation 3 | Catalyst 9 | Technical 6 | Total: 33

Trade Suggestions: Long Normal | Entry: 177.0 | TP: 195.0 | SL: 167.0 | Confidence: 7

Based on a comprehensive analysis, Franco-Nevada offers a compelling long-term investment opportunity as a best-in-class royalty and streaming company. The company has demonstrated exceptional financial performance, driven by surging gold prices and strategic acquisitions, with a robust long-term growth pipeline, most notably the potential restart of Cobre Panama. While analyst sentiment is largely positive and institutional interest is growing, the stock is currently trading at a significant premium and shows signs of being technically overbought. This suggests that while the long-term outlook remains highly bullish, a short-term pullback or consolidation is probable. Therefore, a tactical long position initiated on a dip to key support levels is recommended to capitalize on the strong fundamental tailwinds and catalysts, while prudently managing the risks associated with its current elevated valuation and overextended technicals.

$FNV ( ▲ 2.46% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Research any US stock in seconds using Orion AI.