Welcome equity investors—today’s edition unlocks Orion AI equity research on five large-cap US stocks in Aging & Longevity: $ALNY ( ▲ 3.74% ), $IONS ( ▲ 1.83% ), $VRTX ( ▼ 1.36% ), $BNTX ( ▼ 0.58% ) and $CRSP ( ▲ 1.35% ).

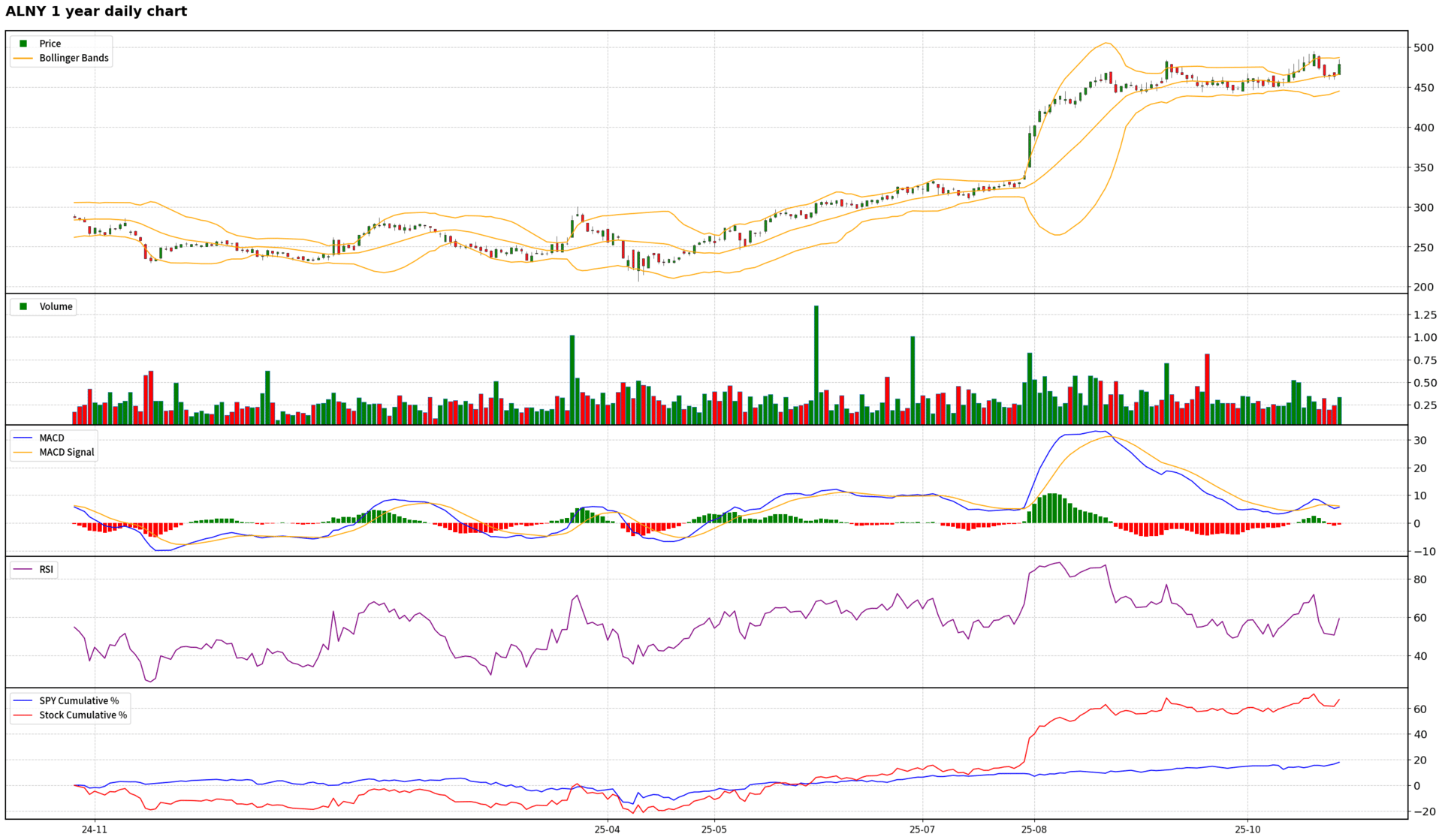

$ALNY ( ▲ 3.74% ) - Alnylam Pharmaceuticals Inc

Scores: Fundamental 9 | Analyst Sentiment 9 | Valuation 4 | Catalyst 9 | Technical 5 | Total: 36

Direction: Neutral to Slightly Long

Alnylam Pharmaceuticals presents a compelling long-term investment opportunity, driven by its leadership in RNAi therapeutics, exceptional commercial execution of AMVUTTRA, and a robust, diversified pipeline with significant future growth potential. The company is on a clear path to non-GAAP operating profitability in 2025, supported by strong revenue growth and increasing shareholder's equity. Analyst sentiment is overwhelmingly bullish, consistently raising price targets and endorsing the company's strategic vision. However, the stock's current valuation appears stretched, with much of the positive news already priced in. From a technical perspective, while the long-term trend remains bullish, short-term momentum is weakening, suggesting a period of consolidation or a potential pullback is likely, especially given the broader market's overbought condition. Therefore, while $ALNY ( ▲ 3.74% ) is a high-quality company with strong fundamentals and catalysts, a 'Neutral to Slightly Long' bias is appropriate for the medium term. Investors should exercise caution and consider waiting for a confirmed technical breakout above $486.85 on strong volume, or a healthy pullback towards key support levels (e.g., 50-day MA at $459.93) to establish new long positions with a more favorable risk/reward profile. The long-term growth story remains intact, but short-term market dynamics warrant patience.

$ALNY ( ▲ 3.74% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

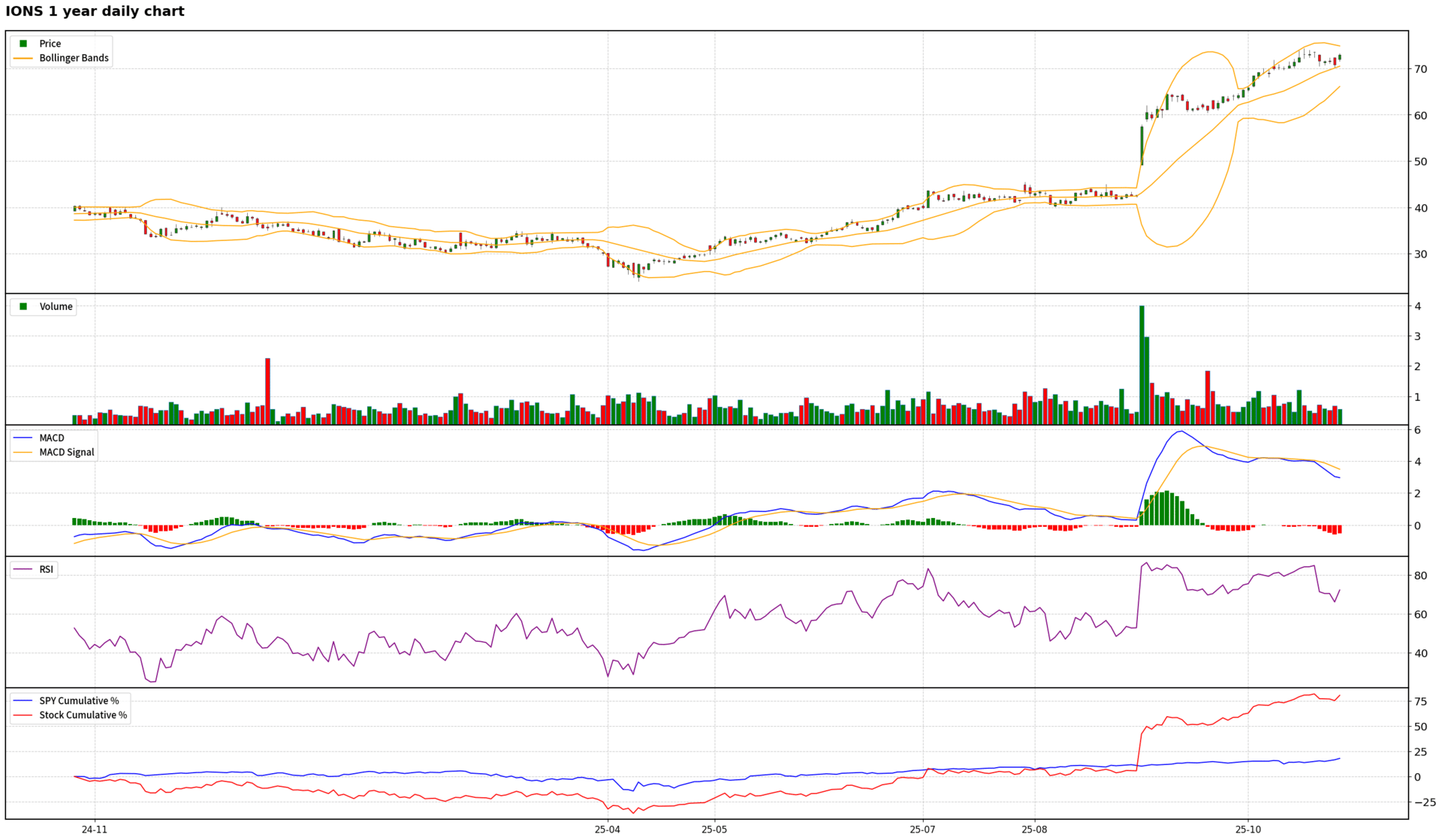

$IONS ( ▲ 1.83% ) - Ionis Pharmaceuticals Inc

Scores: Fundamental 8 | Analyst Sentiment 9 | Valuation 4 | Catalyst 9 | Technical 6 | Total: 36

Direction: Long

Based on a comprehensive analysis, Ionis Pharmaceuticals presents a compelling long opportunity for the medium term. The company is successfully executing its transformation into a fully integrated commercial-stage biotech, evidenced by the strong Q2 2025 financial turnaround, successful launches of TRYNGOLZA and DAWNZERA, and a robust pipeline featuring blockbuster-potential assets like Olezarsen for sHTG. Management's high confidence and a clear path to sustained positive cash flow by 2028 are further reinforced by overwhelmingly bullish analyst sentiment and increasing institutional ownership. While current valuation metrics appear stretched and short-term technical indicators suggest the stock is overbought, indicating a potential for a healthy pullback or consolidation, these factors are likely temporary. The numerous near-term catalysts, including upcoming regulatory decisions and continued commercial ramp-up, are expected to drive further value. Any short-term weakness should be viewed as a strategic entry point, as the fundamental growth story and strong market tailwinds are poised to propel $IONS ( ▲ 1.83% ) higher over the next 1-3 months.

$IONS ( ▲ 1.83% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

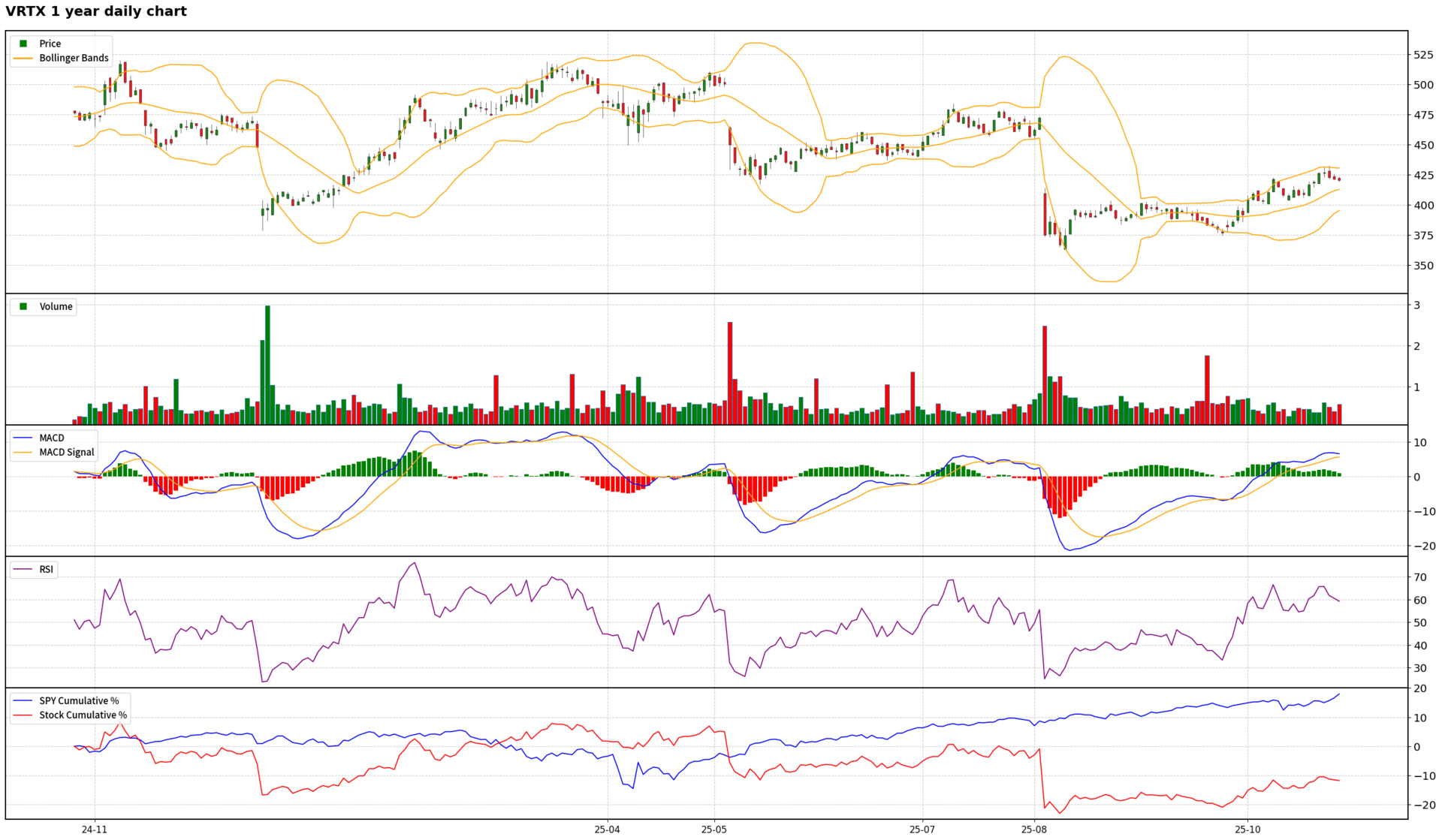

$VRTX ( ▼ 1.36% ) - Vertex Pharmaceuticals Inc

Scores: Fundamental 8 | Analyst Sentiment 7 | Valuation 4 | Catalyst 9 | Technical 6 | Total: 34

Direction: Long

Vertex Pharmaceuticals presents a compelling 'Long' opportunity for the medium term, driven by its unparalleled dominance in the cystic fibrosis market and successful diversification into new therapeutic areas. The company's strong financial performance, marked by significant revenue growth and a robust return to profitability, underscores its operational strength. Key catalysts, including the accelerating commercial ramp-up of ALYFTREK, JOURNAVX, and CASGEVY, coupled with the rapid advancement of its late-stage pipeline (notably povetacicept with potential accelerated approval in H1 2026), provide clear drivers for future growth. While valuation multiples appear stretched and the stock faces technical resistance around $430, the underlying fundamental strength, positive analyst sentiment, and a supportive macro environment suggest continued upside. Investors should monitor pipeline readouts and commercial execution closely, but the overall picture supports a high-conviction long position.

$VRTX ( ▼ 1.36% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

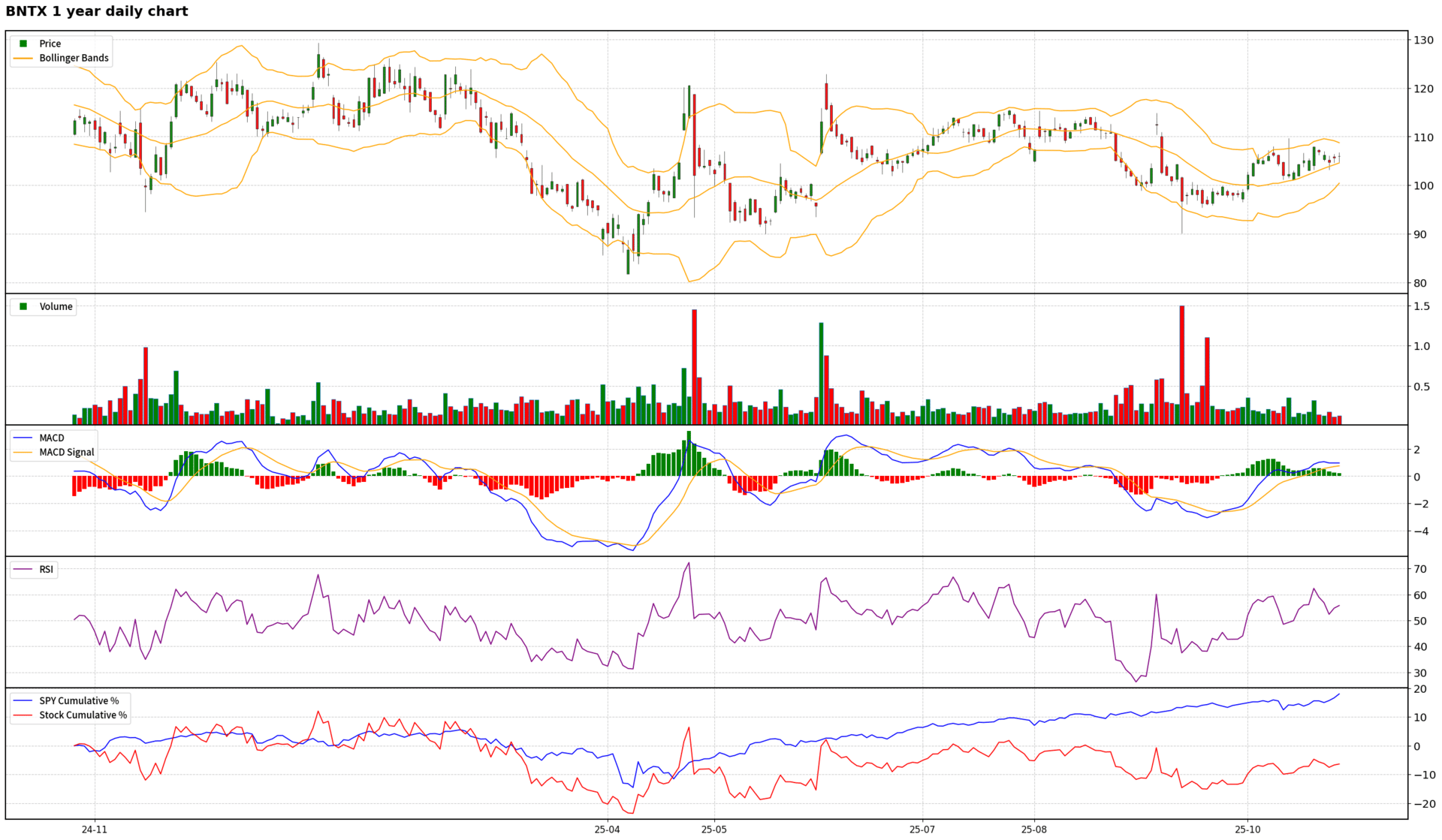

$BNTX ( ▼ 0.58% ) - Biontech SE

Scores: Fundamental 5 | Analyst Sentiment 7 | Valuation 3 | Catalyst 6 | Technical 4 | Total: 25

Direction: Neutral

BioNTech presents a high-risk, high-reward investment profile. While the company is strategically pivoting to a promising oncology pipeline, backed by a robust cash position and key partnerships like BMS, its immediate financial performance is severely impacted by the rapid decline of its COVID-19 vaccine business, leading to widening losses and significant negative news flow. Technical indicators suggest indecision and weakening momentum at a resistance level, with a long-term bearish trend still in play. The broader market, while bullish, shows signs of short-term overextension, which could add pressure. Given the significant near-term headwinds, the inherent risks of drug development, and valuation concerns for an unprofitable company, a neutral stance is warranted for the coming week. Investors should await clearer positive catalysts from the oncology pipeline and a stabilization of the COVID-19 market impact before considering a more aggressive position. Confidence in this strategy is moderate, as any breakthrough oncology data could quickly shift sentiment.

$BNTX ( ▼ 0.58% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

$CRSP ( ▲ 1.35% ) - CRISPR Therapeutics AG

Scores: Fundamental 3 | Analyst Sentiment 5 | Valuation 2 | Catalyst 6 | Technical 4 | Total: 20

Direction: Neutral to Slightly Short

CRISPR Therapeutics presents a high-risk, high-reward investment profile. While the company is a pioneer in transformative gene-editing technology with an approved therapy (CASGEVY) and a promising pipeline (CTX310, CTX112, SRSD107), its near-term outlook is challenged by significant headwinds. Fundamentally, $CRSP ( ▲ 1.35% ) is unprofitable, burning substantial cash, and exhibits weak financial health relative to peers, with a highly stretched valuation. Recent negative catalysts, including a $600 million stock offering that will dilute shareholders and significant insider selling by the CEO, have already triggered a sharp decline in the stock price. Although some analysts maintain bullish long-term price targets, the consensus has shifted to 'Hold,' reflecting growing caution. Technically, while the stock is oversold on some indicators, the MACD is bearish, and a potential double top formation looms. Given the strong negative company-specific catalysts, deteriorating financials, and the potential for a broader market pullback from overbought conditions, a 'Neutral to Slightly Short' stance is warranted for the medium term (1-3 months). Investors should await clearer signs of improved financial performance, successful commercialization of CASGEVY, or positive clinical trial readouts that can definitively offset the current dilution and profitability concerns before considering a long position. The upcoming Q3 earnings report will be a critical near-term event to monitor.

$CRSP ( ▲ 1.35% ) 1 Year Daily Chart

Read the full report in the attachment, and discover more free reports on our website.

Research any US or Hong Kong stock in seconds using Orion AI.

Crash Expert: “This Looks Like 1929” → 70,000 Hedging Here

Mark Spitznagel, who made $1B in a single day during the 2015 flash crash, warns markets are mimicking 1929. Yeah, just another oracle spouting gloom and doom, right?

Vanguard and Goldman Sachs forecast just 5% and 3% annual S&P returns respectively for the next decade (2024-2034).

Bonds? Not much better.

Enough warning signals—what’s something investors can actually do to diversify this week?

Almost no one knows this, but postwar and contemporary art appreciated 11.2% annually with near-zero correlation to equities from 1995–2024, according to Masterworks Data.

And sure… billionaires like Bezos and Gates can make headlines at auction, but what about the rest of us?

Masterworks makes it possible to invest in legendary artworks by Banksy, Basquiat, Picasso, and more – without spending millions.

23 exits. Net annualized returns like 17.6%, 17.8%, and 21.5%. $1.2 billion invested.

Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Become An AI Expert In Just 5 Minutes

If you’re a decision maker at your company, you need to be on the bleeding edge of, well, everything. But before you go signing up for seminars, conferences, lunch ‘n learns, and all that jazz, just know there’s a far better (and simpler) way: Subscribing to The Deep View.

This daily newsletter condenses everything you need to know about the latest and greatest AI developments into a 5-minute read. Squeeze it into your morning coffee break and before you know it, you’ll be an expert too.

Subscribe right here. It’s totally free, wildly informative, and trusted by 600,000+ readers at Google, Meta, Microsoft, and beyond.